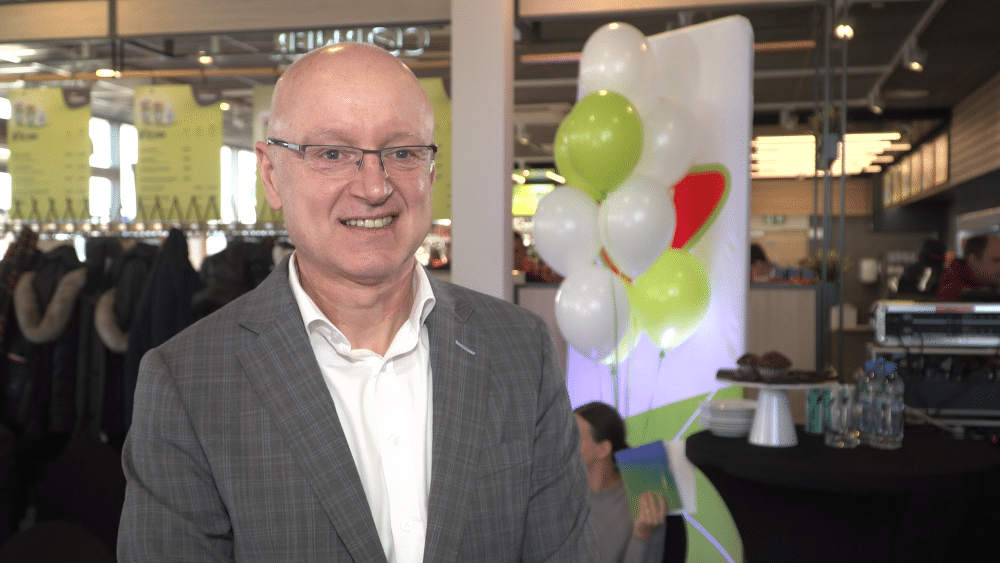

The first MOL-branded station started operations on February 10, 2023. Within a year in Poland, the conglomerate rebranded over 200 stations out of the over 410 which they acquired from Lotos and Orlen. “By the end of the year we should have 80% of the stations ready with our green logo,” says Richard Austen, the President of MOL in Poland. He adds that should the opportunity arise in the market, the conglomerate wishes to invest in over 100 more stations to become second to Orlen in Poland.

“The Polish market is extremely important to MOL. MOL is practically unknown in Poland, so this is for us a kind of the final missing element in the map of our coverage. With the entrance into the Polish market, our network covers the Three Seas area – from the Baltic Sea, through the Black Sea, to the Adriatic Sea, which links the entire continent and is very important. Poland is the largest market within the MOL network, which further confirms the importance of the Polish market for us,” tells Richard Austen to the Newseria Biznes agency.

MOL Group has over 2.4 thousand petrol stations in 10 Central and Southeastern European countries. It’s an international conglomerate operating in the sectors of oil, gas, petrochemicals and retail, with its headquarters based in Budapest, Hungary. In 2022, they took over more than 410 stations as part of the merger transaction between Orlen and Lotos. Previously, they were present in Poland with 80 facilities operating under the Slovnaft Partner brand, which will undergo rebranding along with the acquired stations.

“At the beginning, we are focusing on building our network. We are investing in the rebranding of all stations, which is necessary because we are not the owners of the original brand, so we must change the brand to MOL. We have 200 stations completed and we will continue our work at the same pace. By the end of the year, we should have 80% of the stations ready with the MOL brand and our green logo. The cost of one station amounts to about 80–100 thousand dollars, so you can imagine the cost of the entire enterprise,” says the President of MOL in Poland.

Today, the conglomerate is the second operator in the country in terms of the number of stations along fast traffic routes and the third in terms of the number of facilities in Poland – after Orlen and bp, but it has an appetite for more.

“We want to take second place in the market, but we cannot give any specific date, as there are more than just will here, we will have to make significant investments and buy over 100 stations. We need to find partners who will be willing to sell us part of their network, and then we will buy it. We are convinced that possibilities will present themselves, but we cannot predict exactly when. However, when it does happen, we will be ready to acquire,” assures Richard Austen.

The first year of operation in Poland also meant building a customer network. In July of the previous year, the conglomerate launched the MOL Move loyalty program, which gained a million registered users by the first few days of January. The program is already available on six markets and offers permanent fuel discounts and personalized promotions for other products and services.

“Our position is different on the Polish market compared to others because we are not as strong a player in this market compared to others. In Poland, there is a strong domination of a local entity with a strong position, but the competition is also very strong. Also, the size of the market is incomparable to any other country in which we operate. Poland exceeds our largest market to date by twice in size, which is also worth mentioning. There are always some differences, but the customers themselves don’t differ significantly,” says the President of MOL in Poland.

In January, the conglomerate launched an advertising campaign aimed at strengthening brand recognition, primarily EVO fuels. Research carried out by the brand shows that drivers’ awareness of the brand is increasing. Two thirds of respondents are familiar with MOL and one in five have taken up the company’s offer. MOL’s strategy is based on transforming traditional petrol stations into modern service stations, with a strong retail offering and a gastronomy segment. Fresh Corner points are already available at 34 stations in Poland, and by the end of the year, they will be operating at 69 locations. In the first year of operation, 6.2 million cups of coffee and 5.8 million hot dogs were sold.

“Our Fresh Corner offer is similar across all markets, but it is always adapted to local tastes. Poles like somewhat different food than, for example, Croatians, Romanians, Bosnians or Hungarians. However, the changes are slight,” emphasizes Richard Austen.