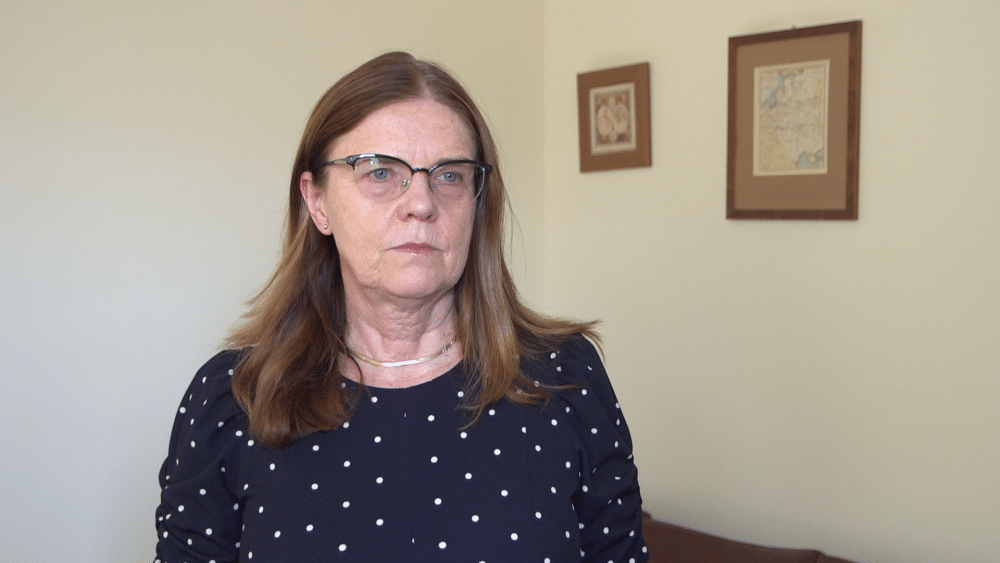

The ruling coalition in Poland pledges not to raise the statutory retirement age – which for men is 65, and for women, 60, confirm the politicians. However, according to experts, this means that other ways must be found to encourage women over 60 and men over 65 to stay in the workforce. “Extending professional activity is one way to increase pensions, but this cannot be done by force, we need to find solutions that would make people want to continue working,” points out Agnieszka Łukawska, expert at the Pension Institute. She notes that senior workers already enjoy several incentives, such as tax breaks, but underscores that additional training support and adequate health care are needed.

“Currently, about 1.8 people are working on average for each retiree, but the situation varies across different regions in Poland. In the Masovian or Pomeranian regions, where 2.3 people are working per retiree, the situation is significantly better than, for example, in the Świętokrzyskie region, where this ratio is only 1.6,” says Agnieszka Łukawska to the Newseria Biznes information agency. She stresses that the decreasing birth rate is likely to exacerbate the situation in the future, with estimates suggesting around 1.3-1.4 workers per retiree.

An attempt to gradually raise the retirement age to 67 for both genders, introduced in 2013, met strong resistance in Poland and was one of the reasons for the defeat of the Civic Platform in the 2015 elections. Since October 1, 2017, earlier thresholds have been in place, and public sensitivity to this issue likely excludes another change in regulations. But specialists contend that longer work is necessary for Poles, if not for the sake of the level of benefits they receive.

“Estimates from different sources suggest that people in their twenties and thirties today will receive pensions not higher than about 25% of their final salary,” says Agnieszka Łukawska. She emphasizes that a multi-faceted and well-conducted senior policy is essential to encourage people to stay in the labour market longer and ensure health care services are available and accessible.

She underlines that people should understand that reaching the statutory retirement age does not mean a significant amount of money from the compulsory system and a comfortable life. “We must tell ourselves directly that relying on ZUS (Social Insurance Institution) is not a solution for a comfortable future,” says Agnieszka Łukawska. She notes that while some people may choose retirement because they have other plans for their lives, the amount of benefits will not be impressive in this case. Therefore, it is necessary to find other sources of income as well.

She maintains that some alternatives might be non-ZUS sources of income security in retirement, such as participation in pension schemes (IKE, IKZE, PPE, PPK), or saving and investing on your own.

On the other hand, the later entry into the labor market of new age groups delays the start of their professional lives, often without tangible benefits from the obtained education. “The question of education policy needs to be reconsidered. Many people are studying longer, so they are entering the labor market much later than those with secondary or vocational education,” notes the expert from the Pension Institute. She suggests that it may be time to question whether we really need to so strongly promote higher education for everyone.