- Tesla: Small Forecast Exceedance, Big Profits: Tesla’s Q2 deliveries reached 443,956 units, surpassing estimates. This caused a 23% rise in stock prices despite weak demand. Investors are looking forward to the robotaxi event on August 8.

- Biden’s Tough Situation: President Biden’s poor performance in the first debate caused panic within the Democratic Party. Discussions about a new candidate are increasing as Biden’s chances of victory seem to be declining.

- UK Election Result May Lead to Revaluation of British Stocks: The Labour Party’s landslide victory in the UK elections is expected to bring political stability, which may positively impact the valuation of British stocks.

- This Week: Key upcoming events include the US CPI inflation report for June, which could influence market expectations for Fed rate cuts, and the beginning of the Q2 earnings season.

Tesla: Small Forecast Exceedance, Big Profits

Tesla shares rose 23% last week as the electric vehicle (EV) manufacturer reported Q2 deliveries of 443,956 vehicles, exceeding estimates of 439,302. However, it should be noted that this is a 5% year-over-year decrease, with EV production also dropping by 14% year-over-year, signaling ongoing weak demand in the EV sector. Investors overlooked this fact, focusing on the slight beat of forecasts. This raised hopes that Tesla might have put the worst behind it. If this momentum continues, it could last until the robotaxi event on August 8, which is another catalyst for Tesla’s shares.

Biden’s Debate Performance Sparks Talk of New Candidate

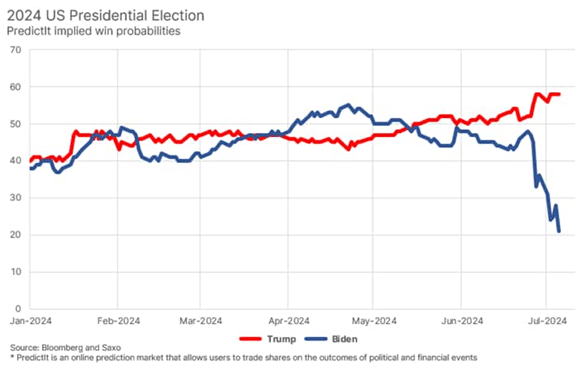

Last week was dominated by narratives of a potential withdrawal of Biden from the presidential race, fueled by a disastrous first presidential debate with Trump. Biden’s poor performance caused panic within the Democratic Party and intensified discussions about the need to find a new candidate for the November election. According to PredictIt, Biden’s probability of winning dropped to around 20%, compared to a 58% chance for Trump. An interview with Biden on ABC, which aired on Friday evening Eastern Time (EDT), did not change the picture. Biden emphasized that he does not intend to withdraw from the presidential race but failed to allay concerns about his ability to govern.

UK Election Result May Lead to Revaluation of British Stocks

The Labour Party scored a landslide victory, winning 412 seats compared to 121 seats for the Conservative Party in the UK election. In the popular vote, the Labour Party secured around 33.7% of the votes, while the Conservative Party garnered 23.7%. Voter turnout was only about 60%, the lowest in many decades. Although the Labour Party’s victory is overwhelming, it does not fully represent a clear social mandate. Nevertheless, the absolute majority means that the political landscape could provide the UK with the needed political stability.

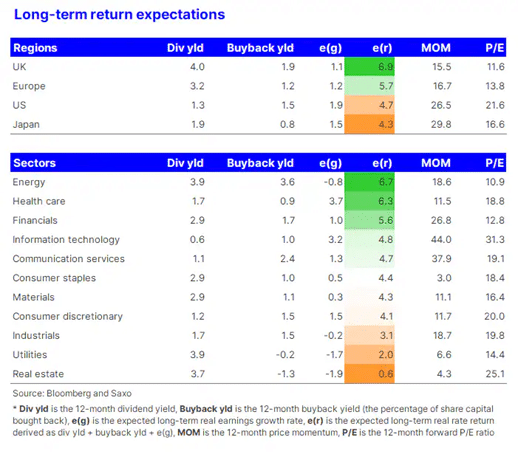

This could be beneficial for British stocks, as reduced political uncertainty usually has a positive impact on asset valuations. As shown in the table below, the long-term expected real rate of return for British stocks is very high compared to European and American stocks. British stocks have a dividend yield of 4%, coupled with low expectations for real earnings growth.

This Week: US CPI Inflation and Q2 Earnings Season Kickoff

Macroeconomics will dominate the key events for investors this week. Below are the main ones to watch.

• US CPI Inflation: On Thursday, CPI inflation data for June will be released. Economists expect core CPI inflation to be 0.2% month-over-month, unchanged from May. The annual CPI rate is expected to be 3.1%, down from 3.3% in May. Another month of low inflation could strengthen market bets on Fed rate cuts this year, which currently anticipate two cuts by the December meeting.

• Corporate Earnings: This week marks the beginning of the Q2 earnings season. Key reports to watch this week include Kongsberg Gruppen, part of the European defense sector (Wednesday), Delta Air Lines, a company in the travel industry with a good business sentiment indicator (Thursday), and JPMorgan Chase (Friday), the world’s most global bank, whose condition is a good barometer of the state of the global economy.

Peter Garnry, Head of Equity Strategy at Saxo Bank