In recent days, ECB representatives have issued increasingly precise statements – to the point that they resemble forward guidance. Whether the bank will indeed provide clear indications regarding future moves will be a key area of interest for the markets this week.

In recent weeks, many members of the European Central Bank’s Governing Council have suggested that interest rate cuts may begin this summer. Even ECB President, Christine Lagarde has shared her views on this matter. During an interview in Davos last week, just before the media blackout, she stated that a rate cut in the summer is “probable”. She also reiterated a message from the ECB’s chief economist Philip Lane, warning against “too rapid recalibration” and indicated that significant wage data would be available before the June meeting.

Such candidness from decision-makers is rare, so whether the Governing Council will maintain such a clear message or revert to signalling strategies less obvious as we have seen in previous meetings is intriguing.

“Weakness in Eurozone Economy Continues”

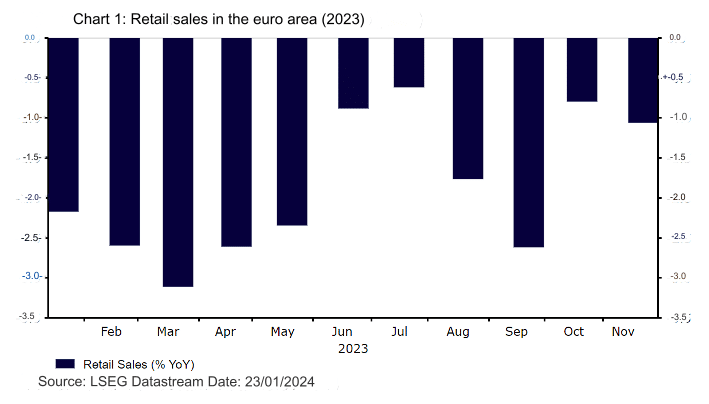

From a macro perspective, the situation has not changed significantly since December. The data continues to suggest that the pulse of the Eurozone economy is barely noticeable. The PMI indicators are only slightly above their minimums, suggesting a decrease in activity in both the industrial and service sectors. Retail sales recently slightly exceeded expectations but the data indicate that consumers still resist spending money. Industrial production has disappointed, with Y/Y decreases continuously reported since March. Markets wait for confirmation in the form of GDP data for Q4, however, it seems unlikely that the Eurozone economy will avoid a technical recession at the end of the year.

Chart 1: Retail sales in the Eurozone (2023)

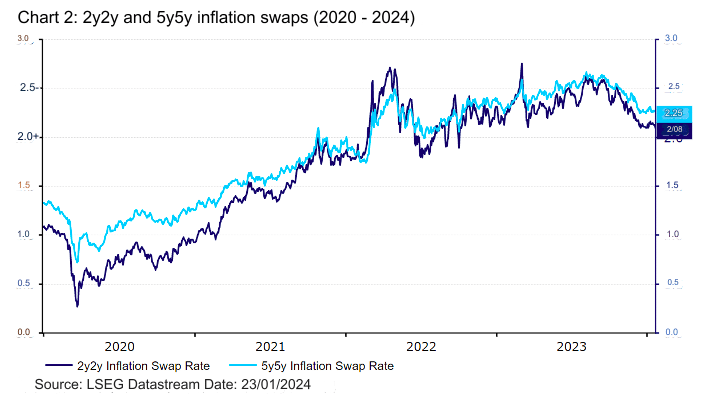

At the same time, price pressure normalized. The primary measure of inflation increased to 2.9% in December after recording a lower-than-expected 2.4% in November. This was widely anticipated given the statistical base effect in the context of energy prices. The core measure dropped to 3.4%, the lowest level since March 2022. Moreover, expectations regarding consumer inflation over the next 12 months also fell significantly (from 4% to 3.2%). The 2y2y inflation swap decreased from a high of 2.75% to below 2.1%, suggesting a growing belief that inflation will remain subdued.

Chart 2: Inflation swaps 2y2y and 5y5y (2020 – 2024)

“ECB Does Not Want To Raise Hopes of Interest Rate Cuts”

The reality of the economic situation in the Eurozone, which we think increasingly supports policy easing – stronger than in most of the major economies we observe, especially in the US, cannot be ignored by policymakers. At the same time, the ECB must tread carefully to avoid giving markets a pretext for increasing bets on rate cuts, which would translate into looser financing conditions. Recently these bets have decreased – markets are now pricing approximately 130 bp. cuts in 2024 compared with about 160 bp at the end of the last year – which could provide some relief for the Governing Council. We believe these valuations are closer to reality.

We expect the January announcements to aim at not raising investors’ hopes regarding interest rate cuts. We also believe that President Lagarde will primarily continue to stress the importance of data. The ECB did not adopt a dovish stance in December and Lagarde emphasised that the bank should not let its guard down. In our view, the ECB will largely repeat the statements from the last meeting, but perhaps with a slightly softer tone.

“Predicted Pace of Cuts is Important for EUR/USD”

We will be particularly focused on the signals regarding the possibility of rate cuts in the summer and any signs of resistance against market valuations, as this could suggest to the market that the ECB is not considering policy easing earlier than June. The implied probability of the first move down in April is currently at 65%. Although we still believe the first cut could occur in April, the hawkishness of ECB members recently suggests that this scenario is becoming increasingly less likely.

Around the time of the press conference, the euro may experience increased volatility. Given that the markets are largely positioned for cuts to start in April, the risk balance for the EUR/USD pair seems to be upwardly inclined – if the ECB suggests to the markets that June is a more probable timing for cuts to start, the pair will appreciate. However, it is not our base case scenario – we believe the messages will not be too decisive due to the bank’s fear of getting into a corner.

The ECB policy decision will be announced on Thursday (25/01) at 2:15pm, with the press conference starting 30 minutes later.

Authors: Roman Ziruk, Matthew Ryan, CFA – Ebury Analysts