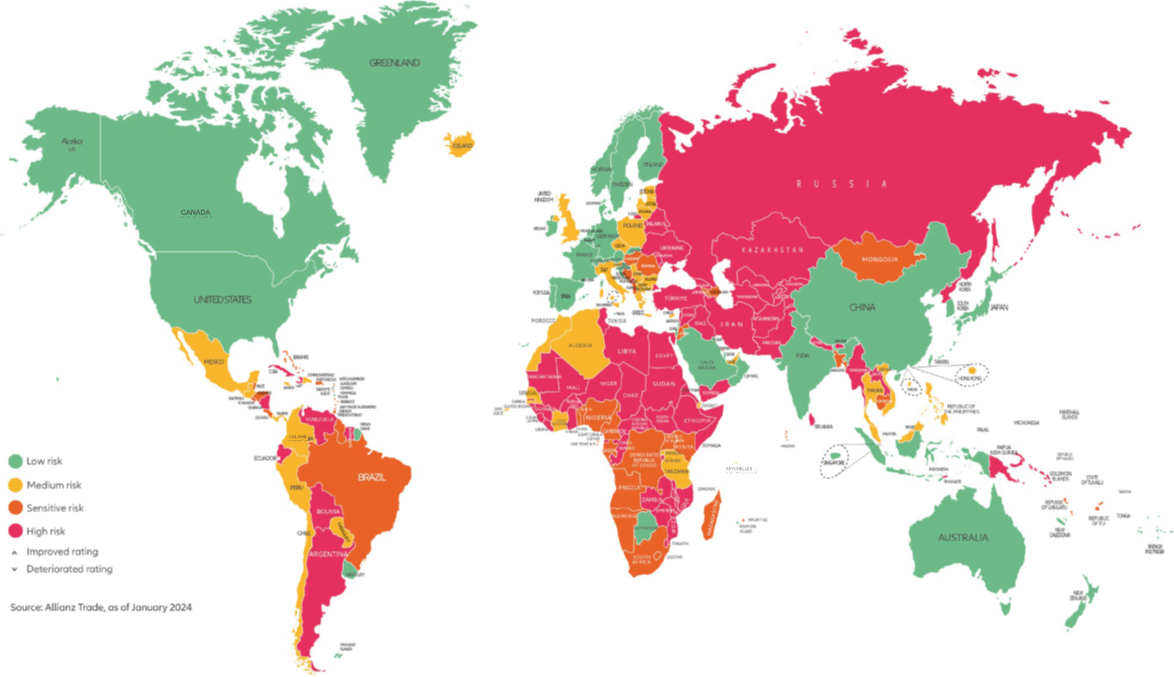

Country Risk Atlas: In 2023, 21 economies raised their risk rating, while only 4 were downgraded; for Poland, it remained unchanged (economic risk assessment in Poland remains at a medium level).

The first edition of the Allianz Trade Country Risk Atlas assesses economic, political, and ESG factors affecting the risk of non-payment for firms in 83 economies worldwide.

In 2023, Allianz Trade increased country risk ratings for 21 countries (+13 compared to 2022) and lowered only 4 (-13 compared to 2022), indicating increased resilience despite global shocks.

Assessment point for Poland “The worst is over in Poland, but the revival will be mild.” Polish exports focused on Europe, the slowest to recover from the slowdown, Polish companies should seek other markets, also thanks to the Business Risk Atlas, especially in Africa (risk assessments are dynamic), but also in Asia and North America.

Allianz Trade is publishing today its first Country Risk Atlas, a new flagship publication focusing on country risk – an expertise that the global leader in trade receivables insurance has built up over decades. The Country Risk Atlas is based on its proprietary risk assessment model, updated quarterly with the latest economic events and Allianz Trade’s own data on global insolvencies and the business environment*.

In 2023, the global economy demonstrated resilience despite several global shocks.

In its first Country Risk Atlas, Allianz Trade reveals that it raised 21 country risk ratings in 2023, and only lowered 4. The trend is entirely different from 2022 when Allianz Trade raised only 8 country risk ratings and lowered 17.

“In 2022, the repercussions of the war in Ukraine greatly influenced our country risk ratings. However, in 2023, the global economy showed some resilience in the face of one of the most aggressive tightening cycles in the world and in the face of major global shocks. Therefore, we raised the risk ratings of 21 economies, accounting for about 19% of global GDP. The most increases were in Africa (10), followed by Europe (6), while only China and Uruguay saw improvements in the risk trajectories for Asia and both Americas, respectively,” says Ana Boata, Director of Economic Research at Allianz Trade.

On average, looking at the average of all Allianz Trade’s country risk ratings, global non-payment risk for companies in 2023 is slightly above 2 (average risk), stable relative to 2022 and almost back to 2019 levels. Regionally, the average risk assessment in Africa is above 3 (sensitive), while the Middle East, Latin America, and Eastern Europe (including Russia) are close but below 3 (sensitive). Asia and the Pacific are slightly above 2 (average), and Western Europe and North America are close to 1 (low).

Poland: the worst is over, but … no improvement without changes – including increasing export diversification.

“The average risk in Central and Eastern Europe does not mean that our region is a monolith, on the contrary – it is quite diverse. With an average risk level – like Poland – are countries where Polish entrepreneurs most often have their local, trusted partners, including the Czech Republic. Meanwhile, not only does Slovenia have to be associated with mountains and skiing, and Croatia only with holidays on the Adriatic – both countries have moved up in our risk ranking (Croatia even twice in the last year!), and there is currently a low risk there, so it is worth considering looking for interesting business options there, even during holidays in these countries,” notes Sławomir Bąk from Allianz Trade in Poland.

Attention should also be paid to the assessment of Poland – the perspectives are direct and, thanks to this, accurate. Allianz Trade analysts evaluating the current components of the Polish economy observe a solid domestic demand, a certain business environment – well above average, while overall public finance requires monitoring, but external finances improved. In conclusion, “the worst is behind Poland, but the recovery will be gentle” also because of fundamental issues, such as the tendency to procyclical fiscal stimuli and a high load of foreign debt.

“One of the concerns is also Poland’s geographically undiversified foreign trade structure – frankly, its very high concentration in Western Europe markets. In Allianz Trade’s study, these countries have a low risk rating, which Polish entrepreneurs have benefited from in recent years. However, now it is worth realizing that the growth dynamics of the euro zone in the coming months and even quarters will be low – dynamic growth will be in other regions, including Africa and Asia, and in North America. I encourage Polish managers and entrepreneurs to familiarize themselves with our risk atlas – in this way, they can look for interesting destinations for their business growth,” summarizes Sławomir Bąk from Allianz Trade in Poland.

Be aware of potential rating downgrades in 2024.

Looking ahead, several factors might pose a challenge to the landscape of country risks, leading to further downgrades in the ratings in 2024.

Key risk factors identified by Allianz Trade for 2024 include:

– Liquidity constraints in an environment of high public and private debt and high interest rates.

– Below potential growth in most regions and lower pricing power for companies, resulting in a decline in revenue growth.

– Increasing insolvent companies (+8% worldwide in 2024), with Europe and the US leading.

– Changes in global supply chains, which may affect countries with a dual deficit, mainly on the current account balances.

– An increasingly polarized geopolitics in a year full of elections, with economies accounting for 60% of global GDP heading for polls.

* “The Country Risk Atlas provides a comprehensive analysis and insight into the economic, political, business environment and sustainable development factors that influence the trends in non-payment risk for companies at the macroeconomic level. Its aim is to accompany companies and investors in making informed decisions by identifying potential threats and opportunities in 83 different economies, along with a map that we create quarterly for all 241 countries and territories that we monitor annually,” says Ana Boata, Director of Economic Research at Allianz Trade.

[1] An upgrade in rating means an improvement in a country’s risk assessment, thus reducing the risk.