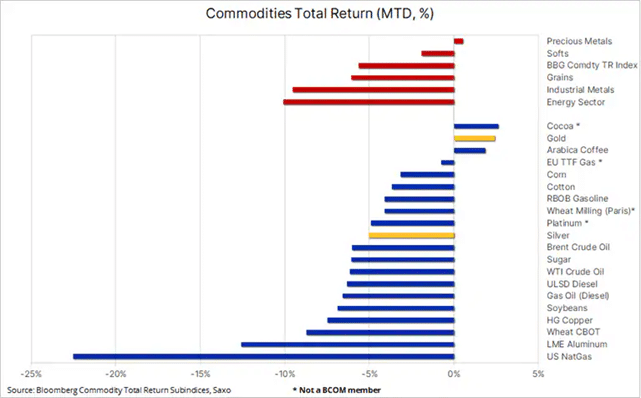

- The commodities sector has wiped out this year’s gains, with all sectors, except for precious metals, recording declines.

- Demand from wealthy private individuals, central banks, and Family Offices are contributing to the maintenance of gold prices.

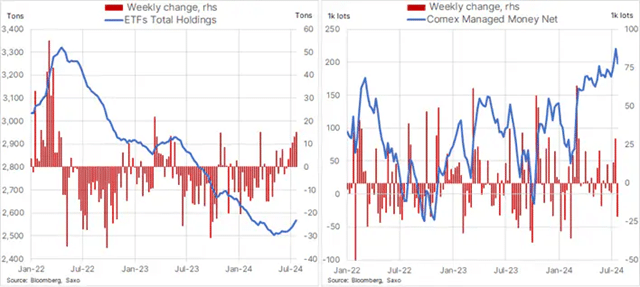

- ETF investors show signs of revival in anticipation of the first US interest rate cut.

This year’s commodity sector gains have been offset by concerns over China’s economic growth potential, a sharp selloff in the energy sector, led by natural gas, and a weak position for industrial metals. Copper, in particular, suffered due to a large liquidation of long positions by investors, resulting from a discrepancy between weak fundamentals in the short term and predominantly positive long-term prospects. Additionally, favorable weather for crops in the Northern Hemisphere has increased prospects for another season of record yields.

These events resulted in a 5% drop this month in the Bloomberg Commodity Total Return Index, leaving the index near zero for the whole year, with the only sector in the green, precious metals, thanks to the continuous resilience of gold supported by various factors.

World Gold Council: Highest demand in Q2 since 2000

This week, the World Gold Council published a report on gold demand trends in Q2 2024 and despite record prices, the organization recorded historic demand for OTC investments from Family Offices and wealthy individuals and stable demand from central banks.

She highlights key points of the report,

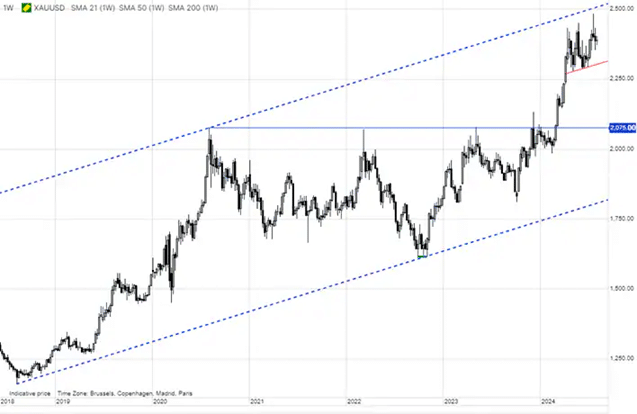

Furthermore, she noted that gold reached a new record in July, just below $2500 – a level that, according to Saxo’s forecasts, the metal was supposed to reach by the end of the year. This came about after traders, following a series of weaker economic data from the US, raised expectations that the cycle of interest rate cuts in the US could begin in September, instead of December. Lower costs associated with maintaining positions in a non-interest-bearing metal, like gold, will increase its attractiveness.

Investors show increased interest in gold amid geopolitical risks

Risks associated with Russia/Ukraine, the Middle East, and uncertainties about the US presidential elections in November are driving investors to assets they perceive to offer security and stability, such as gold.

Interest remains steady among central banks due to geopolitical uncertainties, de-dollarization, and gold’s ability to offer a level of security and stability that other assets may not provide.

Moreover, rising debt-to-GDP ratios among major economies, particularly in the US, raise some concerns about debt stability.

In addition, we are increasingly noting the positive impact of the upcoming US interest rate cut cycle, a period that has historically been favorable for this metal.

Gold maintains key support amidst future interest rate cuts

Looking ahead, Saxo Bank maintains that even with three rate cuts expected in the US this year, some short-term disappointments cannot be ruled out, but the overall direction of increase can be expected in the coming months and quarters. Should gold prices drop, the metal is likely to find key support around $2280, with the short-term target near $2325.

Based on the analysis by Ole Hansen, Director of Commodity Market Strategy at Saxo.

Source: https://managerplus.pl/spadki-na-rynku-surowcow-zloto-pozostaje-stabilne-dzieki-rekordowemu-popytowi-27126