The cryptocurrency market is experiencing a true ‘rebirth’ after a disastrous year in 2022. However, even a 140% increase in Bitcoin has not satisfied the appetite of investors, who are now looking forward to the future with growing optimism. But where has this surge of hope come from, and is the shining future of Bitcoin in 2024 already decided?

Speculative Roller Coaster

The first half of 2024 promises to be extremely exciting due to the final decisions of the U.S SEC regulator regarding the eagerly anticipated ETF applications and Bitcoin’s fourth ‘halving’. The market anticipates that the combined effect of these two events will trigger a new bull market in cryptocurrencies. Falling bond yields and a lower risk-free rate seem to be once more pushing investors back into the arms of risky assets. However, is Bitcoin’s fate certain before the new year even begins? The fact is that the establishment of spot ETF funds for Bitcoin evokes associations similar to that of the first such funds on the gold or S&P 500 indexes, which favored the appreciation of asset prices in the medium and long term.

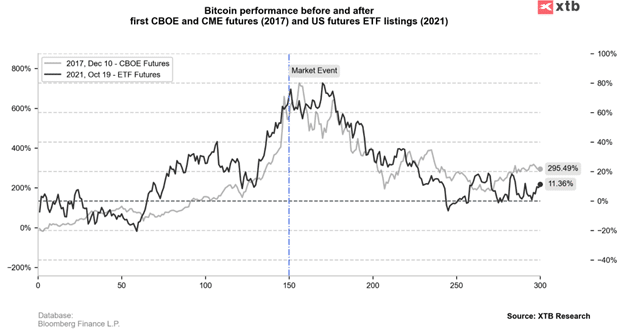

Historically, events such as the introduction of the first Bitcoin futures contracts on the Chicago CBOE exchange in December 2017 and the first ETF based on futures contracts in 2021 led to profit taking but did not determine the medium-term trend and did not yield the widely expected positive effects. Could this time be different?

ETFs are expected to track the market price of Bitcoin, purchasing Bitcoins directly from the market on behalf of investors, which would constitute a hedge for such a fund. Given the limited supply of Bitcoin, this suggests that in the case of large institutional purchases, the natural effect could be significant price increases.

Nevertheless, in the short term, the impact of ETFs on Bitcoin may be lesser than the industry expects, leading to a heated market, profit taking, and a ‘buy on rumors, sell on facts’ scenario. Undoubtedly, however, an ETF fund on spot price could significantly increase demand and raise interest in Bitcoin.

Bitcoin Halving Cycles

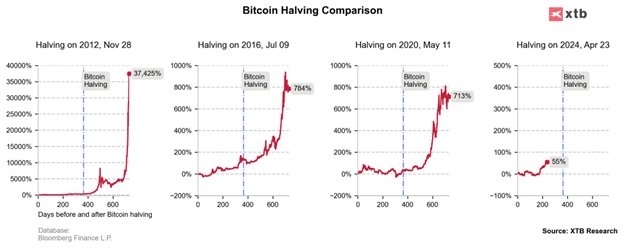

The history of Bitcoin is only 15 years old, but industry investors are closely monitoring seasonality and the dynamics of cycles related to so-called ‘halving’. Although the relatively young market provides data that may not have significant statistical value, the dynamics of the three previous Bitcoin ‘halvings’ suggest that they all influenced the price similarly. A decrease in the new supply of Bitcoin and the reward for ‘miners’ by half affects investor sentiment. It should also be remembered, however, that the past does not always have to repeat itself in the future.

It should be underlined that as of now, such an opportunity would be limited to American institutions. In Europe, the ability to invest in Bitcoin outside crypto exchanges has long existed, for example, through the Swedish Bitcoin Tracker ETN, denominated in EUR, which, however, does not enjoy significant interest.

Analyzing the bitcoin halving cycles and ETF effects, it’s obvious that the fundamentals of trend continuation remain very strong.

Key dates:

– January 10, 2024 – SEC may make final decisions on ETF applications.

– April 23, 2024 – Fourth Bitcoin halving.

Looking at these factors, unpredicted events, an economic downturn or a second wave of inflation could all disrupt the further growth of Bitcoin. However, none of these seem currently probable. A falling inflation justifies the first interest rate cuts by central banks, which alongside strong consumers, creates a favorable environment for cryptocurrencies’ growth in 2024.

Author: Eryk Szmyd, Analyst at XTB