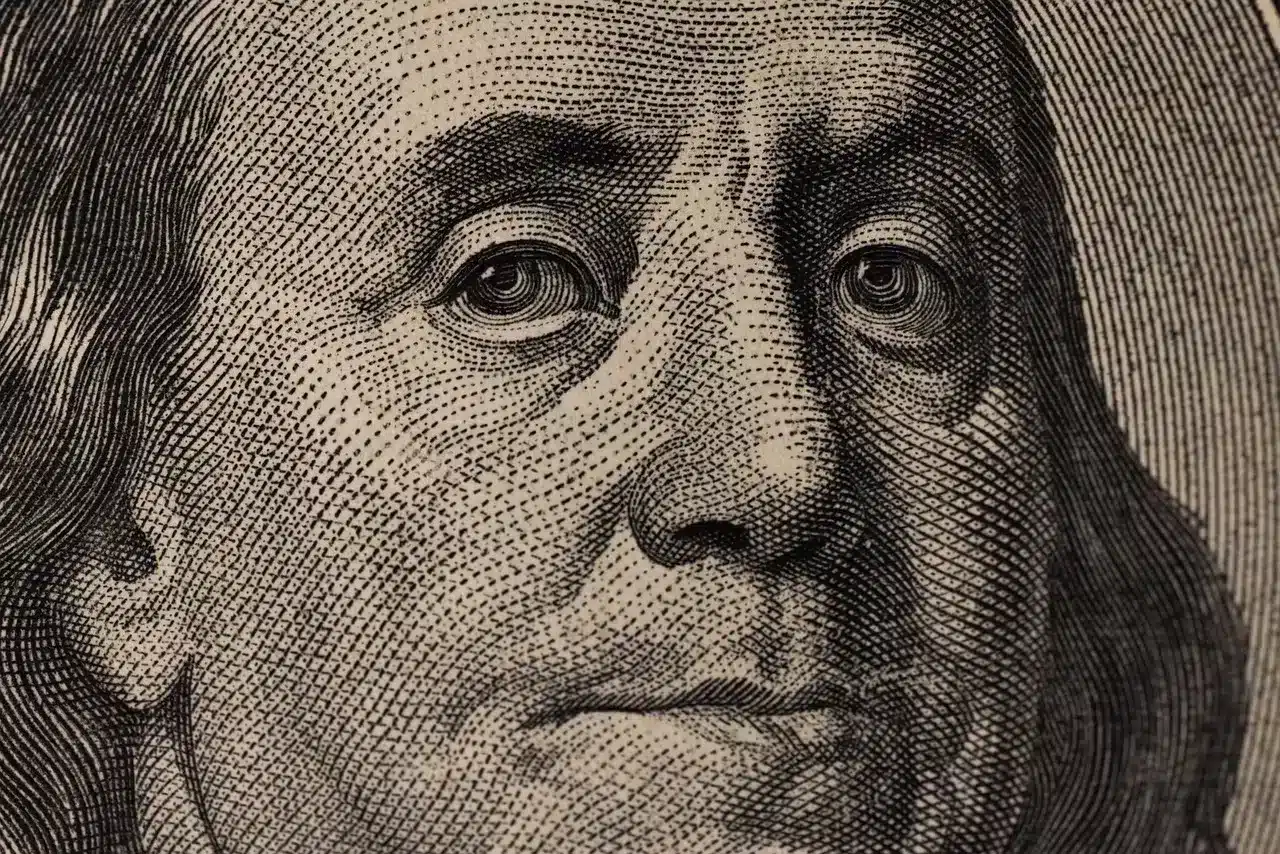

Today, the Fed is likely to give markets a holiday gift in the form of another interest rate cut. All signs indicate that we will end this year with a target federal funds rate range of 4.25% – 4.5%. The market has already fully priced this in. Rate cuts in the coming months, however, are less certain. The central bank will consider the risk of rising inflation and adopt a conservative approach.

The U.S. economy performed better this year than initial forecasts suggested. It has managed to withstand restrictive monetary policy. The labor market has slowed down but has not collapsed. The Fed no longer expects deterioration in this area. Now, the focus will be on safeguarding the progress that has been made.

According to the institution, the current interest rate remains clearly restrictive despite cumulative cuts of 75 basis points. Central bankers see the long-term neutral rate as slightly above 3%. Therefore, theoretically, there is considerable room for further easing. However, in recent weeks, there has been a risk that inflation’s return to the 2% target may not be smooth — particularly due to potential actions by the new Trump administration. Looking at core inflation, measured by the Fed’s preferred indicator, the Personal Consumption Expenditures (PCE) deflator, we see stabilization in the range of 2.6% to 2.8%. The latest CPI data has demonstrated its persistence.

Today’s decision should not come as a major surprise. What will be significant are the new macroeconomic projections, the updated “dot plot,” and the press conference. The degree to which the latest forecasts deviate from those made in September will drive market volatility. It will also be interesting to see how strongly Powell emphasizes his political independence.

Tomorrow, we await decisions from the Bank of England (BoE) and the Bank of Japan (BoJ). The European central bank is expected to “pause” in easing monetary conditions. Labor market data published yesterday supports this scenario. Today, the pound may be sensitive to the CPI reading (8:00), which is expected to come in higher (2.6% and 3.6% for the core rate). At the same time, the market has little faith in the possibility of a rate hike in the “Land of the Rising Sun.”

Author: Łukasz Zembik, Oanda TMS Brokers

Source: CEO.com.pl