According to the latest data from the World Gold Council, the National Bank of Poland (NBP) emerged as the largest gold buyer in the third quarter of this year. Thanks to intensive purchases, Poland has risen to 12th place in the global gold reserves ranking, surpassing countries such as the United Kingdom, Portugal, and Saudi Arabia. However, the ambitious efforts do not stop there – calculations from Tavex indicate that in November, NBP increased its reserves by an additional 21.05 tons of gold. Currently, gold constitutes 17.59% of the bank’s reserve assets. We are now just one step away from achieving the strategic goal of having 20% of national reserves in gold. What is behind this pursuit, and why is it so important for us?

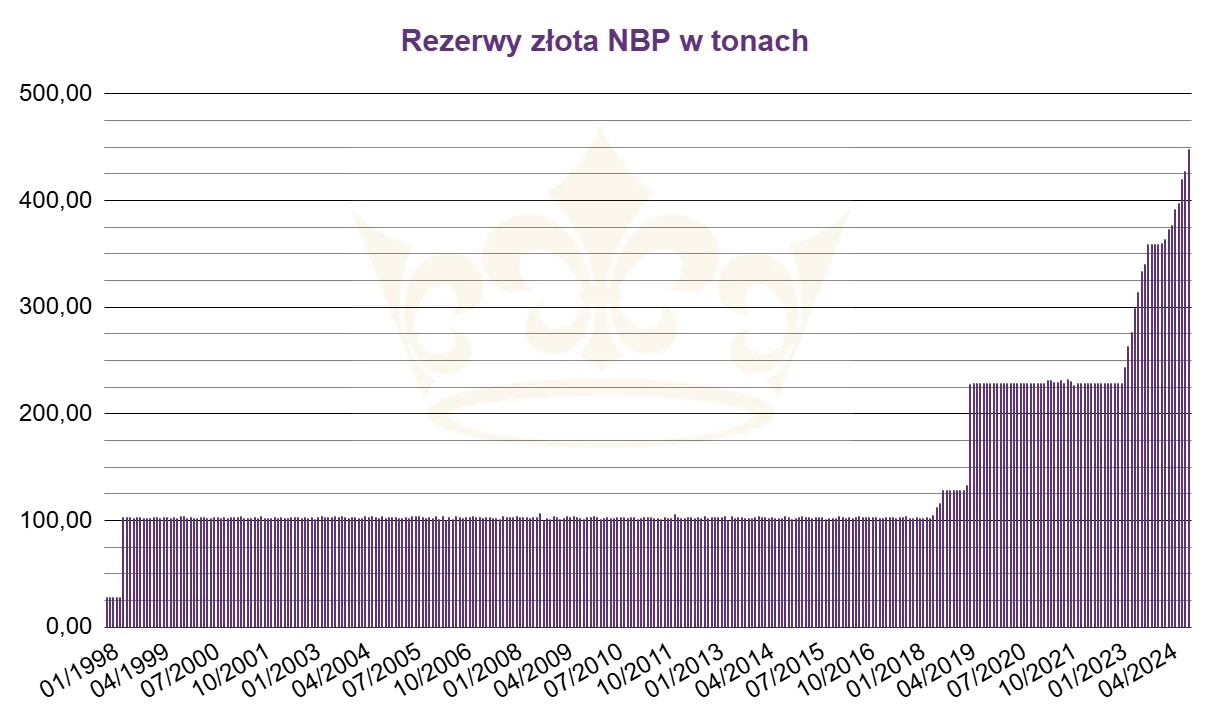

NBP’s Gold Reserves

The global race for gold continues, and Poland is consistently making its mark. The President of the National Bank of Poland has long emphasized the need to increase the share of gold in the country’s foreign reserves to 20%. Following both the October and November purchases, this share now stands at nearly 18%, meaning the ambitious plan is within reach.

According to Tavex data, NBP purchased an additional 21.05 tons of gold in November. Currently, gold accounts for 17.59% of the reserve assets (down from 17.73% at the end of October), with total gold reserves reaching 448.24 tons. The slight decrease in the share of gold in the reserve assets compared to the previous month is due to recent price corrections in the market.

Why is NBP continuing to intensify its gold reserves while other central banks are slowing their purchases? One possible reason is the aim to enhance the perception of Poland’s financial stability. Relatively high gold purchases may also be influenced by Poland’s geographic location and associated geopolitical risks, particularly those present on the eastern border. It’s worth noting that gold is not only a form of security but also a significant factor in building international trust.

Despite recent price declines, monetary gold remains a key element of foreign reserve diversification worldwide. The global demand for this precious metal makes it one of the most sought-after assets, with nations across all continents competing for it. In times of geopolitical tension, gold becomes a guarantee of financial security for many countries, emphasizes Aleksander Pawlak, President of Tavex. Poland’s gold purchase strategy is not only a step towards greater financial stability but also a signal that the country prioritizes economic security. In the face of a changing global economic and political landscape, gold remains a symbol of value and a guarantee of stability, he concludes.

Finally, it is worth highlighting that throughout 2024, Poland consistently ranked at the top of the World Gold Council’s quarterly reports on central bank gold purchases. The latest ranking was no exception. Moreover, thanks to these intensive purchases, Poland advanced to 12th place in the global gold reserves ranking, overtaking countries such as the United Kingdom, Portugal, and Saudi Arabia – an impressive jump of three positions year-over-year. Will this be another golden year, and will the coveted 20% be achieved? We will have to wait another month for the answer.

Source: CEO.com.pl