PZU shares lose 13% at the start of Monday’s session due to dividend cut and flooding in southern and western Poland. The company is currently trading at its lowest level since October 2023.

Shares of the key insurance company in Poland are being traded today without the right to dividends amounting to PLN 4.34 per share. This cut implies a drop of over 9% from Friday’s closing price, exerting justified downward pressure on securities. Losses are exacerbated in the face of tragic events in southern and western Poland.

PZU CEO, following consultations with the Interior Minister Tomasz Siemoniak, announces a simplification of the compensation payment procedure, making money available in many cases within just one day. “In estimating losses and damages we will help swiftly, as soon as the immediate threat to life and health passes,” says Jan Grzegorz Pradzynski.

The scale of damage is difficult to estimate at this moment, although it is believed that it can run into billions of złoty. From a market perspective, it is the insurance sector that is seen as the first to feel the effects of the flood tragedy. Nonetheless, we must not forget that local logistics, agricultural companies and public institutions have also been affected. As of now, there have been two confirmed deaths due to the floods.

Government support was also pledged for the victims. On Sunday evening, Prime Minister Donald Tusk ordered the preparation of regulations introducing a state of natural disaster. The Council of Ministers is also preparing funds for immediate assistance, which will be disbursed by local governments.

The impact of the floods on PZU’s business is not yet decided. Although the company may face increased pressure to payout compensation, it should be noted that insurance companies often protect themselves (reinsure) with external entities in the event of unexpected incidents. This protects the insurance companies and their customers by increasing the chances of actually receiving funds. Importantly, the standard insurance grace period is 30 days. In such a case, people who have recently applied for such insurances may not receive them. In the medium term, however, PZU and other insurers may see increased interest in insurance products from society, which will have a positive effect on the results of companies in this sector.

PZU shares were in a strong growth trend from August 2023 to July 2024, when many flash floods took place, and 2023 was a year of climatic extremes on a global scale. In Europe alone, rainfall increased by 7%, and the damage caused by floods during this period is estimated at 11 billion euros.

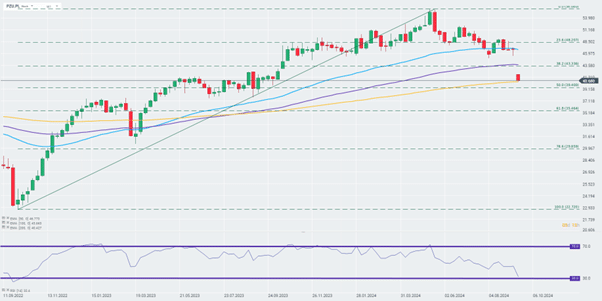

PZU shares are trading at their lowest levels since last October and are testing a crucial support point determined by the 200-week exponential moving average. Source: xStation

Author: Mateusz Czyżkowski, XTB analyst

Source: https://ceo.com.pl/akcje-pzu-pod-presja-najnizsze-notowania-od-pazdziernika-2023-r-14330