Due to the increasing scarcity of residential land in large cities, investors are more often opting to build PRS facilities on attractively located plots with commercial use. What decisions and their consequences do investors have to face?

Authors: Paulina Brzeszkiewicz-Kuczyńska (Research and Data Manager), Marta Marat (Valuer, Valuation and Advisory), Kamil Olechniewicz (Project Manager, Technical Advisory and Project Management), Patryk Błach (Senior Consultant, Investment), Karolina Aleksandrowicz (Junior Research Analyst)

Location of PRS projects and their local master plans

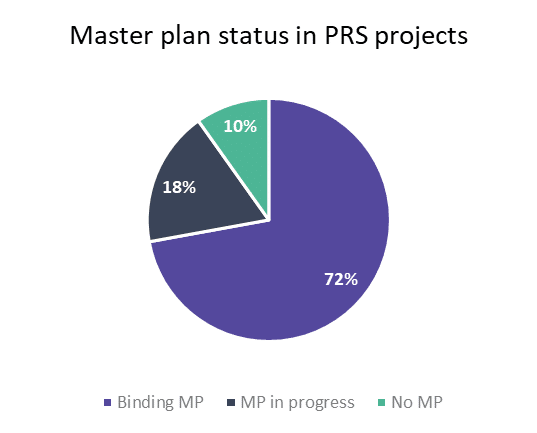

By mid-2024, the number of PRS formula investments in Poland exceeded 120 projects, of which 73% are completed and the remaining 27% are under construction. Nearly ¾ of the projects analysed are located in areas covered by binding local master plan (MP).

Source: Avison Young

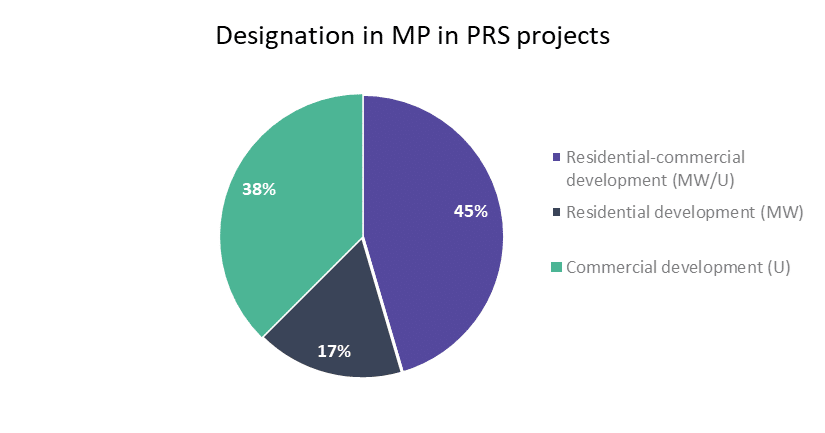

The majority of investors choose to locate properties for institutional rental in areas which are designated in the local master plan for residential and commercial development (MW/U). So far, 40 investments have been or are being constructed on plots with this designation, which accounts for 45% of all projects located in areas covered by the local master plan.

Due to the scarce availability of land in the largest Polish cities earmarked exclusively for multifamily residential development (MW), such projects constitute a definite minority (less than 20%) in the overall structure of the analysed investments. The situation is slightly different in the areas designated in the local master plan for commercial development (U), where almost 40% of PRS investments are currently located.

“The low percentage of PRS developments carried out on land without a MP may be largely due to the fact that such development is then based on development conditions (WZ), where the development of a project with apartments for rent is not usually the landowner’s first choice. As a rule of thumb, in the case of metropolitan locations, most investors and owners of the plots prefer to first try to obtain a WZ for multi-family residential development with a view to the subsequent sale of individual units to private individuals. Only when they fail in agreeing a WZ for residential development do they opt for an alternative in the form of, for example, a typical PRS, co-living, student housing or hotel project.” – comments Patryk Błach, Senior Consultant, Investment at Avison Young.

Source: Avison Young

The portfolios of the leading players in the PRS sector in Poland are dominated by projects located in areas designated for residential and commercial or solely residential development. However, the largest of them locates more than half of its investments in areas designated for commercial development, which gives him an advantage not only in this aspect, but also in general – this investor boasts the largest market share (20%) in terms of the number of existing projects and those under construction.

Visible differences from a city perspective

Structural differences in the share of a given local master plan designation on which PRS projects are located can be seen in the analysis of individual cities. Poznań, Wrocław and Kraków exhibit the highest, ca. 20%, share of projects on plans with residential designation. The Tricity is characterised by the largest, almost 40% share of PRS projects located on a plan with commercial designation, while in Warsaw, Łódź and Kraków approx. 25% of PRS projects are located in the area for which MP is in progress.

Interestingly, in Poznań, more than 30% of investments are located in areas not covered by MP. This is due to the fact that in the central part of the city still many areas do not have a local master plan.

Less land, more projects on commercial development plans

Due to the increasing scarcity of residential land in large cities, investors are more often opting to build PRS facilities on commercial-designated plots whose location is attractive for housing.

“The purchase prices of commercial-designated plots are usually lower than of the ones with residential zoning, which makes them an interesting alternative for PRS investors. In addition, they do not have to compete with typical residential developers when acquiring such a land.”- comments Błach.

“However, a PRS investment on commercial land, despite cheaper land, once the facility is developed and commercialised, involves a VAT charge on rental income, which affects the initial yield,” – points out Marta Marat, Valuer at Avison Young.

The issue of separation of premises and taxation

A major difference in PRS projects developed on land with residential and on commercial uses is the issue of separating independent units. In the first case, the residential units must not be smaller than 25 sqm according to the current building law. For them, certificates of independence can be issued and mortgage registers established. And dwellings with an established land and mortgage register can be marketed both as a target product for an investment fund and for individual customers. The sale of such premises is subject to VAT of 8%.

On the other hand, if the project is built on land designated for commercial purposes, the separation of commercial premises (as such may be referred to here) is characterised by the lack of limitation of the minimum area and the VAT on sale is higher and amounts to 23%. In practice, units with a PRS designation range in size from 15 sqm upwards, with the smaller size of the units being offset by more extensive common areas, such as shared work and leisure spaces, laundry facilities and training rooms.

In the banks’ view

In the case of bank financing PRS investments, from a risk point of view, it seems to be more advantageous to finance projects built on residential land. The possibility of separating individual flats and their eventual resale seems to be more secure option for banks for the financed project. Moreover, restrictions on the separation of units for commercial use, hinder the potential sale of individual units to private customers in the event that the operator resigns from renting units under the PRS formula. In such a situation, the object of the sale must be the entire property.

“Even at the valuation stage of a property under construction on a residential plan, it happens that the bank financing the project asks us for a two-pronged approach – a valuation in an income approach after the rents generated by the property and in a comparable approach, assuming the future separation of individual residential units for sale.” – notes Marat.

Differences in terms of installation and design

“The construction law does not directly standardise the categories of buildings designated for PRS, and the current regulation of the Minister of Infrastructure on the technical conditions to be met by buildings and their location and the Polish Classification of Building Objects define the aspect of residential and non-residential buildings differently. – explains Kamil Olechniewicz, Project Manager, Technical Advisory at Avison Young – Therefore, the scope of technical solutions of installations and fire protection is determined on a case-by-case basis.”

In practice, the buildings located in the specific areas differ slightly in their noise exposure – the daytime and nighttime maximum noise levels for the “U” and “MWU” areas are on average a few dB higher than for the “MW” areas. The same is with the sound insulation of partitions – a value of ≥ 50 dB for walls between flats and ≥ 45 dB between units of other categories, although in the latter case sometimes the required insulation may even be higher than 50 dB, depending on the qualification of the units.

However, there are slight differences in terms of access to daylight and mechanical ventilation solutions. On the other hand, buildings located on the commercial plan are more likely to have fire alarm systems that also cover the interiors of the premises and stricter requirements regarding the flammability class of the furnishings, which directly translates into a higher investment outlay for construction and finishing. “Other issues such as a direct entrance from the lobby or individual metering of the utilities supplied to each unit is a common standard regardless of the use.” – Olechniewicz adds.