Tomorrow, on Saturday, April 20th, around 6:00 AM Polish time, the fourth Bitcoin halving in history is likely to occur. This is a significant event for the cryptocurrency market, anticipated by investors, traders, and short-term speculators from all over the world.

Historically, after each of the three previous halvings, Bitcoin has entered a period of dynamic growth, and investors repeatedly asked the same question: Will this time be different? Let’s pose this question again and respond by addressing the key issues stemming from the cyclicality and the changes that have occurred in the cryptocurrency market and Bitcoin itself in 2024.

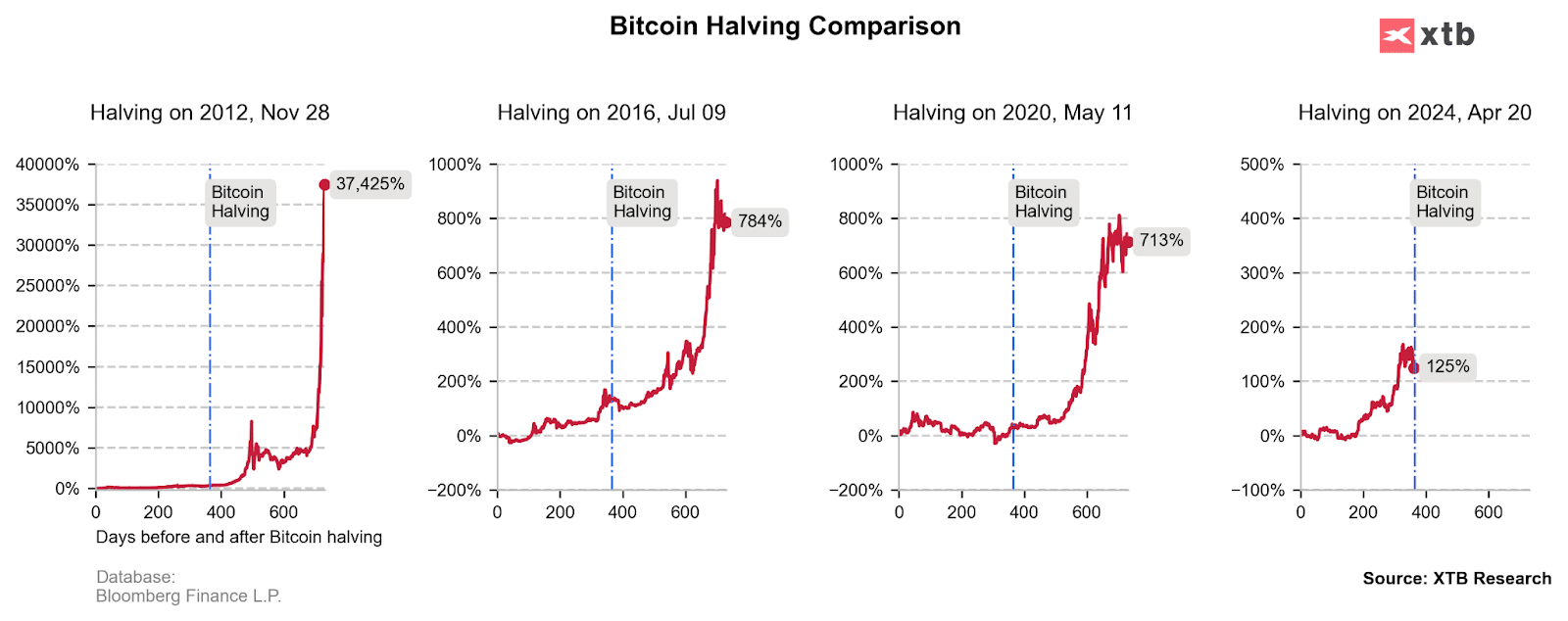

Historically, halving has preceded Bitcoin bull runs, which typically start about 12 months before the supply cut and last for approximately 12 months afterward. The chart shows the price of Bitcoin one year before and one year after each previous halving. Remember, past results do not guarantee future returns, and the market tends to fall into various cognitive errors. Importantly, over 90% of the total Bitcoin supply of 21 million BTC is already on the market. Moreover, the three halvings so far seem like a small sample to estimate their actual short-term impact on price. Nevertheless, the long-term supply-reducing effect of halvings is clear. We thus assume that the short-term reaction of BTC depends on overall moods and, in line with the nature of the “counterintuitive” and consistently surprising Bitcoin market, may be opposite to prevailing sentiments. Source: XTB Research

If history repeats itself

As Mark Twain famously said, “History does not repeat itself, but it often rhymes.” Similarly, although never exactly the same, all previous cryptocurrency cycles were characterized by extreme panics and euphoric rises. In the first case, let’s consider the impact of the halving in a scenario optimistic for Bitcoin, similar to previous cycles. In such a case, on April 20th, we may face a temporary drop (known as ‘sell the news’), followed by consolidation, a longer period of correction, and a transition into a dynamic and final phase of the Bitcoin bull run.

It seems that the current 20% correction is already significant and dynamically similar to previous periods of decline from 2023 and early 2024. Each previous instance proved to be a “buying opportunity.” Thus, we might well see increases immediately after the halving, or just before it, although demand so far seems dormant. According to JP Morgan’s analysis, the futures market still signals an overbought level, and the volatility-adjusted valuation of BTC, relative to gold, suggests a price around $45,000. Nevertheless, in both scenarios, the initial short-term reaction can be deemed insignificant for the further (upward) trend and we can expect significantly higher Bitcoin prices within a few months of the halving.

Historically, a strong support level for Bitcoin prices has been the mining profitability level, which is currently about $42,000 and reflects the cost borne by miners. Another significant support comes from the average purchase price of BTC by short-term investors (around $59,000), who are currently recording about a 7% profit, compared to nearly 40% about 30 days ago. On-chain data, relating to previous cycles, specifically the amount of time in which BTC purchased by short and long-term investors recorded profit or loss, suggests about 5 to 12 months of a bull run ahead. This would mean a peak of cyclical rises around Q4 2024 or Q1 2025. Forecasts by Bernstein analysts also provide some extrapolation, suggesting even a peak of $150,000 per BTC in the current cycle.

The broader picture of limited supply (which only translates into price increases in a still-high demand scenario) now overlays not just the halving, as in previous cycles. Bitcoin has become a globally recognized asset, with a market capitalization of nearly $1.3 trillion. The available supply is more influenced by the activity of American exchange-traded funds (ETFs), which, after four months of operation, already hold over 5% of the total Bitcoin supply. We have already seen a taste of this impact; Bitcoin has never before experienced such large increases nor reached a new all-time high before a halving. Investors should therefore closely monitor sentiments on the Nasdaq100, bond yields, and the U.S. dollar itself; the combination of these three factors may determine short-term price movements, through specific behaviors of ETF holders. Further bull runs on the stock markets would likely favor Bitcoin.

If history does (not) repeat itself

As is known, Bitcoin is a deflationary asset, meaning its supply is limited. The halving programmed into Bitcoin’s code affects the inflation rate of the cryptocurrency and halves the mining reward (now it will drop from 6.25 to 3.125 per BTC block). Historically, this has created the prospect of increased demand, in anticipation of a bull run. Consequently, investors have been reluctant to part with their Bitcoins, expecting that the value of their investments will increase over the medium term. But what if this time really is different, and the previous cycles are completely disrupted? Although a few months ago, such a prospect seemed less likely, we now see at least one factor that may decide this.

We are talking about American ETFs, which in recent months have “swallowed” a huge number of BTC. Just the two largest among them, namely BlackRock Bitcoin Trust and Grayscale Bitcoin Trust, hold Bitcoins worth nearly $36 billion. Additionally, regulators in Hong Kong have expressed consent to establish similar funds. The marginal demand is currently broader and has been enriched by investors whose reactions may more strongly correlate with Wall Street. More than in the case when Bitcoin was an alternative but very little-known asset. Sentiments related to Bitcoin may be more tied to what is happening in the stock markets.

A number of individual and institutional investors investing in exchange-traded ETFs will adjust their portfolios according to the risk assessment of their components. Bitcoin is still perceived as a risky investment, and the restrictive policy of the Federal Reserve and recent, surprising data about inflation supporting the dollar have caused capital to at least temporarily “turn its back” on risky assets. Furthermore, the tension between Israel and Iran in the Middle East has not helped the cryptocurrency, even leading to an increased markdown, despite recent optimistic voices suggesting that Bitcoin might serve as a hedge during military tensions.

Nevertheless, although ETFs have recently recorded outflows, and interest in them has waned, this is consistent with market cyclicality, and the lack of stronger sales suggests that many holders adopt a long-term investment horizon, effectively limiting the BTC supply. However, a potential sale of BTC gathered by them could cause panic and change the cycle. The entire cryptocurrency market, similar to hedge funds implementing a trend-following strategy, observes inflows to them as a main indicator of market strength. The increase in oil prices, the tougher fight against inflation, and economic data justifying restrictive (and consequently potentially dangerous for stocks) central bank policies (higher for longer) seem to pose some risk to the halving cycle. On the other hand, the massive size of US debt and resulting fiscal problems, and the potential continuation of the downward trend of the US dollar relative to assets (not necessarily currencies), still provide tailwinds for speculative Bitcoin.

Bitcoin Chart (D1 interval)

Bitcoin’s price caught its breath after a huge rally. The support level around $60,000 is still being maintained, supported by two significant levels. Both the 23.6% Fibonacci retracement of the upward wave from December 2022 and the 71.6% retracement of the downward wave from November 2021. In each of the previous bull runs, the average purchase price of BTC by short-term investors (holding BTC for less than 155 days), which is currently about $59,000 and for American ETFs hovers around $55,000, proved to be a significant support level. A dip below any of these two thresholds could lead to accelerated selling. In the scenario of deeper falls and panic, key levels include the vicinity of $51,000 supported by past price reactions, the 38.2% Fibonacci retracement, and the aforementioned profitability level of miners around $42,000.

Author: Eryk Szmyd, Analyst at XTB