Today, Poland is the fifth-largest leasing market in Europe and the fastest-growing in the European Union according to a report from the Polish Leasing Association prepared in collaboration with EY-Parthenon.

In the last 18 years, the leasing market in Poland has grown over sixfold: from 16 billion PLN of financed assets annually in 2005 to 102 billion PLN in 2023, developing at an average rate of over 10% per year.

The leasing industry is a driving force in the Polish economy: leasing finances nearly 30% of all investment outlays in the Polish economy, and is a preferred form of financing for SMEs, which generate almost 50% of Poland’s GDP.

As many as 77% of leasing companies believe that the sector will experience good fortunes in the next 5 years, with an additional 18% believing it will be very good.

The Polish Leasing Association (PLA) has published a report “Leasing on the Path of Transformation. We have been driving the economy for 30 years”, prepared together with EY-Parthenon. The occasion for its creation is the 30th anniversary of the PLA’s operations this year.

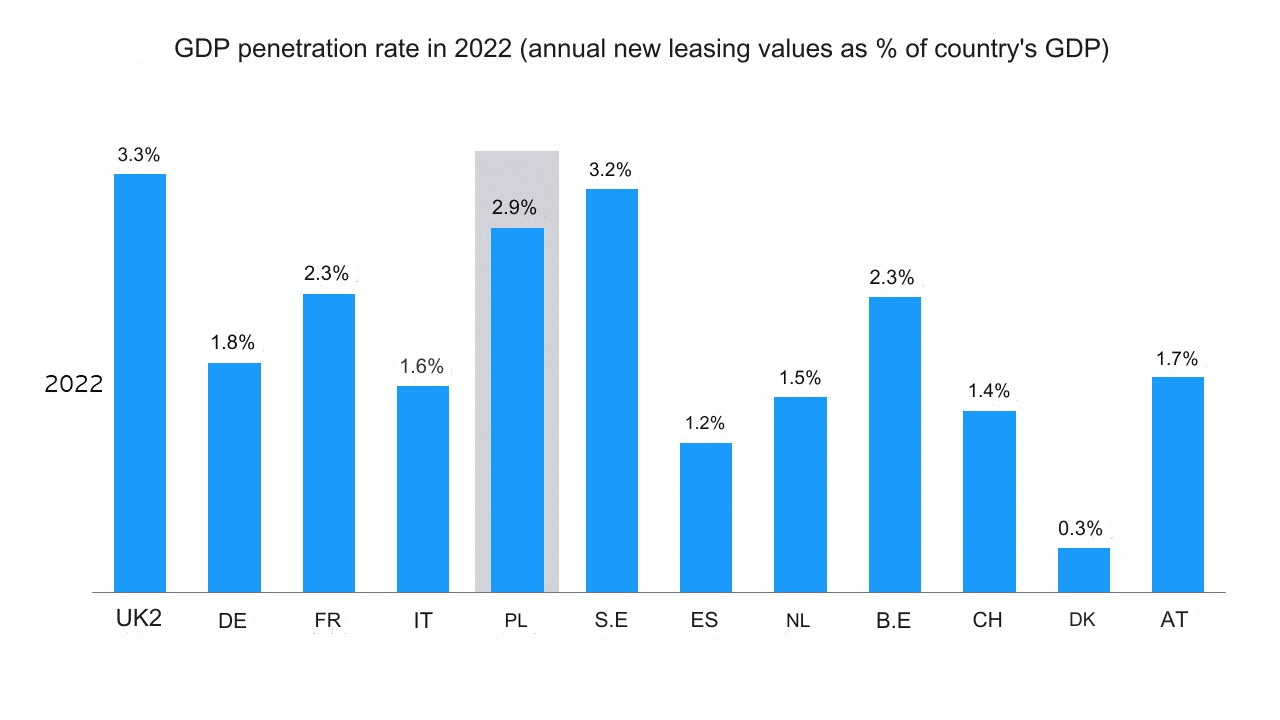

According to the report, the Polish leasing market is on a path of steady growth – it is the fastest-growing market in the European Union. Considering the value of new financed investments, we currently rank fifth in Europe.

“The position of leasing in Poland has grown alongside the business of our clients. In 2023, companies affiliated with the Polish Leasing Association financed investments worth over PLN 100 billion based on leasing contracts and loan agreements,” said Paweł Pach, President of PKO Leasing and Chairman of the PLA Council.

Since 2005, the leasing market has grown over six times: from PLN 16 billion of financed assets in 2005 to PLN 102 billion in 2023. Last year, the industry broke the barrier of PLN 200 billion in the value of all assets used by over one million customers. In 30 years, the total value of investments financed by leasing is as much as PLN 1 trillion.

After 30 years, Poland has become the 5th market in terms of the value of assets financed by leasing in Europe, catching up with countries like the UK, Germany, France, or Italy.

As the report reveals, financing movable assets with leasing and a leasing loan is higher than with an investment loan. The value of all movable assets financed by leasing at the end of last year was close to PLN 200 billion, while it was less than PLN 170 billion with an investment loan. Already, more than half of new vehicles are registered by leasing companies and rentals.

Leasing is already the preferred form of financing for many entrepreneurs, offering greater flexibility and less risk for both parties to the contract.

The most important issues that, according to leasing companies, hinder the development of the market are regulatory and legal barriers.

It is positive that leasing companies rate the economy well for the next 5 years. As many as 77% of respondents in the EY-Parthenon and PLA study believe that the sector will be good, and an additional 18% believe it will be very good.

Compared to other European countries, leasing in Poland is an exceptionally popular service, and the penetration rates for leasing are higher than the European average.