This is unfortunately a record that no one is happy about, especially in Western Europe, which plays a key role in the Polish economy and has the highest contribution to the global number of insolvencies of large companies (6 out of every 10 cases globally). Moreover, all three sectors that contributed the most to the global number of large company insolvencies (services, retail, and construction) were particularly affected by problems in Western Europe. This impacts the results and outlook for Polish exports and individual companies for which this is a key market.

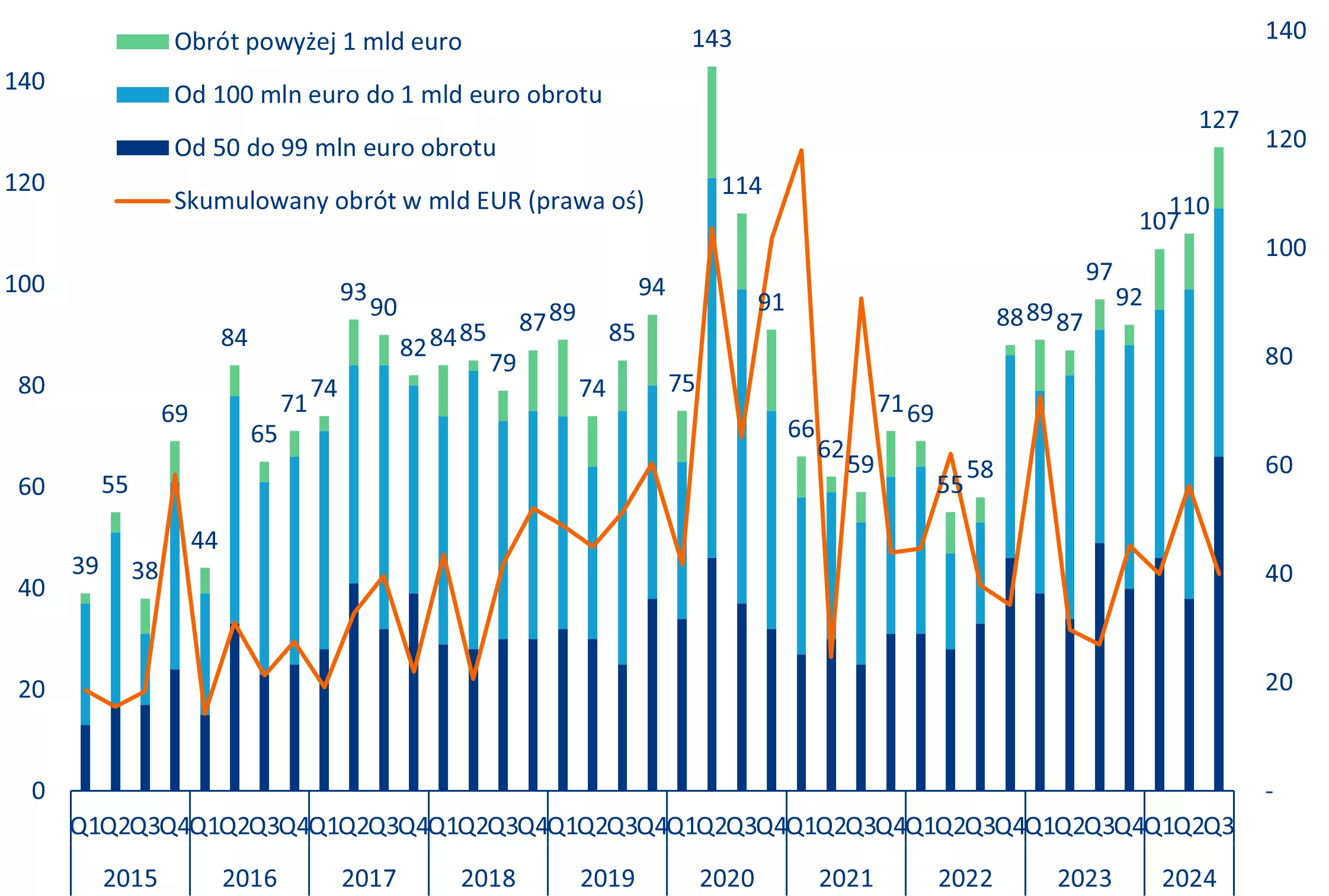

- Record number: In Q3 2024, there were 127 cases of insolvencies of companies worldwide with a turnover of over 50 million euros, i.e. +17 compared to Q2 2024 and +42 compared to the pre-pandemic average of 82 in 2017-2019.

- Record turnover: The total turnover of insolvent large companies increased by +48% year-on-year to 40 billion EUR.

- Record region: Western Europe recorded the fastest increase and number of insolvencies of large companies (over 50 million EUR turnover), but the highest number of insolvencies of the largest companies (over 1 billion EUR turnover) was observed in both the Americas.

- Sectors with record numbers: The sectors most affected were services and retail, particularly in Western Europe and North America, as well as construction, especially in Western Europe and Asia.

- With 344 cases of large company insolvencies globally recorded in the first three quarters of this year, this number has already exceeded the totals for the full years of 2015-2019, 2021, and 2022.

- Ongoing economic uncertainty, structural changes in sectors, and the transformation of supply chains and global trade are likely to cause the final number of significant insolvencies to reach a new record in 2024, increasing the risk of a domino effect for suppliers and subcontractors.

In Q3 2024, insolvencies of companies with a turnover exceeding 50 million euros reached a new record level. According to Allianz Trade analysis, there was more than one such insolvency case per day. The number of the largest global insolvencies for this quarter increased to 127 cases, +17 compared to Q2 2024 and +42 compared to the pre-pandemic average of 82 in 2017-2019. This is the second-largest quarterly increase since our research began in 2015. Since the beginning of the year, the number of large company insolvencies worldwide has increased by +26% year-on-year, reaching a total of 344 cases (in the first three quarters of 2024). Additionally, the total turnover of the largest insolvent companies (>1 billion EUR) for the first three quarters of this year increased by +48% year-on-year to 40 billion EUR, reinforcing the trend observed in Q2. Since the beginning of the year, the total turnover of large companies (insolvencies of those with turnover >50 million EUR) has increased by +5% to 136 billion euros, with an average turnover just below 400 million euros. For comparison, in 2015-2019, total turnover amounted to 463 million euros. Furthermore, significant cases such as HNA and Evergrande in China contributed to raising the total and average turnover of large insolvent companies in 2020 and 2021.

Chart 1: Major insolvency cases, quarterly number, by turnover size

Source: Allianz Trade

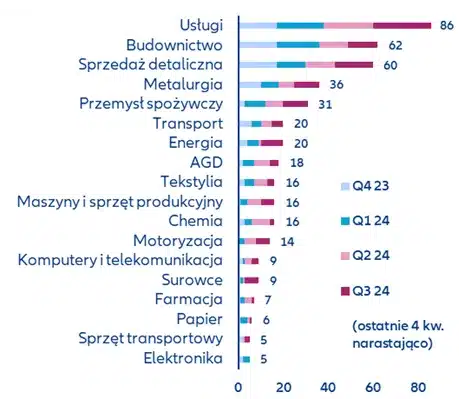

Western Europe is the leader in both the number and pace of growth of large company insolvencies, but the highest number of insolvencies of the largest companies (with a turnover of >1 billion EUR) is recorded in both the Americas, according to Allianz Trade analysis. In Q3, Western Europe was the main contributor to the increase in the number of large company insolvencies year-on-year (+30 cases, reaching 91 companies). North America and Asia stand out with nearly stable numbers year-on-year (a decrease of -1 year-on-year, to 13 and 12 cases, respectively). Since the beginning of the year, the picture has remained mostly the same, with Western Europe leading ahead of North America (respectively: +81 cases and +7), while Central and Eastern Europe, Latin America, and Asia have seen declines (respectively -2, -5, and -7). Western Europe accounts for six out of 10 large company insolvencies globally, with 276 out of 436 insolvent companies in the past four quarters (from Q4 2023 to Q3 2024 inclusive), followed by North America (73) and Asia-Pacific (62) as key regions shaping the overall number. It is worth noting that the United States remains the leader in terms of the number of insolvencies of the largest companies (turnover >1 billion EUR) – accounting for 7 out of 10 of the largest insolvencies in Q3 2024 and 9 out of 20 largest insolvencies since the beginning of the year, ahead of Western Europe and China (five such cases from the beginning of 2024) for the second consecutive quarter.

Chart 2: Major insolvency cases worldwide, numerical data for the last Q4, by region (left) and by sector and quarter (right)

Source: Allianz Trade

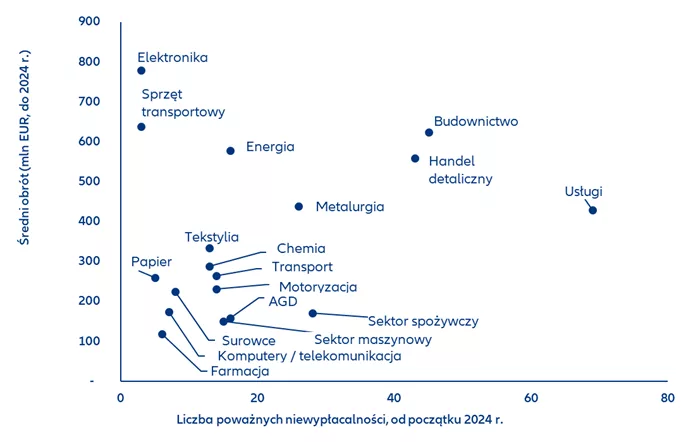

The most affected sectors were services and retail, particularly in Western Europe and North America, as well as construction, especially in Western Europe and Asia. All three sectors that had the largest share of global large company insolvencies in Q3 were particularly affected by problems in Western Europe: services (18 cases), retail (13), and construction (9). In Asia, most cases occurred in services (3) and construction (3), while in the United States, there were insolvencies of large companies in services (3) and energy (3). Interestingly, the most affected sectors remain the same when summarizing the first three quarters of this year, with 69 cases in services, 43 in retail, and 45 in construction recorded worldwide. In Q3, the insolvency of the largest companies with a turnover exceeding 1 billion EUR remained high (12 cases, compared to 11 cases in Q2 2024, compared to an average of 8 cases in 2015-2023). Looking at the last three quarters (Chart 3), electronics stood out with the largest repercussions of insolvencies related to turnover size (average of 779 million euros), followed by the sectors: transport equipment (638 million euros), construction (623 million euros), and energy (578 million euros).

The year 2024 seems set to be record-breaking in terms of the number of large company insolvencies. With 344 such cases in the first three quarters, this year’s total has already exceeded the levels of the full years 2015-2019, 2021, and 2022. To beat the previous record, set in 2020, only 80 more cases are needed, which seems highly likely, given that this number is lower than the average quarterly figure recorded since 2015, and large companies continue to face significant challenges, particularly in Europe. These challenges include the overall economic situation, as well as structural changes in individual sectors and the transformation of value chains and global trade. In addition to the resulting risk of losing a significant number of jobs, the increase in the number of insolvencies of large entities also raises the risk of a domino effect for suppliers and subcontractors.

Chart 3: Large company insolvencies worldwide by sector, number of cases (x-axis) and average turnover (y-axis, million EUR) in 2024 (Q1/Q2/Q3)

In the opinion of Sławomir Bąk, Board Member for Risk Assessment at Allianz Trade: “Unlike almost the entire world, and especially Western Europe, in Poland, insolvencies primarily affect small companies, and cases of large company insolvencies have been sporadic so far. Although we are seeing monthly insolvencies of 300-400 companies in Poland, those noticeably larger ones (with turnovers of several tens to hundreds of millions, not to mention several hundred million zlotys) can usually be counted on one hand! Unlike other countries, the very flexible restructuring process in Poland, instead of ‘freezing’ obligations and insolvency procedures, allows liquidity issues to be resolved at the source, within individual companies, without the domino effect seen in other countries. In Poland, there is no domino effect; one company’s problems do not directly impact many others, but… on the other hand, customers are mass disappearing. This can be clearly seen in retail and also, for example, in transport. Limited demand, while profitability is also falling sharply due to labor costs and energy, is drastically reshaping the Polish economy – leading to a rapid concentration in many of its areas. It doesn’t always stop with the smallest firms, and let’s not deceive ourselves that it will always stay that way, especially in an open economy within the European Union, where slightly larger businesses than the purely local ones have to compete and reach beyond this very local market. We can already see this in construction, where issues related to industry conditions and investment fund flow (or rather lack of it) were hitting ever-larger companies, as observed last fall. Insolvencies may not have occurred in the largest international or listed construction holdings, which have a portfolio of orders and can ride out the dry spell, but local and regional companies, often among the main subcontractors of major contracts, were affected.”