- 2024 was significant for investments in precious metals, including silver.

- Silver prices were shaped by a unique combination of macroeconomic factors and increasing industrial demand.

- This dual role, balancing investment and industrial demand, could see silver outperforming gold in the coming year.

Looking ahead, the dual nature of silver as both an industrial and precious metal will continue to shape its market dynamics. Silver often outperforms gold during periods of rising industrial metal prices; however, it lacks stable demand from central banks, a factor that stabilizes gold prices during market downturns. This lack of support may make silver more susceptible to volatility than gold, especially during market corrections.

Key Factors Driving Silver Prices in 2024

This year’s rally in the silver market largely reflects the increase in gold prices, driven by several shared macroeconomic factors. Demand for investment metals rose amidst growing geopolitical uncertainty, with global tensions and economic changes prompting investors to seek safer assets.

Central banks are aggressively buying gold to diversify their reserves and reduce dependence on the U.S. dollar and dollar-denominated assets, such as bonds. These actions indirectly support silver prices. Furthermore, concerns over rising global debt, especially in the United States, have prompted investors to hedge against economic instability through investments in precious metals. The prospect of interest rate cuts, as inflation decreases, has further boosted the appeal of assets such as silver.

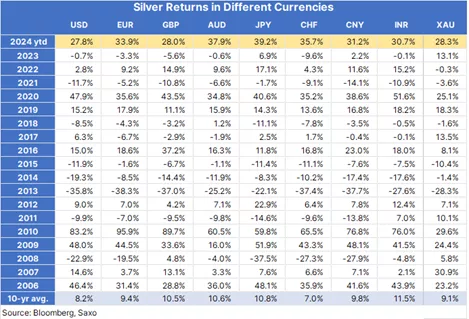

Annual return on silver in various currencies compared to XAUUSD

Investment and Industrial Demand

While investment demand has played a significant role, silver’s price dynamics are closely tied to its industrial uses, which account for about 55% of total demand. In 2024, increased industrial demand contributed to a physical shortage in the silver market. Sectors such as electronics and renewable energy, particularly photovoltaic technologies, had a significant impact on this growth. Expectations of sustained industrial demand are likely to contribute to a further supply deficit in silver in 2025.

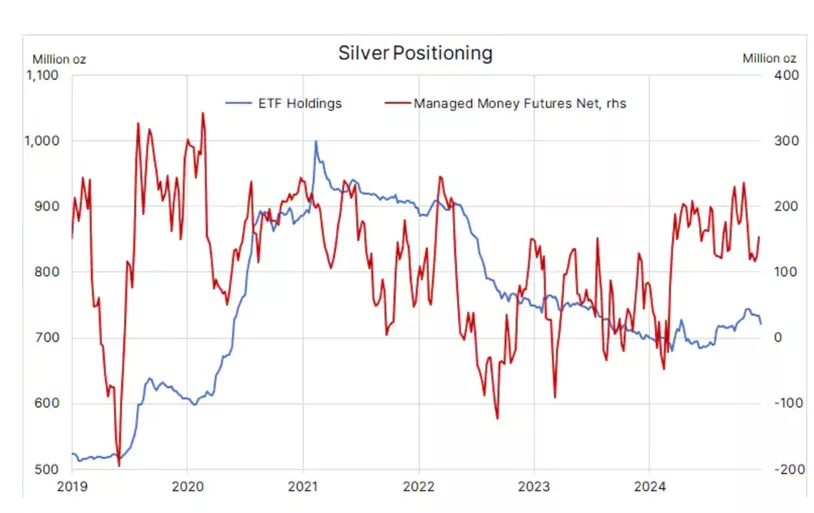

Investment demand for silver, assessed based on positions in futures contracts on COMEX and the value of assets in ETF funds, presents a mixed picture this year. Hedge funds and other fund managers are largely dependent on short-term price changes, as they attempt to predict, accelerate, and reinforce price movements initiated by market fundamentals. Traders, as proponents of momentum strategies, typically buy during price increases and sell during declines, meaning they actively increase and reduce exposure depending on price movements, often leading to larger-than-expected price moves in both directions.

In the week ending December 10, managed funds had a net long position of 30,685 contracts, equivalent to 153 million ounces, which was higher than the five-year average of 22,900 contracts. Total assets in ETF funds reached 712 million ounces, a 1.7% year-on-year increase and below the five-year average of 792 million ounces. In other words, both long-term assets in ETF funds and short-term positions in futures contracts are relatively low ahead of 2025, leaving room for potential price increases if market fundamentals continue to favor further gains.

Total silver holdings in ETFs and managed fund (speculative) positioning in futures contracts.

Structural Deficit and Its Impact on Prices

According to the Silver Institute, the silver market is facing the prospect of a significant structural deficit for the fourth consecutive year. Under favorable fundamental conditions, this deficit could provide silver with a similar boost to that received by gold from central bank demand. Since silver is often a by-product of the mining of lead, zinc, copper, and gold, higher prices are unlikely to lead to a significant increase in production. This dynamic ensures that supply constraints will continue to support the market.

The ongoing structural deficit can be attributed to the difficulties miners face in discovering new silver deposits, despite the sharp rise in demand for this metal in photovoltaic cells. Solar technologies currently account for nearly 20% of total industrial demand for silver, reflecting the global trend toward renewable energy sources and sustainable infrastructure.

This year’s rally in the silver market shows no significant differences compared to previous increases. Silver continues to follow gold’s movements, but with more volatility. Often referred to as “gold on steroids,” silver tends to see more dramatic price increases and declines compared to its more stable counterpart.

Despite strong dynamics in 2024, silver has only reached a 12-year high, while gold has repeatedly set new records. However, the dual role—balancing investment and industrial demand—may allow silver to surpass gold in the coming year. At Saxo, we forecast a possible decline in the gold-to-silver ratio, which currently stands at around 87, towards 75, a level seen at the beginning of 2024. If this happens, and gold reaches our forecast of 3,000 USD per ounce (a 13% increase), silver could reach 40 USD per ounce (a more than 25% increase).

Silver: spot prices. Source: Saxo.

Author: Ole Hansen, Director of Commodity Market Strategy at Saxo

Source: https://ceo.com.pl/srebro-na-fali-wzrostu-czy-w-2025-roku-przescignie-zloto-51499