Trump and Republicans’ victory triggers commodity price fall due to tariff and economic growth concerns.

- Global financial markets in some cases aggressively responded to the U.S. election results, which increasingly point to a decisive victory for Trump and the Republican Party.

- These results elevated the value of the U.S. dollar to its highest level in a year, with the currencies that suffered the biggest losses being the Mexican peso, the Japanese yen and the euro.

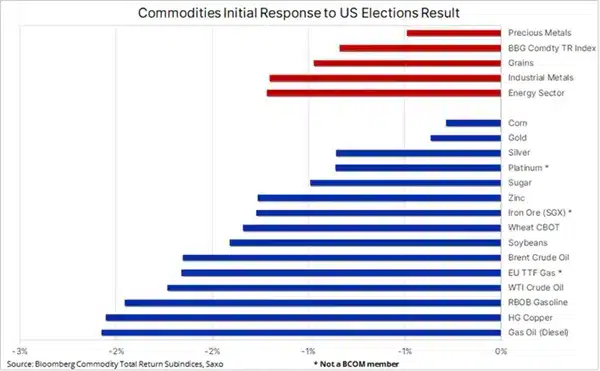

- Overnight trading saw declines in the commodities sector, particularly for industrial metals and grains, due to concerns about tariffs.

The reactions of global financial markets were aggressive in some cases in light of the U.S. election results, which increasingly point to a decisive victory for Trump and the Republican Party. We are nearing a “Trump 2.0” or “Red Wave” scenario, in which the Republicans control both the White House and Congress, potentially giving them a significant advantage in upcoming crucial negotiations concerning taxes and government spending. The results so far have boosted the value of the U.S. dollar to its highest level in a year, with the biggest currency losers being the Mexican peso, the Japanese yen, and the euro. The potential interest rate policy gap between FOMC and other major central banks has particularly impacted the peso and the yen.

The U.S. bond yield curve underwent a so-called bear steepening, where long-term yields rise faster than short-term ones. This occurs as fears grow that Trump’s un-financed tax cuts and import tariffs could once again trigger inflation concerns, possibly slowing the pace and depth of future U.S. interest rate cuts.

Overnight trading resulted in losses across the commodities sector. The Bloomberg Commodity Index fell by nearly one percent as investors began to price in the probability of the “Trump 2.0” scenario. This may enable the implementation of proposed tariffs on imported goods, especially targeting China, potentially triggering a new wave of trade tensions and economic disruptions.

Industrial metals, reflecting these expectations, experienced some of the largest declines, led by copper and iron ore, which are particularly sensitive to changes in trade and industrial demand. The anticipated escalation in trade relations raised concerns about future demand, translating in the metals markets reacting sharply to increased uncertainty.

Agricultural goods also suffered – grain prices fell, especially soy. This reflects fears that China may respond with retaliatory actions, potentially limiting the export of key U.S. crops, which puts pressure on prices to drop. China, as one of the largest recipients of U.S. soy, is a key market for local farmers, so any disruption in this trade flow can have significant consequences for the agricultural sector.

The price of oil also fell, under the pressure of concerns that a potential global trade war based on a “quid pro quo” principle might weaken demand and further burden already weak market forecasts for 2025. The expected drop in demand for oil and related products results from predictions that an increase in tariffs might slow down global economic growth, thus decreasing energy demand. The geopolitical situation will also be in focus, especially U.S.-Russia relations, Russia’s war with Ukraine and the Middle East, where the Trump administration may tighten sanctions on Iranian oil exports.

Gold prices temporarily dipped, but found support just above the 2,700 USD mark. This is due to the ongoing strengthening of the U.S. dollar, linked to markets considering the potential response of the FOMC to inflation risk. Amid concerns that tariffs and fiscal policy may once again trigger inflation pressure, there is growing anxiety that the FOMC could adopt a more cautious approach to interest rate cuts.

In general, the election results reinforce our positive forecast for precious metals as increased market volatility and uncertainty may fuel growing demand for these assets. Nevertheless, short-term risks remain as long positions opened at a late stage might be susceptible to selling pressure as the dollar strengthens and treasury bond yields rise. Also, it’s worth keeping an eye on silver, which could become a driver for gold prices. This metal has experienced a technical breakdown, reflecting the overall weakness evident in the industrial metals market.

Commentary by Ole Hansen, Director of Commodities Market Strategy at Saxo

Source: https://ceo.com.pl/zwyciestwo-trumpa-i-republikanow-wywoluje-spadek-cen-surowcow-76479