Fed Chairman Powell has essentially confirmed that the time has come to start the much-anticipated cycle of Fed monetary policy easing, so Wednesday will bring an interest rate cut. The unknown is its scale – the market sees a chance for a big move of 50 bp. We believe this would be an overly abrupt response, which could spark concerns about economic growth prospects. We expect a cut of 25bp to 5.00-5.25%.

Key points:

- Fed will lower interest rates for the first time since 2020.

- We are preparing for a cut of 25bp to 5.00-5.25%.

- The US labor market is cooling down, but there are no signs of an imminent recession.

- The downward revision of the dot plot seems inevitable.

- We believe that the Fed will suggest three cuts in 2024 and four or five in 2025.

- The main risk for the USD is a big move of 50bp.

During the July FOMC meeting, Federal Reserve officials made it clear to the markets that cuts are close. A number of dovish changes were introduced in the statement, and during the press conference, Chairman Jerome Powell indicated that decision-makers are adopting a more balanced approach to the dual mandate (ensuring the appropriate level of inflation and full employment) and are attaching greater importance to the state of the labor market. Since then, we have seen further cooling in this area. Moreover, during his appearance at the annual Jackson Hole Symposium in August, Powell essentially confirmed that the cut would take place in September.

The US job market is cooling down, but there are no signs of a recession

So, the question for the markets is not whether the Fed will lower interest rates this month, but by how much. We still believe that talks about a move of 50bp are exaggerated. Although conditions in the labor market have clearly deteriorated and inflation is heading towards the 2% target, we see no evidence that this will lead to mass layoffs or a recession in the USA. We also believe that the Fed will be cautious not to ignite panic in the markets. A larger cut could signal to investors not only that the Fed is late, but also that it sees a greater risk to growth prospects than it had communicated earlier.

At some point after the publication of the July NFP (non-farm payrolls) report, market participants almost fully priced in a 50bp interest rate cut in September. However, it seems that data flowing in since then have significantly limited such a possibility. August’s job report was disappointing. Last month, job creation stood at 142k against a 160k consensus, and the 3-month moving average fell to its lowest level since June 2020 (116k). However, there is a dichotomy between household and business surveys, as the unemployment rate fell as expected to 4.2%, and wage growth accelerated to 3.8%.

Chart 1: US non-agricultural sector employment change (2022-2024)

Source: LSEG Datastream Date: 13.09.2024

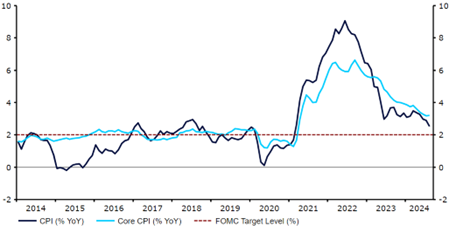

We believe that inflation in August, although in line with the need for monetary policy loosening, was not low enough to prompt the Fed to make a larger move. Its main measure fell to its lowest level since February 2021 (2.5%), but the underlying remained at the July level (3.2%) and showed a larger than expected monthly increase: +0.3% is the fastest pace of price growth in four months. In our view, this means that a larger move is much less likely, and we maintain our view that the Fed will this week lower the fed funds rate by 25bp to 5.00-5.25%.

Chart 2: Inflation in the USA (2014-2024)

Source: LSEG Datastream Date: 13.09.2024

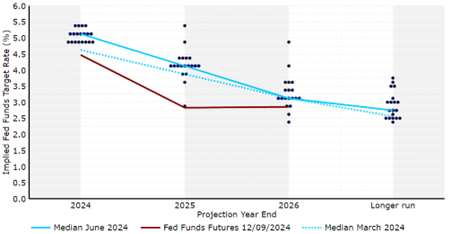

Dot plot will undergo a significant revision

However, market participants still have doubts about the scale of the move. At the beginning of this week, the probability of a 50bp cut estimated by them rose to over 60%. Taking this into account, the decision and messages from the Fed, especially the revision of the dot plot, will matter for the dollar. At the June meeting, when the last quarterly summary of projections was published, the average FOMC member assumed just one cut of 25bp by the end of the year and four in 2025. Given the scale of the cooling in the American labor market and further progress on the inflation front, the likelihood of a downward revision of the median this week is not only probable but almost inevitable.

Chart 3: FOMC Dot Plot (June 2024)

Source: LSEG Datastream Date: 13.09.2024

We expect quite a big change in terms of signaled expected rates both in 2024 and, even more so, in 2025. We believe that the median interest rate for this year will be revised downwards and will indicate a total of three cuts of 25bp, i.e., two more after the September meeting. The rate path in 2025 is less clear. We expect a narrowing of the difference between Fed and market views, however, we do not believe they will be fully aligned – market valuations currently suggest a fed funds rate below 3% at the end of next year. We won’t be surprised if the Fed sticks to its plan for cuts roughly every quarter in 2025, resulting in a median indicating 3.375% or 3.625% at the end of next year.

Powell himself is unlikely to stir up too much excitement during the press conference and may mostly repeat the messages from the Jackson Hole Symposium. He is likely to make it clear to the markets that more cuts are coming and may suggest that each meeting this year could bring a rate change. However, we think Powell is more likely to disappoint the markets. In futures contracts, more than 115bp cuts are currently priced in by the end of the year. This seems excessive, especially given the messages from FOMC members, including Bowman, Waller, and Harker, suggesting that the Fed should gradually reduce rates.

A 50bp move is a risk for the dollar

We believe that while the Fed may be slightly late in cutting interest rates, conditions are not so bad as to require swift action. We do not expect a 50bp move, nor do we think the FOMC is ready to align its expectations with market ones. We currently expect three cuts of 25bp this year (in September, November, and December), and depending on the data coming in, four or five in 2025.

Any suggestion that gradual interest rate cuts remain the Fed’s baseline scenario can support the dollar in the short term, especially given dovish market valuations. At the same time, messages highlighting increased concerns about the labor market and suggesting that cuts may be needed at every meeting for a long time in 2025 could trigger another dollar selloff. The major negative scenario for the dollar would be an immediate 50bp cut in rates, which cannot be completely ruled out with full confidence.

The FOMC policy decision will be announced on Wednesday (09/18) at 8:00 PM, and Chairman Powell’s press conference will start 30 minutes later.

Authors: Matthew Ryan, CFA – Head of Market Analysis at Ebury.

Source: https://ceo.com.pl/czas-na-ciecia-w-usa-wlasnie-nadszedl-82636