The elections in France, which were expected to be a triumph for Marine Le Pen and the National Rally (RN), ended in a surprising defeat for the far-right faction. President Macron’s Together for the Republic bloc and the leftist New People’s Front (NFP) successfully stirred anti-right sentiments in society, leading to a significant loss for Le Pen’s party.

According to the final results, RN secured 143 seats, placing third behind Macron’s coalition with 168 seats and NFP with 182 seats. No party achieved the 289 seats needed for an absolute majority, resulting in a “hung parliament.”

This outcome is likely to lead to potential political paralysis in France. Macron’s faction, despite temporarily uniting with the far-left NFP of Jean-Luc Mélenchon to defeat the far-right, is unlikely to opt for long-term cooperation. The French political landscape, usually unfamiliar with building such coalitions, may face fragmentation unless compromises are reached. The most favorable situation for the markets would be if Macron could build a coalition (with an absolute majority) with the New People’s Front, excluding Mélenchon’s radicals.

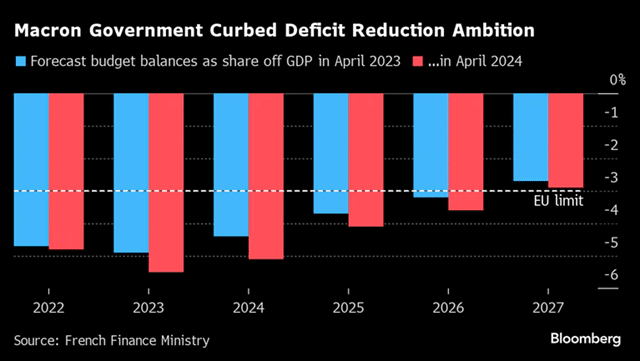

As a result of this deadlock, France may face even greater difficulties in addressing internal and budgetary issues. Implementing the necessary cuts required by the EU will not be easy and is likely to increase tensions between France and the authorities in Brussels. Moreover, the implementation of Macron’s growth-oriented agenda is now uncertain due to pressures from both leftist and far-right factions to increase spending, leading to greater fiscal risk.

New elections could resolve the deadlock, but Macron has the right to call them only after a year. This means that France cannot expect any immediate resolution if the paralysis continues. As coalition negotiations progress, markets may react negatively to the uncertainty, although the better-than-expected result for Macron’s bloc may mitigate this somewhat. In summary, the outcome of the weekend elections extends the period of uncertainty. Although the euro may experience a short-term boost due to Le Pen’s far-right not winning, this is likely to be temporary. The medium-term challenges for the currency are increasing, especially considering additional risks from the upcoming US elections.

Charu Chanana, Head of Currency Strategy at Saxo Bank