We have changed our view on the final FOMC meeting of the year and expect that on Wednesday, the Federal Reserve will make another 25 basis point rate cut. The dollar’s reaction will be influenced by the new dot plot, which we believe may surprise the markets. If the median indicates two cuts in 2025, the dollar may strengthen.

Key points:

- The Fed is likely to cut rates by 25 basis points.

- Communications will likely be hawkish.

- Powell will emphasize the strength of the economy and rising core CPI inflation.

- An upward revision of the dot plot is almost certain.

- The dot plot for 2025 will show a maximum of three cuts.

- Upside factors for the USD prevail.

Since the last FOMC meeting, macroeconomic readings from the US have generally been good, and most activity indicators are consistent with an annualized growth rate of about 3%. However, markets have seen enough to change their expectations, particularly after weak labor market data in November — a December cut is now almost fully priced into futures contracts. In the period leading up to the media blackout before the meeting, FOMC members did not push back against market bets, making it very unlikely that the Fed will disappoint those expectations.

While a December rate cut is almost certain, the path forward is less clear. Most signals suggest that the Fed will adopt a more gradual pace of policy easing next year than previously thought, especially following Trump’s presidential election victory:

- Growth remains solid, with no signs of slowing. Consumer activity remains strong (retail sales grew at the fastest pace in eighteen months over the four months to October), and business activity is robust (the composite PMI is at its highest level in nearly three years). This makes another quarter of approximately 3% annualized growth likely — the Atlanta Fed’s GDPNow forecast currently points to a 3.3% growth rate.

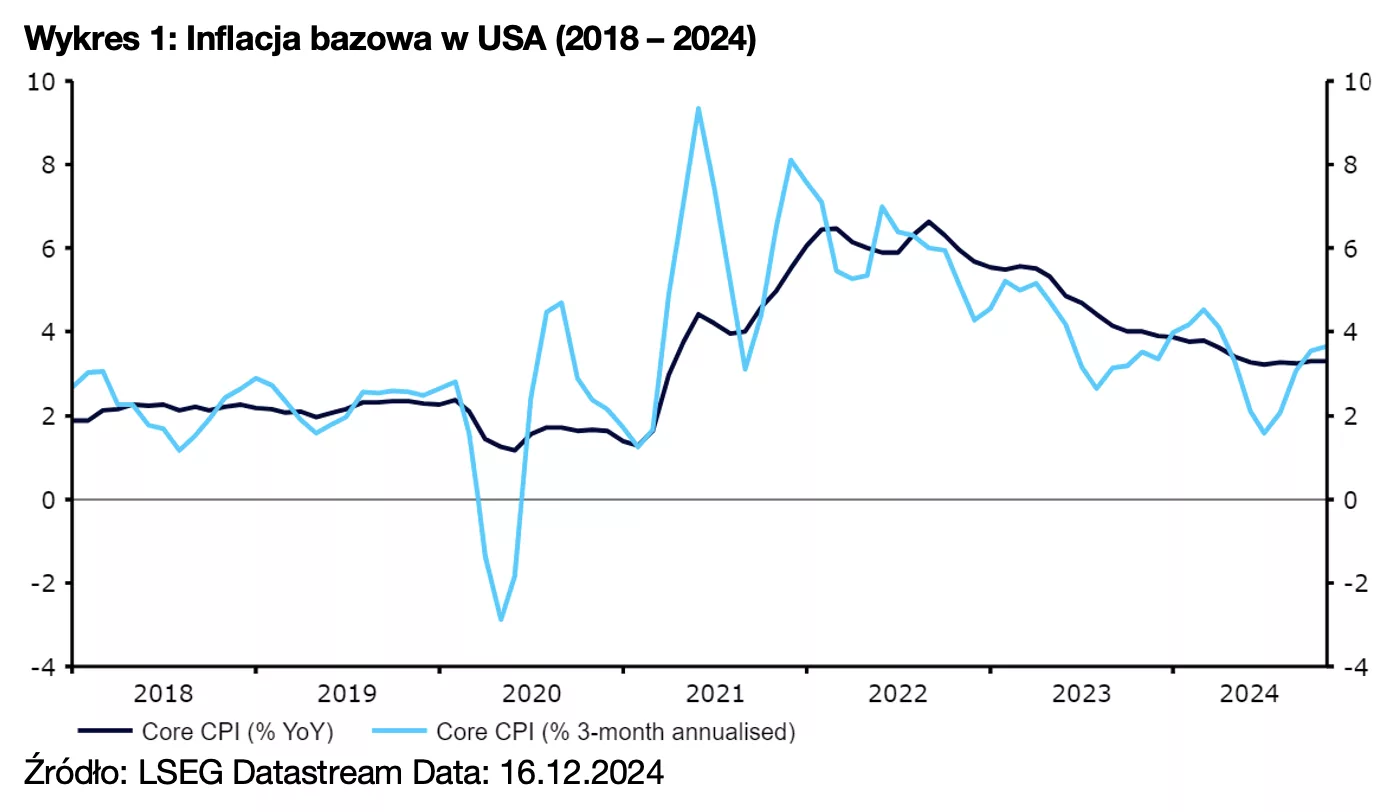

- Core inflation in the US continues to rise. Recent price dynamics reports have been concerning for FOMC members. Not only is the headline measure increasing again, but core inflation also appears to be rising — the three-month annualized core inflation rate rose to 3.7% in November, the highest level in seven months.

Trump’s policies appear inflationary. A second Trump term is expected to lead to higher inflation in the US for longer. His proposed changes to taxes and tariffs could boost demand and raise prices for imported goods.

Trump’s policies appear inflationary. A second Trump term is expected to lead to higher inflation in the US for longer. His proposed changes to taxes and tariffs could boost demand and raise prices for imported goods.

Powell Will Emphasize the Strength of the Economy and Rising Core CPI Inflation

Given the above, we expect the Federal Reserve to deliver a “hawkish cut” this week, with policymakers signaling that they are in no hurry to lower rates further next year. During his press conference, Chairman Jerome Powell is likely to speak positively about the state of the US economy. He will likely reiterate that the risks to the Fed’s dual mandate — inflation and employment — are fairly balanced. He may also express concerns about persistent elements of inflation in the US and the noted worrying rise in core inflation. It will be interesting to see if he mentions potential inflationary implications of a Trump presidency or simply notes that it makes the future price dynamics more uncertain, as ECB President Christine Lagarde did last week.

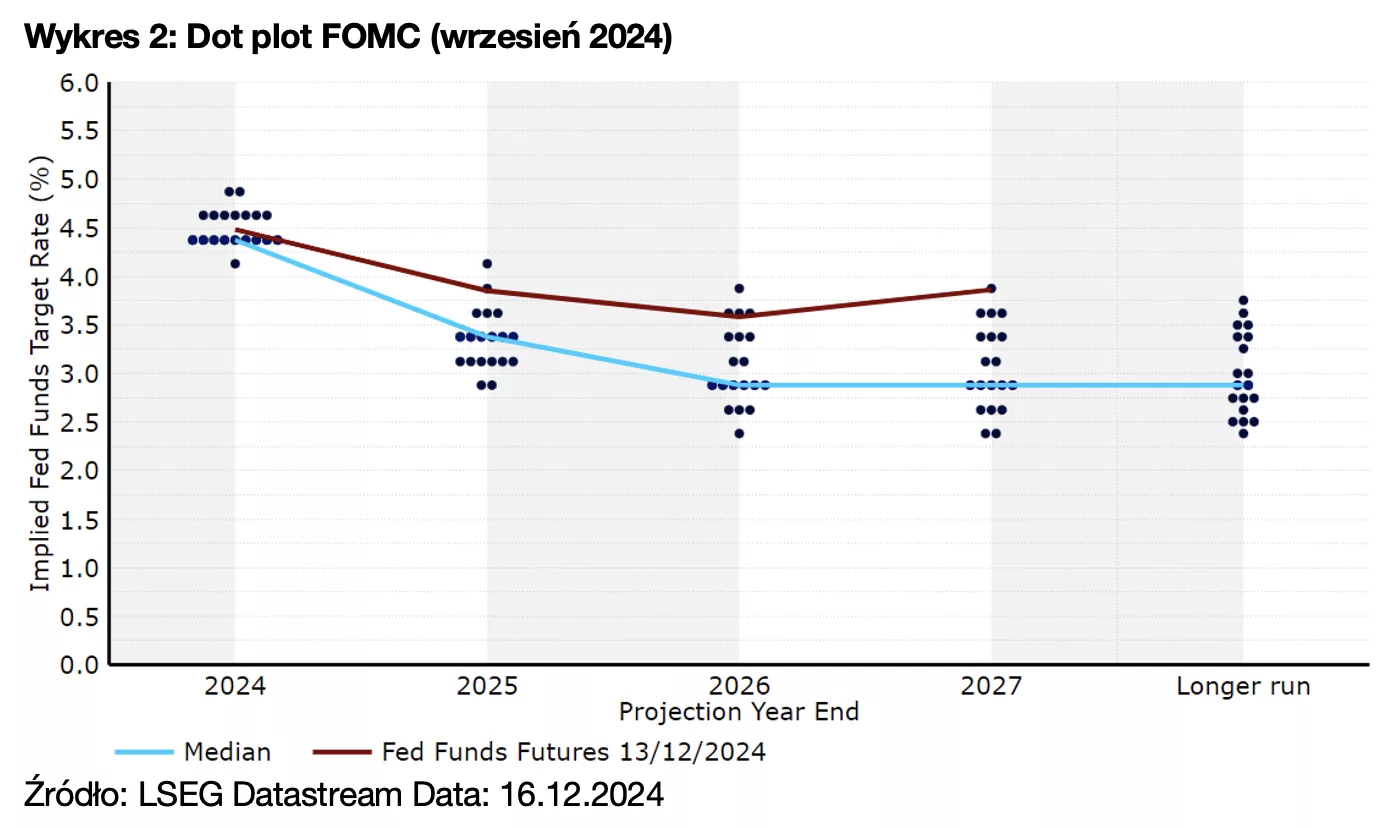

Powell’s tone in communications will likely matter less than the revised Fed dot plot, which will be in the spotlight. In September, the median suggested that Fed members expected four rate cuts (100 basis points) in 2025 and another two in 2026. We would be very surprised if this does not change. An upward revision of the 2025 median to show three cuts would be fairly conservative but would be a safe option and, being closer to market pricing, would likely provoke a limited dollar reaction.

The New Dot Plot Could Lead to Dollar Appreciation

Divisions among FOMC members regarding the future rate path may grow, especially given uncertainty surrounding Trump’s domestic and international policies. We would expect that some officials may foresee rates at 3.875% by the end of 2025, consistent with only two cuts. A median at this level wouldn’t surprise us significantly but could lead to dollar appreciation. The 2026 projection will be somewhat less significant, but a revision to fewer than two cuts could also support the US currency.

As always, the FOMC’s quarterly economic projections will be crucial for investors, offering valuable clues about future monetary policy. Given that recent activity and CPI inflation readings have exceeded expectations, we believe GDP and price growth forecasts will be revised upward, providing a sharp contrast to the ECB’s statement last week. Changes in inflation forecasts are likely to be limited, but if they rise by at least 0.2 percentage points, they could confirm a gradual approach to further easing, further supporting the dollar.

At the Beginning of 2025, the Fed Will Halt Rate Cuts

We believe that the balance of risks for the US currency is tilted upward, meaning upside factors currently prevail. A 25 basis point cut is fully priced in by the markets, and an upward revision of the dot plot appears inevitable. However, we think markets may underestimate the extent of the revision for 2025. We believe it will be difficult for the Fed to justify more than three cuts next year, especially given the strength of US demand and the obvious inflationary implications of a second Trump term. Hawkish communications will almost certainly rule out a January cut and may even cast doubt on a March move.

The FOMC policy decision will be announced on Wednesday (18.12) at 20:00, with Chairman Powell’s press conference starting 30 minutes later.

Authors: Matthew Ryan, CFA – Head of Market Analysis at Ebury

Source: https://managerplus.pl/nadchodzi-jastrzebie-ciecie-fedu-17556