We expect that the Federal Reserve will push back market expectations for immediate monetary policy easing in the US on Wednesday, which should support the dollar in the short term.

The tone of the Fed’s December statements was more dovish than expected. The Fed maintained its interest rates at the unchanged level (5.25-5.50%), however, it was also announced that discussions on their cuts had begun. The December dot plot indicates that – on average – members of the FOMC (Federal Committee for Open Market Operations) expect three cuts in 2024. In response, the market increased the pricing of rate cuts – futures contracts were even pricing in 160 bp for 2024. In our opinion, this change in expectations was too aggressive and the recent repricing in the opposite direction seemed to confirm this thesis.

New data doesn’t make it easier for the Fed

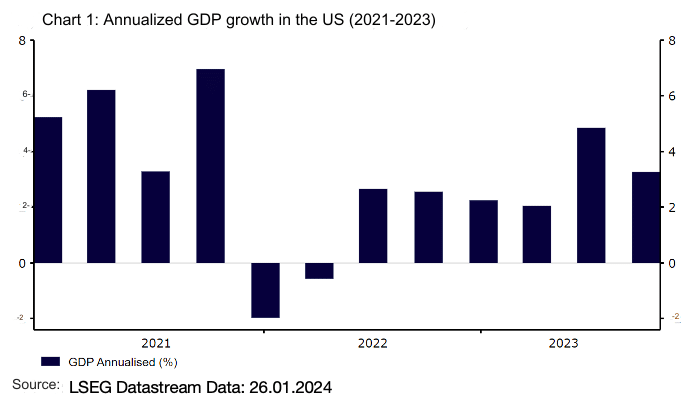

Currently, futures contracts show less than a 50% probability of the easing cycle starting in March and approximately 135 bp cuts by the end of the year. We believe that the strength of recent data from the US, particularly regarding economic growth and the job market, justifies both a later start to cuts and a more gradual pace. Last week’s GDP reading was another positive surprise – the economy grew by 3.3% on an annualized basis in the fourth quarter, significantly above the consensus of 2%. Consumer spending, the heart of the American economy, remains at a very good level, supported by the labor market, which shows at most minor signs of cooling.

Chart 1: Annualized GDP growth in the US (2021 – 2023)

Source: LSEG Datastream Data: January 26, 2024

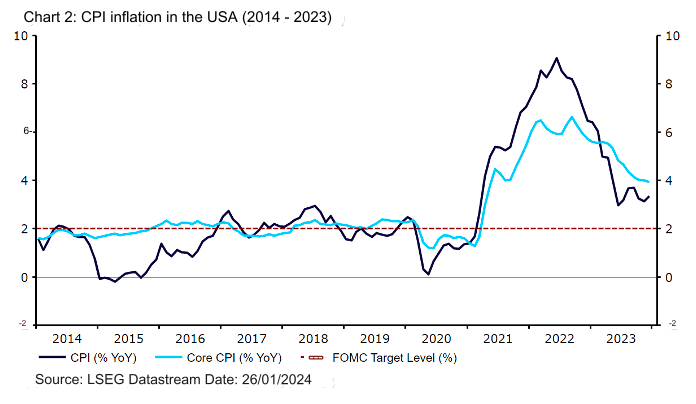

The December inflation report makes a March cut even less likely. The main measure of price dynamics increased to 3.4%, the base inflation (3.9%) also exceeded the consensus. Core PCE inflation, which is the measure preferred by the Fed, was slightly lower than expected. However, we believe it’s insufficient to consider a rate cut in March again. In the December minutes, the Fed stated that the upside risks to inflation have “diminished”, emphasizing that some risks for persistent inflation remained. These include the enduring strength of the job market, which in our view is probably the biggest obstacle to achieving the Fed’s inflation target.

Chart 2: US CPI inflation (2014 – 2023)

Source: LSEG Datastream Data: January26, 2024

The FOMC has to perform some gymnastics

Given all these, we believe that the Fed at this week’s meeting will push back market expectations for rate cuts. In their most recent comments, the majority of FOMC representatives tried to lower the bets for immediate cuts, and most likely Chairman Jerome Powell will do the same during his press conference on Wednesday.

The FOMC has to perform some gymnastics – on one hand, it will want to reassure markets that cuts are coming and at the same time, they will most likely not start in March. It may express this through minor changes in the statement or, more likely, through a straightforward message from Powell during the press conference. The Fed Chairman may indicate that the bank needs more evidence in data before it begins the easing cycle.

We will not learn about the new dot plot or macroeconomic projections this week – the next ones will be published in March.

Dollar sees the chance for strengthening

The US dollar is the best performing G10 currency since the beginning of 2024, which is due to mentioned changes in US interest rates pricing. If Powell and other decision-makers cool down market expectations for a cut in March, the appreciation of the dollar may continue on Wednesday. However, considering how much the bets for cuts have already decreased, the scale of movement will likely be limited.

At the moment, the scenario in which the Fed unambiguously advocates for cuts in March doesn’t seem realistic to us – especially considering the strength of the recent GDP reading and labor market data. However, if the announcement of cuts in March emerges, the dollar would probably experience a strong sell-off. In such a situation, the currency could give up most of the gains made this year.

The signals from the Fed on Wednesday will also be significant for the Polish zloty. The more hawkish the message, the greater the risk that the Polish currency will come under pressure. Striking a more dovish note would have the opposite effect.

The decision on FOMC policy will be announced on Wednesday (January 31) at 20:00, and Chairman Powell’s press conference will begin 30 minutes later.

Author: Matthew Ryan, CFA – Chief Market Analyst at Ebury