The growing reduction of subscriptions and falling margins offered in subsequent bond issues are impacting the secondary market. Fewer and fewer companies offer yields above 10%, which is decreasing daily.

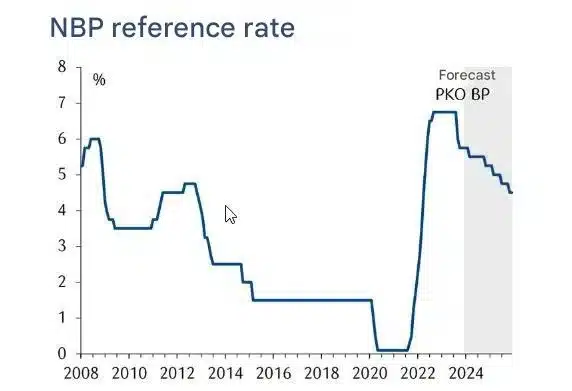

While WIBOR rates remained around 7% during 2022-2023, investors became accustomed to double-digit returns from corporate bonds, especially since issuers previously increased the offered margins. Now, with the WIBOR rate staying below 6%, the situation is changing. The number of companies offering yields above 10% is shrinking, but interesting options can still be found.

Based on previous issuances in the corporate debt market, experts expect record demand for public prospectus-based issuances this year. The Polish corporate bond market remains robust.

An additional factor is the decline in bank deposit interest rates, where the corporate debt market – particularly bonds listed on Catalyst – remains very appealing to investors. High bond yields persist; yields of 10% are still achievable. However, corporate bond yields are declining, reflecting government policy and WIBOR rates.

Many companies have capitalized on issuances to benefit from favorable conditions. Notable is the significant presence of developers and debt collection companies. Recent issuances in the past six months include Kruk SA, Best SA, Cavatina Holding SA, PragmaGO SA, Victoria Dom SA, Marvipol SA, White Stone Development SA, and Arche SA.

Investors are drawn to the reliability of companies and the Catalyst market. While investing in stocks primarily focuses on future prospects, investing in corporate bonds places more emphasis on the current financial health of the issuer.

For example, the Warsaw-based developer White Stone Development achieved a net profit exceeding PLN 26 million in H1 2024, nearly four times higher than the same period the previous year.

– To date, the company has issued bonds worth almost PLN 180 million across 11 issuances. Nine series, totaling nearly PLN 130 million, have already been repaid on time. Interest payments have always been made on schedule, with no violations of issuance terms recorded. The most recent issuance, conducted in June 2024 (amounting to PLN 25 million), was a success, with a 53.25% subscription reduction rate and the lowest margin in White Stone Development’s history at 4.40% per year – emphasized Anna Suchodolska, co-CEO of White Stone Development.

The company intends to use the funds from the issuance for new investments. In 2025, the developer plans projects in Warsaw, Zamień (a suburban area), and Szczecin.