Following the outbreak of the Covid-19 pandemic in early 2020, the Polish investment market has consistently navigated its repercussions, only to face additional challenges from the economic turbulence resulting from the war in Ukraine, rising interest rates or inflation. Despite maintaining stable investment volumes for three tough years, 2023 witnessed an inevitable slowdown, as anticipated.

With a total investment volume slightly above €2 billion, 2023 results decreased by two-thirds compared to the volumes recorded in the preceding three years. In Poland, only 3 out of 85 transactions surpassed the €100 million mark, with the largest being the M&A of 7R shares by NREP. Additionally, only 6 portfolios were acquired, 4 of which pertained to small retail schemes. Thus, despite the moderate liquidity, the ultimate investment volume is the lowest since 2010. Avison Young expects that the situation should stabilize this year and have a positive impact on the revival of investor activity throughout the whole 2024.

Highlights:

- EUR 2.1 bn – total investment volume in 2023

- 85 transactions closed

- Only 3 deals above EUR 100 mln

- 46 active disclosed investors

Industrial market

Leader for good and bad times

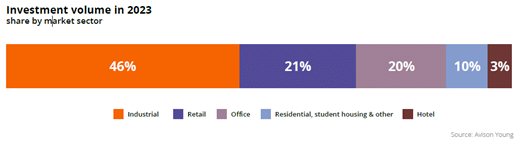

In 2023, the warehouse sector emerged as the dominant force in Poland’s investment market. Despite a noticeable overall market downturn, industrial transactions constituted nearly half of the total investment volume. This performance highlighted the resilience and dominant position of the Polish warehouse market, even in the face of challenging economic conditions.

In 2023, the industrial sector recorded an investment volume of €966 million, primarily driven by smaller-scale projects. This resulted in a 25% decrease in the average transaction volume compared to 2022 and 2021. Notably, only two transactions surpassed the €100 million threshold: NREP’s acquisition of an 80% stake in 7R and the Campus 39 deal in Wrocław. Continuing the trend of increased interest in assets in western Poland, over 70% of the investment volume in 2023 was concentrated in the top five major industrial hubs, with the majority in the Wrocław region. The market witnessed only 2 portfolio deals acquired by EQT Exeter and P3.

In 2023, excluding the 7R M&A transaction, over 80% of warehouse properties were sold in the primary market. Panattoni divested 12 assets, totalling over €520 million, representing more than half of the total investment volume in the warehouse sector. We anticipate sustained interest in the sector in 2024, particularly in sale and leaseback deals and the acquisition of existing facilities that remained unsold in 2023. This trend is anticipated as the market progresses toward a more consolidated pricing consensus.

Industrial sector highlights:

- EUR 966 m – total sector’s investment volume in 2023

- 2/27 – share of portfolio transactions

- The biggest deal – M&A of 7R by NREP

Retail market

Era of retail parks

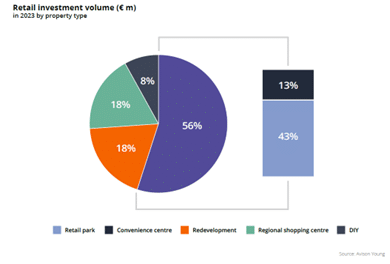

The retail investment market in Poland is drawing interest from investors across various formats and asset types, spanning major agglomerations to small cities and towns. The diverse range of available products caters to opportunistic and redevelopment acquisitions. However, transactions involving prime shopping centres are not anticipated in the near term due to the persistent discrepancy between sellers’ and buyers’ pricing expectations.

The retail sector concluded 2023 with a total volume of €430 million. The most significant transaction marked the debut of FREY. The French newcomer successfully completed the acquisition of Matarnia Retail Park in Gdańsk for over €100 million in the third quarter. Another debutant, an Austrian family office introduced by the Avison Young team, invested in 2 convenience schemes in the Silesia region.

Unwaveringly, retail parks continue to represent a reliable and secure investment option, consistently garnering the trust of investors. In 2023, retail parks and convenience schemes accounted for 56% of the sector’s total volume and were involved in 13 out of 27 transactions. The segment experienced sustained demand for regional shopping galleries and schemes for redevelopment.

In upcoming quarters the retail sector will invariably attract investors with retail parks and convenience assets, which remain a safe type of investment. Investors seeking higher returns, on the other hand, will continue to look for attractively priced malls in secondary cities, as well as opportunistic assets with redevelopment plans. The competitive prices and attractive locations of older malls make them a higher-return alternative.

Retail sector highlights:

- EUR 430 m – total sector’s investment volume in Q1-Q3 2023

- 13/27 – share of retail parks and convenience schemes transactions

- 2 newcomers attracted by retail parks

Office market

Testing investors’ flexibility

In 2023, there was a noticeable surge in investor interest in older value-add and opportunistic office buildings. Over 60% of the transaction volume in the Polish office investment market was associated with these types of properties, many of which were designated for redevelopment. This trend is driven, in part, by the scarcity of land for development. Consequently, such buildings are being considered for demolition or a change in function into PRS, student housing or other alternative use. These investments are particularly sought-after by investors that are focused on achieving high returns.

In the past year, these asset classes represented two-thirds of completed deals, marking a substantial increase from 2022, which witnessed a predominance of core and core+ transactions. Avison Young team played a pivotal role in shaping the office investment landscape in 2023, brokering nearly one-third of the market in terms of volume. In contrast to the trends of the previous year, regional office buildings accounted for only 2 out of the 18 concluded office transactions.

Warsaw was the epicentre of office investments in 2023, capturing 97% of the total volume, with a notable 76% of transactions occurring in noncentral office areas. This trend aligns closely with the nature of the properties being acquired. This pattern is unlikely to shift in the near future. While there is a resurgence of investor interest in core assets in prime locations, such as Warsaw’s CBD and premier, modern buildings in centres of regional cities, the high transaction volumes continue to pose a challenge. This scenario is expected to lead to a more nuanced and structured approach in the real estate acquisition process.

Office sector highlights:

- EUR 429 m – total sector’s investment volume in 2023

- 16/18 transactions closed in Warsaw

- Sharp increase in opportunistic deals in 2023

PRS

10 year anniversary

Despite the slowdown in purchasing activity within the PRS sector, investors are actively monitoring the market. However, the product’s availability is limited due to current residential market conditions. Developers prefer to sell apartments directly to individual clients rather than selling entire properties to investment funds.

In 2023, the closed residential deals amounted to approximately €150 million. The sector’s momentum is constrained by the limited availability of land for new projects and the high construction costs. While land acquisitions resemble “beauty contests”, investors are increasingly open to considering purchase of older office buildings, with the possibility of demolishing or converting them for PRS purposes. A notable example of this trend is the divestment of the Obrzeżna Center office building in Warsaw, a transaction brokered by the Avison Young team, earmarked for residential redevelopment.

In 2024, the Polish PRS market will mark a decade since its inaugural transaction in 2014, initiated by Fundusz Mieszkań na Wynajem in Poznań. While the market is still in its early stages compared to its Western European counterparts, it displays significant dynamism. If all the projects scheduled for completion in 2024 are finalized as planned, the market will experience a fivefold increase within a span of five years. The leading player in the Polish PRS landscape is Resi 4 Rent, boasting over 4,000 operational units, with an additional 4,300 units currently under construction.

We expect that the Polish market will attract both local and foreign investors, who can obtain higher investment returns in this sector than in Western European markets. Given the development of the PRS sector, it seems that 2024 may bring the creation of more platforms, created by the developer-investor arrangement, which will ultimately increase the product base for purchase by current and incoming investment funds in Poland.

Looking forward

Ready for 2024?

Currently, the market is explored mainly by investors hunting for opportunities. The situation is unlikely to change in the short term. The geopolitical uncertainty and bargains at local markets are restraining Western European institutional funds from investing in Poland at larger scale. New foreign players who are not yet present in the Polish market, but have analysed potential projects in the past, are also waiting. Albeit, may consider certain asset classes when it comes to larger platforms or more complicated structures.

Prime yields are showing the trend to stabilize across all market sectors. Although banks are still looking carefully at the projects they are to finance, interest rates are expected to decrease at some point this year. Therefore this situation might accelerate investment activities, at the beginning mostly among opportunistic buyers. Furthermore, we expect to see a surge in refinancing activity and renegotiations of existing financing terms, coinciding with the five-year mark since the high volume of loans issued in the record year of 2019. Thus, this may force some owners to divest their assets or to look at alternative ways of exit. Due to this fact some large transactions, which were not seen in 2023, may finally occur.

ESG will also continue to be an important factor influencing real estate purchases, which is increasingly being incorporated into the investment strategies of funds in particular institutional ones. This aspect will also be a key element in obtaining financing from banks.

Will this be a better or worse year? It seems that 2024 will be an interesting one, with the gap in pricing expectations between sellers and buyers narrowing, which in turn will translate into increased investor activity in all market sectors and hopefully higher investment volume. We are aware of dozens of deals that are underway and should finalize this year.

AUTHOR: Paulina Brzeszkiewicz-Kuczyńska, Research and Data Manager at Avison Young