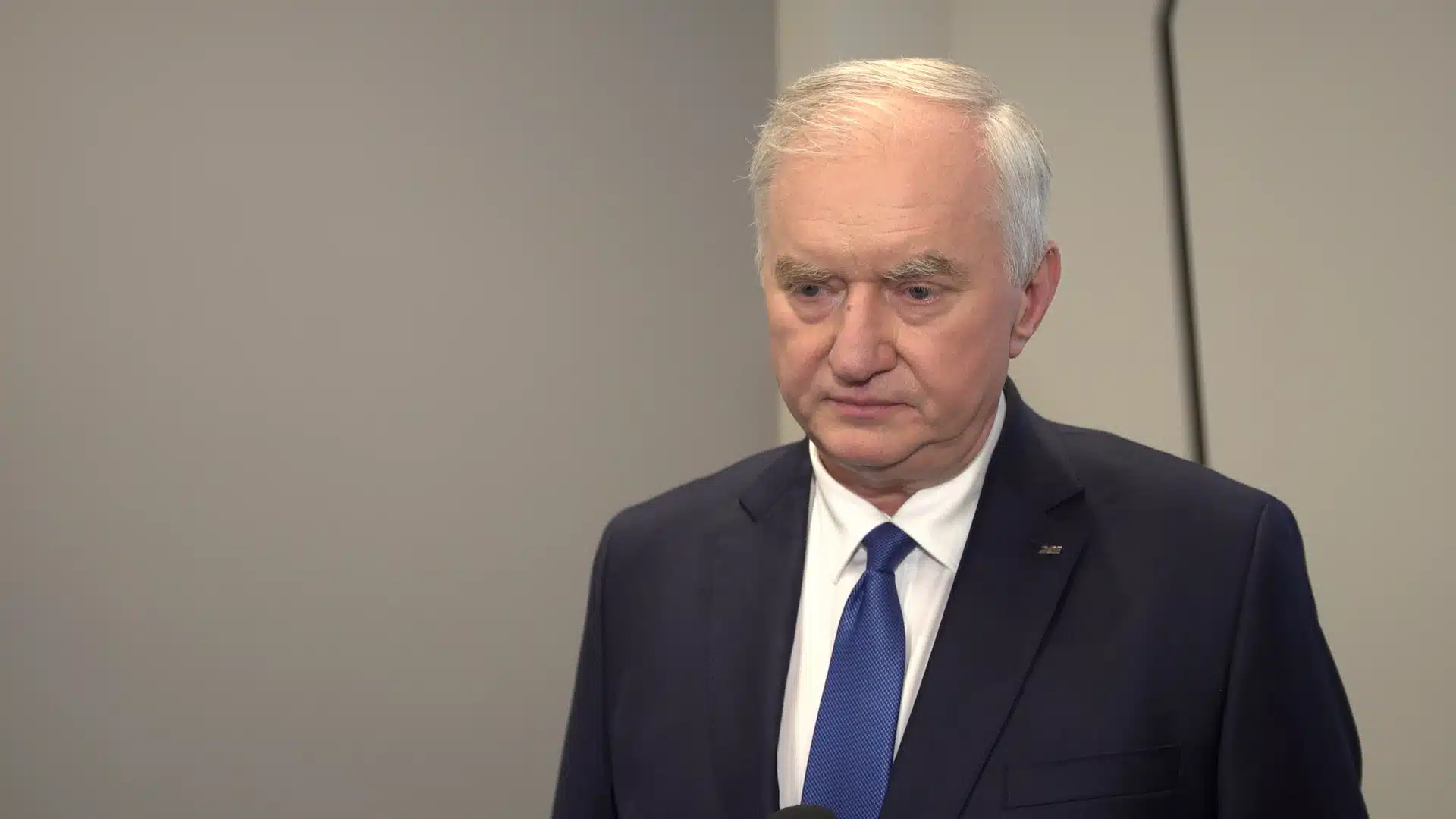

The PGE Group has published its financial results for the first quarter of 2024, which align with previous estimates. During this period, investment expenditures significantly increased, exceeding PLN 2 billion. However, the further development and financial capacity for subsequent renewable energy projects are heavily constrained by the conventional energy segment, which is becoming an increasing burden for the group. “This confirms the necessity of separating this segment and changing its ownership structure,” emphasizes Dariusz Marzec, President of the PGE Group.

“Investments in the PGE Group have accelerated significantly since the beginning of 2024. In the first quarter of this year alone, investment expenditures were approximately one-third higher compared to the same period last year. We are now moving forward with the implementation of further projects that are strategic for the Polish economy and energy sector,” says Dariusz Marzec, President of PGE Polska Grupa Energetyczna, to Newseria Biznes.

The largest energy producer in Poland has just released its financial and operational results for the first quarter of this year, which are in line with previously reported estimates. The recurring EBITDA, excluding one-off events, amounted to PLN 2.53 billion, net profit for shareholders was PLN 893 million, and the group’s revenues were slightly over PLN 16.8 billion. The final amount of investment expenditures reached nearly PLN 2.07 billion, marking a significant increase compared to the same period last year, when the company allocated nearly PLN 1.6 billion for investments.

“The key investments we are undertaking include the construction of offshore wind farms in the Baltic Sea, primarily MFW Baltica 2, decarbonization efforts, including the decarbonization of the heating segment, and investments in the distribution network. We invest over PLN 4 billion annually to improve the quality and technical condition of the distribution network. These are the three main directions of our activities, which our further plans pertain to. In the coming years, we also intend to significantly develop the energy storage segment,” announces Dariusz Marzec.

He points out that in the first quarter of this year, the conventional energy segment significantly impacted PGE Group’s financial results, with an EBITDA result of -PLN 498 million (loss) compared to PLN 909 million achieved in the same period last year. The company stated that this decline is mainly due to a decrease in the margin on electricity generation resulting from lower energy prices.

“The place of coal energy in the system is very important; however, it cannot function based on market principles, which only confirms the need to separate this segment and change its ownership structure,” says Dariusz Marzec, President of PGE Polska Grupa Energetyczna.

As he emphasizes, to provide the PGE Group with development opportunities and financing for further investments, it is necessary to create stable operational frameworks for the energy sector and to separate conventional assets from the company.

“Coal assets are a significant burden that currently blocks the group’s development and investment capabilities. In the current structure of production assets, we will not be able to finance the development of renewable energy, particularly large-scale wind farms in the Baltic Sea,” admits Dariusz Marzec. “The separation of conventional assets will unlock development potential and enable us to secure financing in European and American markets, which are currently inaccessible to us due to the structure of production assets.”

According to the report published by the company for the first quarter of this year, the distribution segment had the largest contribution to recurring EBITDA during this period, recording PLN 992 million compared to PLN 1.27 billion last year. This result was primarily influenced by higher costs of purchasing electricity to cover the balancing difference, resulting from the recalculation of the balancing difference due to changes in electricity prices. The recurring EBITDA of the renewable energy segment in the first quarter of this year amounted to PLN 379 million, slightly decreasing from PLN 436 million in the same period last year. The heating segment, on the other hand, recorded a recurring EBITDA result of PLN 510 million compared to PLN 916 million achieved in the first quarter of 2023.

In the new report, the PGE Group also reported the results of the gas energy segment for the first time, including revenues from the commencement of gas energy production in March this year. The EBITDA result of this segment recorded a loss of PLN 22 million in the first quarter of this year.

Net electricity production in the first quarter of this year in the PGE Group’s generating units amounted to 14.6 TWh, a 7% decrease year-on-year. Production from lignite amounted to 7.63 TWh (7% less y/y), from hard coal – 4.32 TWh (12% less y/y), and from natural gas – 1.44 TWh (3% less y/y). The total production from PGE Group’s renewable sources reached 0.89 TWh, with additional production from pumped storage power plants amounting to 0.32 TWh, an increase of 10% compared to the same period last year.

Investments in low- and zero-emission sources are one of the main pillars of the PGE Group’s strategy. In collaboration with the Danish company Ørsted, the company is currently implementing the MFW Baltica project, consisting of two stages with a total capacity of approximately 2.5 GW. To illustrate, this is half the installed capacity of the largest conventional power plant in Europe, the Bełchatów Power Plant, which currently covers about 20% of Poland’s total electricity demand. The first stage – Baltica 2, with a capacity of approximately 1.5 GW – is scheduled to be operational by the end of 2027 and will produce green energy to meet the needs of about 2.4 million Polish households. The second stage – Baltica 3 – is expected to start operating three years later. Another important area is investments in networks, through which the company supplies energy to about 5.5 million Polish consumers.