The Extraordinary General Meeting of ORLEN has decided on changes in the Supervisory Board of the Company. Nine people were appointed to the new 10-person Supervisory Board of ORLEN, with Wojciech Popiołek chosen as the chairman. Shareholders also agreed, among other things, to the disposal of 100% of the shares in the company Gas Storage Poland, which is a remedy condition imposed by the President of the Office of Competition and Consumer Protection (UOKiK) for the merger of ORLEN with PGNiG.

ORLEN shareholders decided that the Supervisory Board, in its new composition, will consist of 10 people. Subsequently, board members nominated by the State Treasury were elected: Michał Gajdus, Ewa Gąsiorek, Katarzyna Łobos, Kazimierz Mordaszewski, Mikołaj Pietrzak, Ireneusz Sitarski, Tomasz Sójka and Tomasz Zieliński. At the request of the State Treasury, Prof. Wojciech Popiołek was elected Chairman of ORLEN’s Supervisory Board, and will take up his position on February 7.

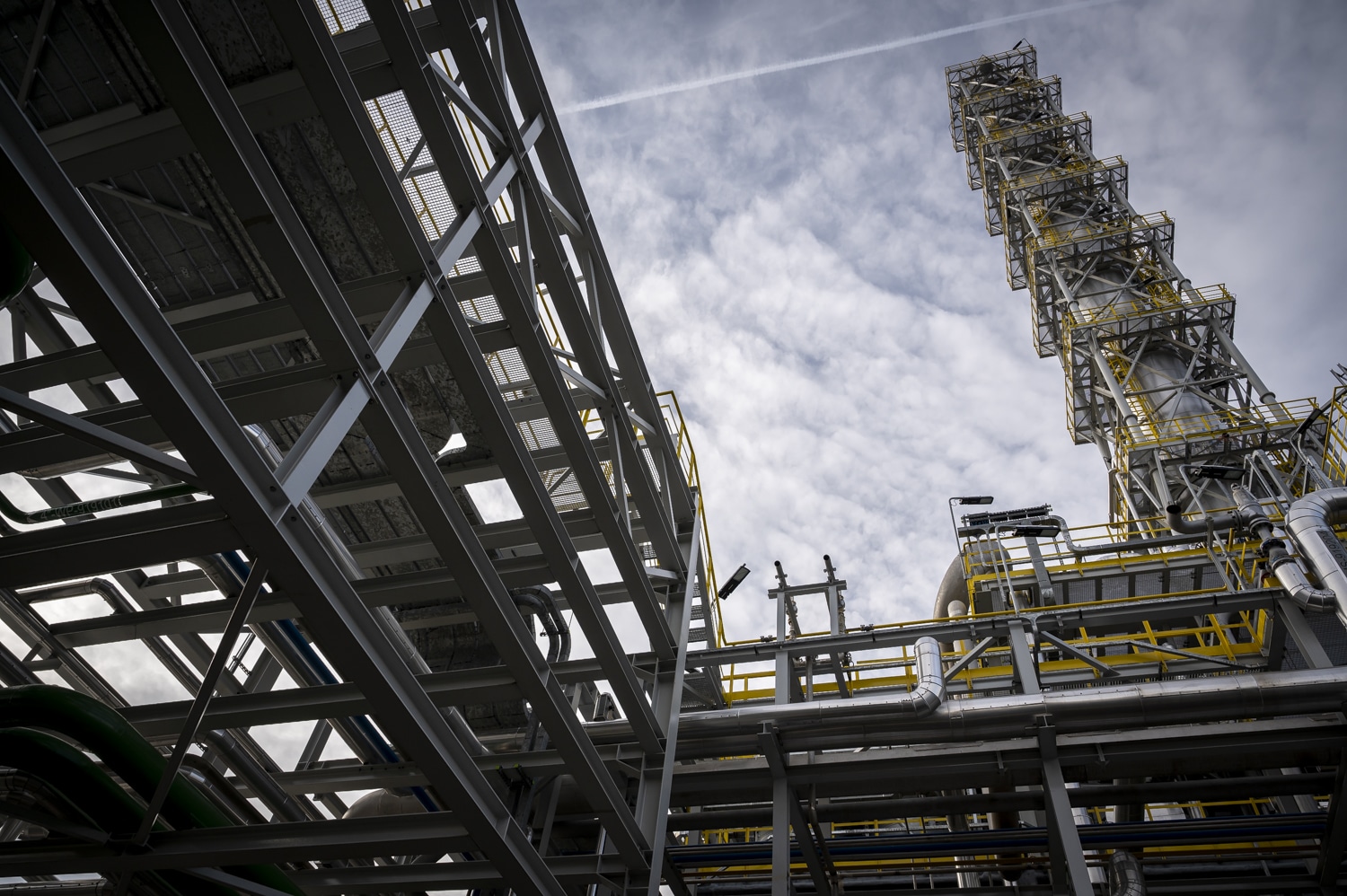

Consent was also given to the disposal of 100% of the shares in the Gas Storage Poland company in Dębogórze, which is the operator of gas storage facilities; however, the storage facilities themselves will remain the property of the ORLEN Group. The buyer of the shares, accepted by the anti-monopoly office, will be Gaz-System, the operator of the gas transmission system.

ORLEN’s shareholders also agreed to dispose of an organized part of the enterprise, including storage facilities, to PGNiG Upstream Polska. This is scheduled to take place on July 1, 2024. The actions taken aim to increase the economic efficiency of the use of assets acquired by ORLEN after the merger with PGNiG and the LOTOS Group. As part of the first stage, PGNiG Upstream Polska will be transferred, among other things, storage facilities that are part of the gas extraction system. In the second stage, storage facilities that are part of the natural gas storage system will be transferred.

Shareholders also consented to the disposal of properties in the Stara Biała commune and in Płock by contributing them as non-cash contributions to cover shares in the increased share capital of ORLEN Olefiny, a company belonging to the ORLEN Group. This is connected with the continued expansion of the Olefin Complex III – the largest petrochemical investment in Europe over the last 20 years, and the process of obtaining financing for it.