High inflation and growing consumer propensity to save, coupled with increasing ecological awareness and generational change, are factors driving the re-commerce market, or the trade of goods reintroduced online. On the OLX platform, in the first half of last year, second-hand, refurbished or end-of-line items accounted for almost 70% of the 111 million ads, reflecting the scale and potential of this market. Businesses increasingly recognize re-commerce as a source of additional income that also positively impacts their image and Corporate Social Responsibility (CSR) strategy. A report prepared by the OLX platform shows that it is the business sector’s participation in this market that will be the driver of re-commerce development in the coming years.

Re-commerce, also known as reverse commerce or re-sale, is a response to growing awareness and changes in consumer behavior, as they make increasingly ecological, sustainable, and frugal purchasing decisions.

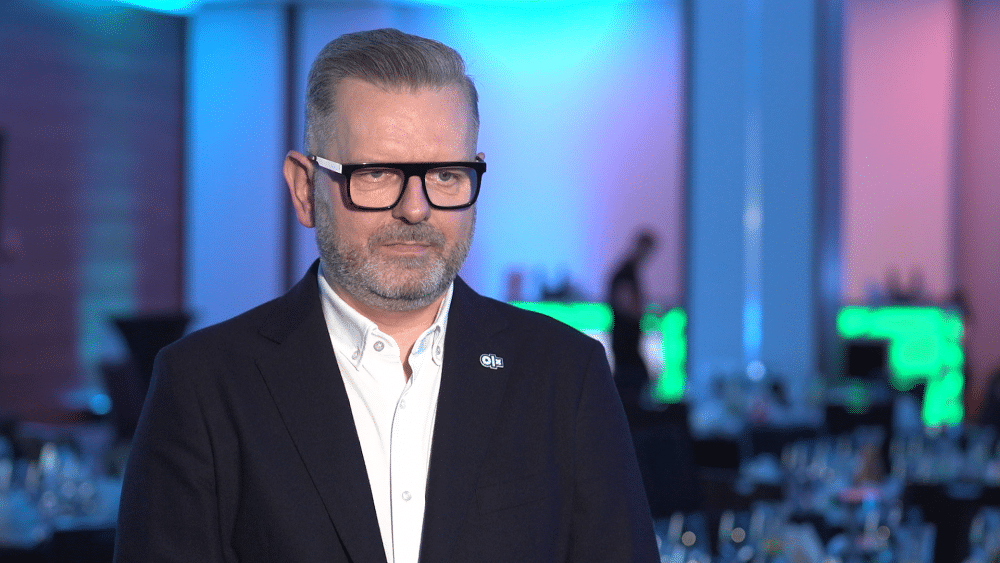

“The re-commerce market originates from the circular economy, the secondary circulation of items, when we give them new life through refurbishment or second-hand sale. Today, as we pay more and more attention to ecology and social responsibility, this trend is gaining in importance,” explains Paweł Świderski, Operational Director at OLX.

Items entering the re-commerce market are refurbished, repaired, and upcycled, and this sales model now covers almost all product categories, including furniture, clothing, jewelry, electronics, machinery, and luxury goods.

“The whole e-commerce industry is growing dynamically, but all indications are that the dynamics of re-commerce will be even higher. It is estimated that by 2030, the re-commerce market will grow four times faster than traditional retail and by the end of this period, it will already account for nearly 10% of the value of all online trade,” says Paweł Świderski.

According to data cited by OLX, in the last five years, online trade of items reintroduced into circulation has grown globally by an average of 10% annually, reaching a value of $174 billion in 2022. However, comprehensive data analyses are still lacking on the European and Polish markets, which would enable at least an estimation of the size of the re-commerce market in our region. Its potential, however, is demonstrated by statistics showing that in the first half of 2023 alone, 111 million adverts appeared on the OLX platform, 68% of which were resold items. The largest number of them were in the music and education, electronics, and sports and hobby categories.

“On our platform, which is currently the leader in the Polish re-commerce market, categories such as fashion, children’s articles, music and education account for the majority of the volume, i.e. over 50%, and in some months 60% of all adverts. We see that the supply side is getting stronger, we have more and more adverts and more and more exhibitors. On the other hand, categories such as antiques and collections, electronics, and home and garden also enjoy a huge interest from buyers – we observe increases at the level of 15-20%, and in some months even 30% year on year,” says Mateusz Bochat, category development manager at OLX.

According to last year’s “Re-commerce Report” by Cyrek Digital in Poland, 59% of consumers buy used, refurbished or outlet items online (compared to 9% in offline channels). The vast majority – a whopping 94.5% – mainly buy such items for themselves, but a considerable proportion also look for such items for their closest family, i.e. children, partner and family. More than half (54.5%) claim to buy second-hand items a few times a year, but over 11% do so a few times a month. 77% of Polish consumers declare monthly spending on such purchases up to PLN 100. Importantly, the re-commerce market is primarily dominated by women, who account for as much as 74% of all people buying and selling used goods online, which results from their greater sensitivity to price, quality and ethical origin of products. The main group driving this market and popularizing second-hand shopping is the young generation.

“More than 80% of Generation Z representatives declare that they regularly buy second-hand items online,” says Paweł Świderski.

According to Less Group data, 84% of Generation Z and over two thirds of millennials make such purchases online. They perceive re-commerce not only as a better choice for the climate and an element of sustainable consumption, but also as a simple way to save money, especially in categories such as fashion or electronics. According to last year’s report by Cyrek Digital, fashion is currently the fastest growing category in the re-commerce market – 82% of Polish consumers buy and 79% sell second-hand clothes. The most common motivation for this is care for the environment, the desire to save money or simply to get rid of old things. However, a report prepared by the OLX platform shows that the e-commerce market is also a place to search for unique items coming from collector’s editions, introduced to the market in small quantities or produced as part of upcycling.

“The development of the re-commerce market is supported by two trends. The first is economic factors such as high inflation, uncertainty and increasing propensity to save money, which mean that consumer interest in re-commerce is growing. On the other hand, we have businesses, companies that want to be perceived as modern brands that care about the environment and are socially responsible. CSR, ESG – these are initiatives that are directly related to re-commerce. That’s why we already see today that a large part of the adverts for selling used products on the OLX site come from companies that are involved in this type of activity, giving products a second life,” explains the OLX Operations Director.

The report prepared by OLX shows that the business sector’s participation in this market will be a driver of re-commerce development in the coming years. Especially given that business users have a higher level of consumer trust. In a study conducted in 2022 by Digital Poland, 12% of respondents stated that circumstances encouraging them to use the re-commerce market include the ability to verify the seller. Companies as organized structures surround the purchasing process with advanced protection, which already gives them an advantage over private sellers from the start.

“Advertisements posted by companies are attracting more and more interest from buyers, and of course, this is primarily a matter of trust. As consumers, buyers can check a given company, verify it online, and it is also guaranteed to provide 14-day returns in accordance with the law. That’s why interest is growing and we can see that from the supply side, we also have more and more businesses on our platform,” says Mateusz Bochat.

The business sector is increasingly recognizing the potential of re-commerce, considering it an opportunity for development and a source of additional income, which also has a positive impact on the company’s image and CSR strategy. According to the “Visa Globe Scan Research” report, on a global scale, 50% of international business is already engaged in re-commerce activity, and the trend is rising. As many as 66% of the companies surveyed in the report expect an increase in the return on their re-commerce activities over the next three years.

“Traditionally OLX is associated primarily as a platform for private users, with transactions that are made directly, locally. This local character is, of course, very important to us, but we are also developing strongly online, in the direction of e-commerce. Four years ago we launched the OLX delivery project, which gives sellers access to buyers from all over the country, and gives buyers the opportunity to take advantage of offers from virtually every corner of Poland. We can see that more and more businesses are appearing on our platform. These are small and medium-sized sellers who enjoy increasing interest and trust from buyers,” says the category development manager at OLX.

“Basically, all types of companies are present on OLX – from small, single-person to known, global brands and large sellers. We have over 200,000 of them and every month they publish over 3 million adverts,” says Dawid Fabiś, Sales Director at OLX. “Our platform has about 16 million users in Poland, almost half of the Polish Internet is present on OLX. We are a place where a huge crowd of people are looking for various types of goods and services. For companies that can sell and offer their goods or services in 23 categories, this means access to a very wide range of customers. At the same time, these are specific users, as they are looking for so-called bargains, heavily discounted goods e.g. because they are the end of the series, outlet goods, return goods. For sellers, it is often a challenge to reintroduce such products into circulation, and we are a perfect place for this.