Nomagic, a company that develops and implements robotic solutions for picking orders in warehouses based on artificial intelligence, has secured 8 million euros in new funding. This was possible thanks to signing an agreement with the European Investment Bank (EIB) for Research & Development (R&D) loan type financing. This new investment confirms the company’s growing market position and its achievements in the field of AI research and development in creating warehouse solutions that operate at 99.9%, meaning almost without interruption.

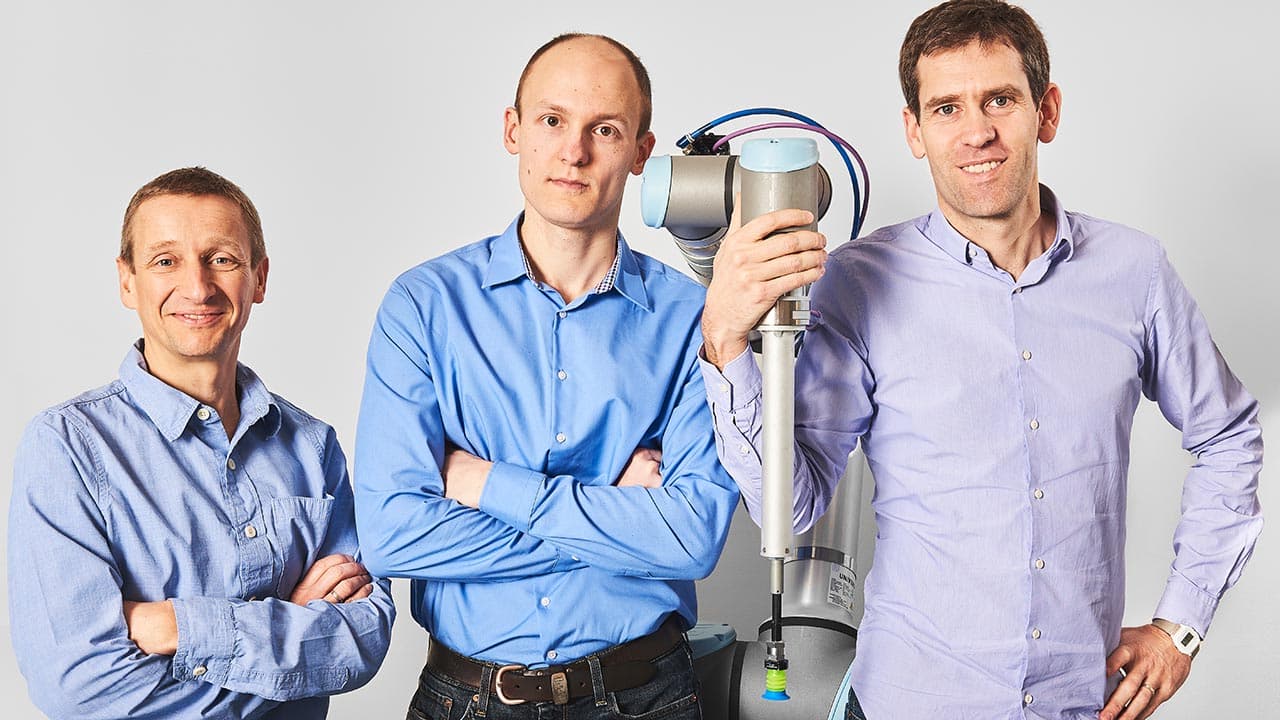

“The agreement with the EIB is not only an expression of faith in our pro-development projects that we intend to implement. It is primarily an appreciation of our path so far, from the founding of the company, as this type of funding is only provided to companies with strong, documented market demand and that can boast the support of renowned investors. Thanks to it, we will be able to continue to compete effectively with American companies,” emphasizes Kacper Nowicki, co-founder of Nomagic.

“Supporting innovation is the foundation of the European Investment Bank’s strategic priorities. We are pleased to announce the provision of necessary capital for Nomagic under the InvestEU program. Our financial commitment aims to support Nomagic in the development of automation solutions for the warehouse sector,” notes Prof. Teresa Czerwińska, Vice President of EIB.

The significant injection of capital earmarked for research and development comes at a crucial moment for Nomagic. The Polish startup is accelerating its commercialization and attracting more customers for its solutions, especially its flagship products, justInduct for Pocket Sorters and justPick for AutoStore. Recently announced partnerships with leading external logistics companies (3PL), such as Fiege and Arvato, have cemented Nomagic’s position as a leader in robotic handling of items in logistics centers.

The capital secured from the EIB will be used to accelerate strategic projects in the field of AI systems research and development at Nomagic. A significant portion of the funds will be used to improve already industry-leading solutions for robotic order picking, in particular React.AI technology.

React.AI uses video analysis-based advanced anomaly detection functions to identify even rare errors in order picking in the warehouse, such as lifting and packing two items at a time when items are stuck together or when unsealed boxes open during robot operations. After identifying a problem, React.AI automatically responds and corrects these errors, allowing operations to continue without the need for on-site human intervention. The new funds from the EIB will allow Nomagic to implement this technology in all its robots and enable multi-hour autonomous operation during night and weekend shifts when there are no operators in the warehouses.

“Nomagic has built a world-class, agile team of AI experts and practitioners, striving to develop solutions with 99.9% efficiency. This standard provides our customers with the best service and a sure return on investment. This means building platforms and functions that are not visible to the naked eye when observing the work of our robots, but are essential to provide the customer with the greatest business value. A perfect example of our capabilities in the use of AI is the Nomagic React.AI technology, which thanks to the new funding we will implement in all our production robots,” emphasizes Marek Cygan, co-founder and Chief AI Officer of Nomagic and recently also a member of the AI advisory team at the Ministry of Digital Affairs.

Currently, Nomagic’s robots are present in several logistics centers around the world, including in Germany, Switzerland, and Norway. With the just announced funding, the company has raised 38 million USD in capital from investors in the US and Europe.

Data from Research and Markets and Mordor show that the value of the global warehouse automation market will reach 31 billion USD by 2025, while the order-picking robot market is growing at a rate of 62.5% and will reach a value of 2.9 billion USD by 2026.