Currently, consumers are much more willing to spend money on entertainment than on durable goods. That’s why service-oriented economies like the United States are faring better globally. Our economy is unique in this context, because structurally it is similar to industrial Germany, but it is not experiencing recession. On the contrary – it is intended to grow by approximately 3% this year.

Typically, the economic structures matter more to economists than ordinary citizens. However, now structural economic differences directly affect results and growth in individual countries and thus – the economic situation and citizens’ wallets. The global economy in 2024 is predicted to grow at a rate of about 1.5% and moves towards a so-called “soft landing”. However, there is a divergence between the improving situation in services, and the recession in the manufacturing industry. It turns out that currently, consumers much prefer to spend money on entertainment than on durable goods. This causes problems for economies such as Germany or China, where the industrial sector’s share in the GDP is the highest. This, however, helps the United States, their economy, and their stock market.

The global downturn in manufacturing is deepening. This pushed Germany into recession and contributed to recent growth disappointment in China. Global PMI indices have been falling for seven months, and manufacturers are currently reducing the number of employees and shopping. This also led to a decrease in inflation, and China is on the brink of deflation. Services and consumer spending were a positive economic surprise of the past year. They helped keep the USA and UK away from the predicted recession. At the same time, unemployment rates are close to record low levels. Falling inflation supports the growth of real wages and expenditures. The latest PMI indicators show that service segments such as technology, healthcare, and tourism are global growth leaders.

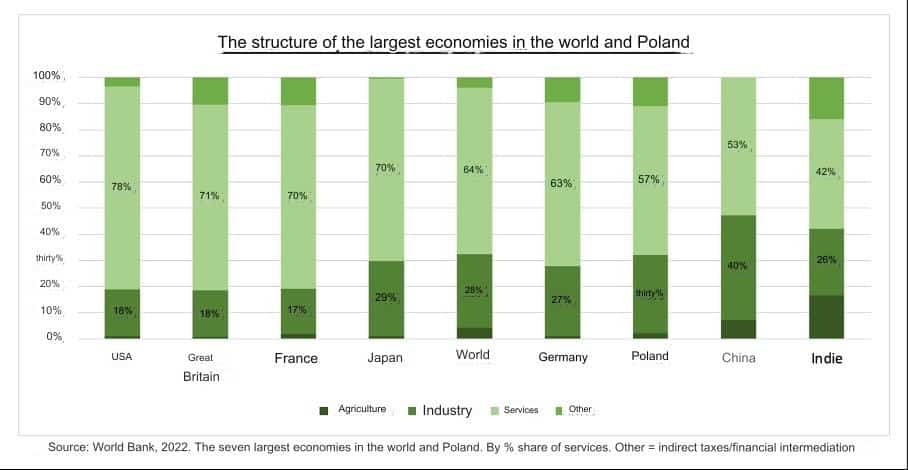

Against this backdrop, Poland stands out. We have a large industrial sector, which constitutes as much as 30% of our GDP. For comparison, in Germany, it is 27%, in the USA 18%, and in China as much as 40%. The share of services in our economy is 57%, while in Germany it is 63% and in the USA as much as 78%. With such an economic structure, growth in 2024 is forecast at around 3%. The reasons for such growth are several – it turns out that Polish industry, compared to its competitors, is performing very well, becoming a beneficiary of the deglobalization process. Many companies after the pandemic have moved their factories from China to Europe, locating them in Poland. Lower wage levels in Poland than in other EU countries and a relatively weak zloty continue to help. The diversification of Polish product recipients is also important. In a situation where exports to Germany have fallen significantly, other export directions enable production stabilization.

At the same time, the Polish consumer is happy to spend money, and this supports growth. According to GUS data on consumer climate, consumer moods related to the economic situation in the next 12 months are currently at the highest level in 4 years. The percentage of consumers declaring readiness to incur more significant expenses such as home renovation or car purchase has grown significantly. This is a result of inflation decrease and the appearance of real wage growth for the first time in a long time. All this makes the Polish economy highly diversified and resilient to restrictions. While many world economies suffer becoming prisoners of their structure.

Paweł Majtkowski, eToro analyst in Poland