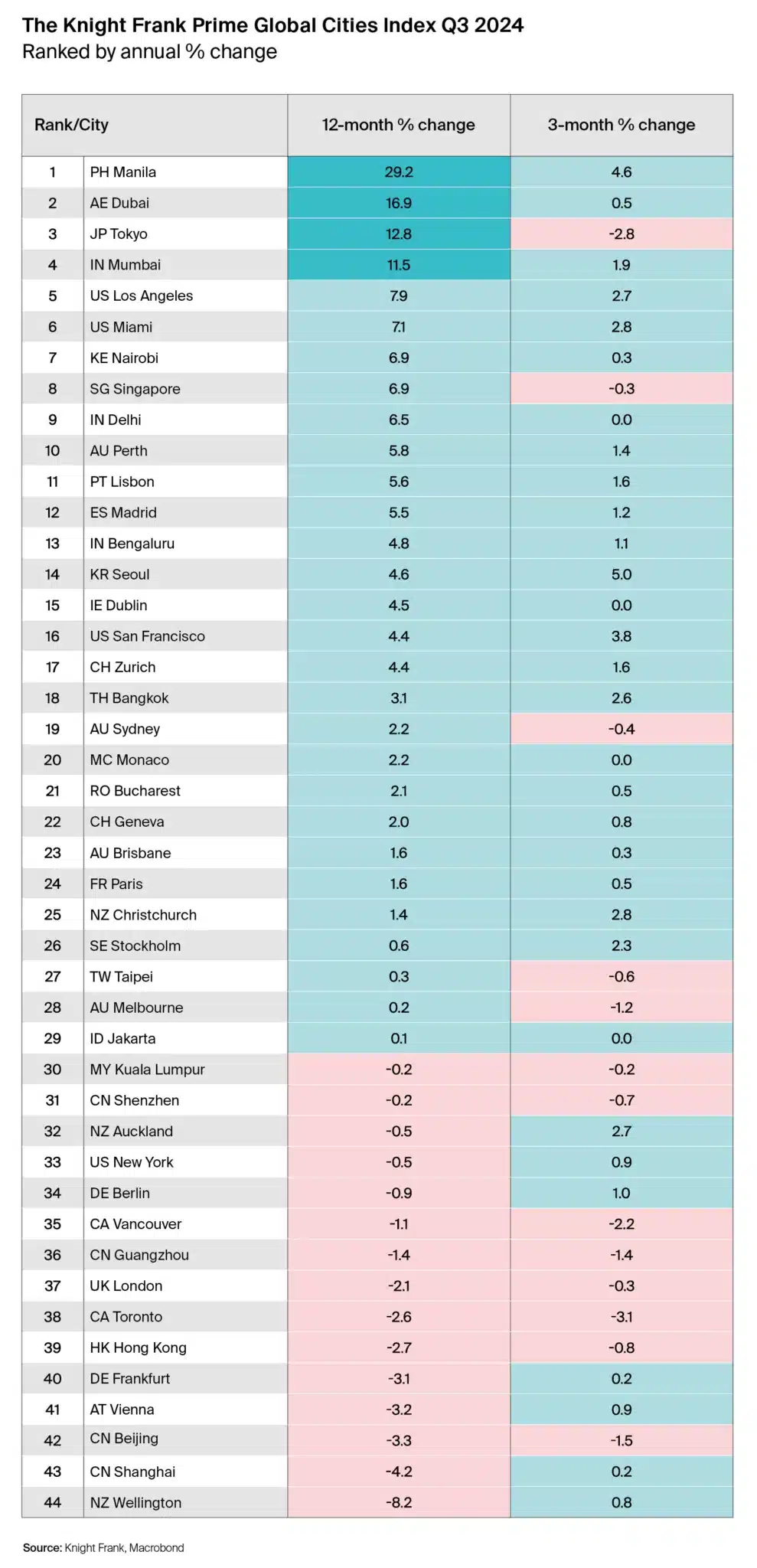

The increase in luxury housing prices continues to be moderate, according to the Knight Frank Prime Global Cities Index, which covers 44 of the world’s most expensive cities. In the third quarter of 2024, the annual increase in prices slowed to 2.9% from 3.4% in the first quarter of the year. This is significantly below the 10-year high of 10.3% recorded in the fourth quarter of 2021.

Growth Slowdown

In the third quarter of 2024, the best residential property prices grew at a rate of 2.9% annually. This represents the lowest year-on-year increase of the year, and a significant drop from the 10-year average of 4.6%.

Interest Rate Cuts are Key to Success

“Recent rises in global housing prices were driven in part by interest rate cuts by central banks. The European Central Bank lowered interest rates in October, and the U.S. Federal Reserve did so earlier in September. It seems that further cuts are necessary to maintain price growth in the luxury real estate market,” comments Dorota Lachowska, Head of Research at Knight Frank.

Rising Markets

Among the 44 cities studied, the majority (29 out of 44) recorded growth in residential property prices compared to the previous year. This positive trend was also reflected in quarterly comparisons, where most cities (31 out of 44) saw price growth compared to the previous quarter. Manila, continue to grow, recorded an increase of 4.6% over the last three months and an annual growth of 29.2%. This was due to strong economic growth and rising consumer confidence. Tokyo, despite a quarter-on-quarter decrease of 2.8%, maintained solid annual growth of 12.8%. However, with a strengthening Japanese yen and the Bank of Japan, being one of the few central banks set to raise interest rates, the housing market may face slower growth in the coming quarters.

Sustainable Growth

Dubai, which had been an active market in terms of price growth since the pandemic, is becoming a more stable market. Prices of the best residential properties gradually increased by 0.5% over the last quarter, resulting in a total price growth of 16.9% over the past year. However, the level of price growth in the UAE is extraordinary, as the market for the best properties in Dubai has grown a staggering 190% since the beginning of 2020, surpassing all other cities in the index during this period.

“The recent slowdown in global price growth reflects the need for additional stimuli in the form of further interest rate cuts before prices can strengthen. We anticipate the expected wave of cuts by 2025 will support higher property price growth in the medium-term perspective,” explains Liam Bailey, Global Head of Research at Knight Frank.

“We might expect a similar trend in the local Polish market, however, the prospect of the National Bank of Poland cutting interest rates remains distant,” adds Dorota Lachowska.

Source: https://ceo.com.pl/wzrost-cen-mieszkan-luksusowych-hamuje-inwestorzy-oczekuja-impulsu-od-obnizek-stop-procentowych-24553