Last year, the overall demand for liquid fuels in Poland increased by 6%, with demand for main transportation fuels—gasoline, diesel oil, and LPG gas—rising by 7%. This translated into record revenues that the industry contributed to the state budget. Taxes from fuel sales totaled more than 93 billion PLN last year, according to a summary by POPiHN. Domestic fuel consumption was supported last year by fuel tourism and a significant number of cars with Ukrainian license plates on Polish roads. This year, according to experts, may prove even better. Demand for fuels will be driven by new investments initiated with EU funds.

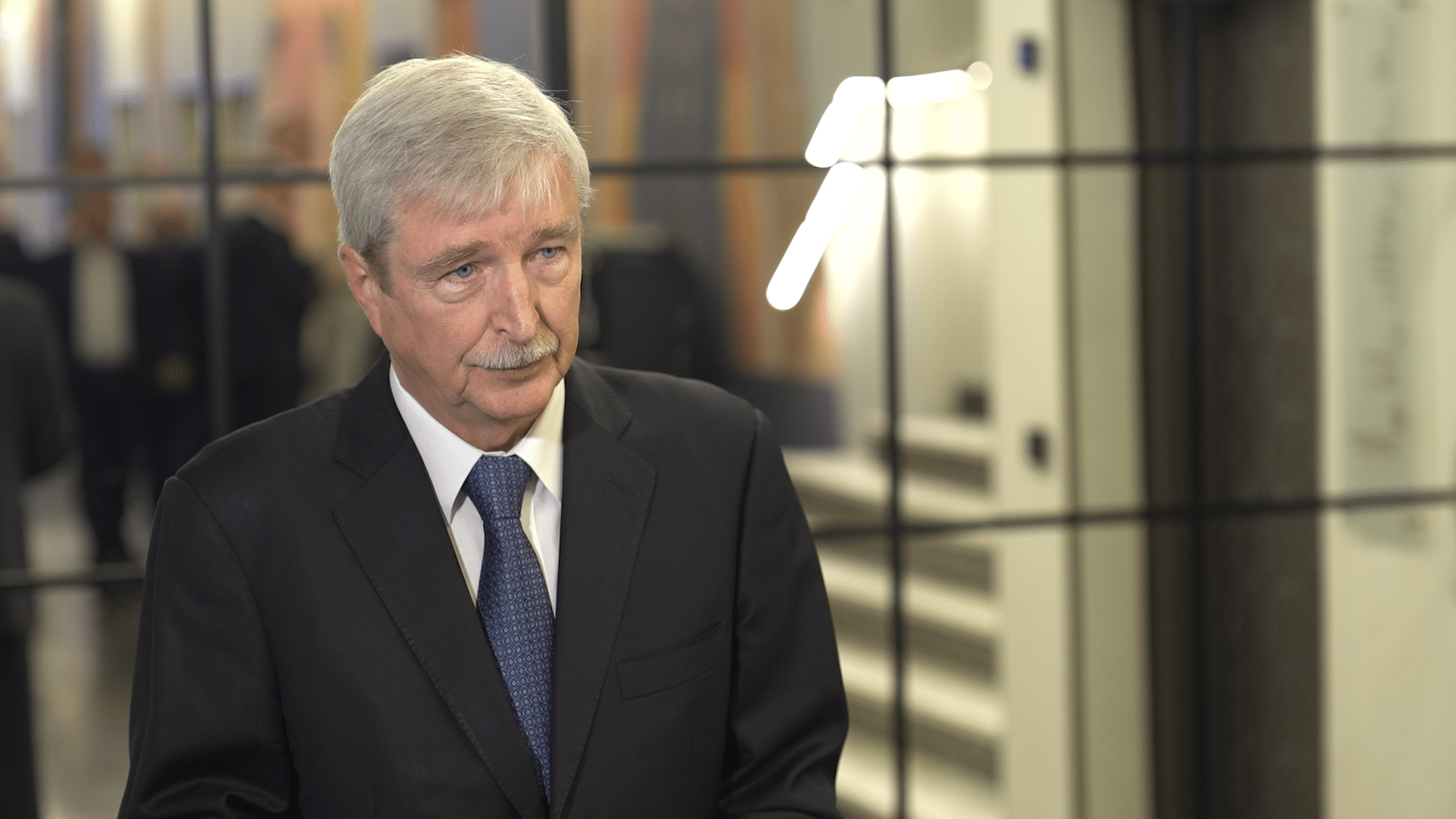

“We can safely say that 2023 was a better year in the fuel market than the previous one,” says Krzysztof Romaniuk, Director of Market Analysis at the Polish Organization of Oil Industry and Trade, to Newseria Biznes. “Fuel sales in the domestic market increased by about 6%, with transportation fuels, namely gasoline, diesel oil, and liquid LPG gas, seeing an increase of about 7%. In terms of individual types, sales of motor gasoline rose by about 12%, diesel oil by about 5%, and liquid LPG by about 7%. Thus, the market jumped significantly compared to the previous year, while compared to the pre-pandemic year of 2019, the market growth is around 10%.”

The challenging economic environment, the ongoing war in Ukraine, the need to change supply directions after the EU embargo on the import of oil and refined fuels from Russia, and high fuel prices in the first quarter of 2023 (especially for diesel oil) were the main factors determining the condition of the Polish liquid fuel market last year. Demand for liquid fuels in Poland grew mainly due to purchases of motor gasoline and liquid LPG—especially in the second half of the year, their sales were noticeably higher than in the previous year. Traditionally, the highest amount of automotive fuels was sold in the Mazowieckie voivodeship, and the lowest demand was noted in the Opolskie voivodeship.

In 2023, premium fuels also sold well again (with a 1% increase in the gasoline segment and a 6% increase in the diesel segment). In total, the share of premium grade in the entire sales of motor gasoline on the domestic market reached about 5%, and for diesel oil – about 6%. Analysts note that the purchase of such fuels by drivers is heavily dependent on their prices, which were lower in 2023 than in the previous year (although on average, the prices of these fuels were higher by 25-50 groszy per liter compared to standard grades). Interestingly, the sales dynamics of premium diesel oil were the highest among all types of motor fuels last year.

POPiHN points out that domestic fuel consumption last year was supported by fuel tourism at the western and southern borders. Polish fuel stations offered fuels at prices significantly lower than in neighboring European countries, which encouraged drivers from these countries to come to fill their tanks and canisters, boosting retail sales. The result was also strengthened, especially in the second half of the year, by increasing sales of diesel oil and aviation fuel for the revitalizing air travel. High levels of sales were stabilized by the holiday travels of nationals, and a significant factor affecting demand was also the continued significant number of cars with Ukrainian license plates moving on Polish roads. Additionally, the war in Ukraine requires large amounts of fuel, mainly diesel oil, and Poland is the main transshipment hub for this type of supply. As a result, the export and re-export of liquid fuels, carried out by Polish entrepreneurs, were at record levels.

“We expect that 2024 will be even better than last year. We have access to new funds, including from the Recovery Fund, so investments should start, and thus the sale of diesel oil should increase significantly. We forecast gasoline sales at a similar, maybe slightly better level than last year. However, for autogas, we are likely to face some market fluctuations, as sanctions are coming into force on the import of this fuel from Russia. Therefore, we probably have to count on slight price increases, and it is known that this element always influences sales,” says a POPIHN expert.

Fuel prices sharply increased at the turn of February and March 2022 when, just after the outbreak of the war in Ukraine, there were mass purchases of fuels wholesale and at fuel stations. Last year, the situation stabilized, but fuel prices in the first half of the year remained high, though significantly lower than in the second half of 2022. Later, fuel buyers benefited from steadily decreasing wholesale and retail prices and from demand-sustaining margin limitations by fuel station operators. The final level of average fuel prices was also influenced by pricing decisions taken from the beginning of September by major market operators. Retail price reductions below 6 PLN/liter for both main types of fuels corrected the average market prices for the entire year significantly downwards.

The POPIHN expert forecasts that this year—at least in the first half—fuel prices should remain stable, and in 2024, they may stay at levels similar to the previous year. However, this forecast is currently subject to significant risk, mainly due to the unstable economic and geopolitical situation.

“The first two months of this year showed that—despite the tense situation in international markets, the ongoing war in Ukraine, and the conflict in the Middle East—prices did not increase significantly, and gasoline prices are even lower than the average last year. So the prospects for the coming months, despite the heightened global situation, are quite good. In the second half of this year, we may face some increases,” assesses Krzysztof Romaniuk. “This market is very sensitive to all kinds of disturbances, whether political or economic. Therefore, it is difficult at this time to forecast far ahead, as it is like reading tea leaves. If the situation we have now continues, we will probably have prices this year quite similar to last year’s levels.”

The expert notes that high competition in the market is one of the elements that allows maintaining prices at relatively stable levels without special fluctuations in different periods of the year. For years, both large domestic and international corporations and many private and independent operators, who own up to 40% of this market, have been operating in the domestic market.

“After the entry of a new operator, MOL [the Hungarian operator finalized the purchase of over 400 gas stations previously belonging to Lotos in December 2022], all major Lotos stations were rebranded, so MOL is now visible. Combined with Slovnaft stations, which have been operating in the Polish market for years, its position is now the third place on the podium. The first place belongs to Orlen, and the second is occupied by the BP conglomerate. However, it is visible that international conglomerates are increasing the number of fuel stations in their networks, but on the other hand, independent operators such as Moya or Unimot, who are taking over stations from the independent market to their franchise networks, are also expanding their networks. The greater the competition, the smaller the price fluctuations and the better for drivers,” emphasizes the Director of Fuel Market Analysis at POPIHN.

According to information collected by POPIHN, at the end of 2023, there were about 7.9 thousand generally accessible fuel stations in Poland selling at least two types of fuels (BS, ON). Besides this segment, there are also stations that sell only autogas or exclusively diesel oil.