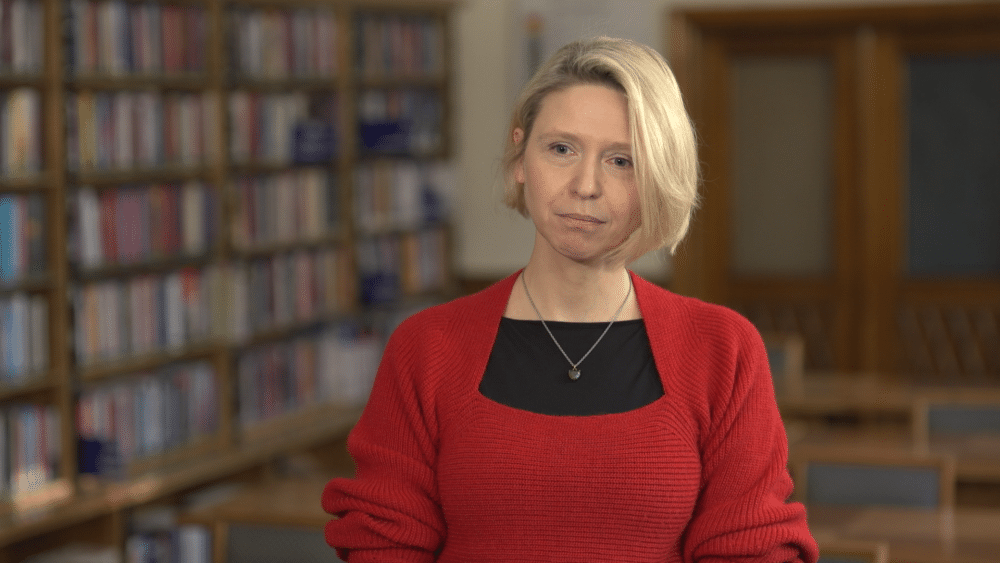

“Compared to the rest of the world, the EU has imposed the highest number of sanctions on Russia, and will certainly tighten this sanction policy in the future. There is still a lot of work and many areas where restrictions could be imposed to increase the cost of Russia waging war in Ukraine,” says Professor Agnieszka Legucka, analyst at the Polish Institute of International Affairs. As she points out, further tightening of EU sanctions is needed because, despite Europe drastically reducing its dependence, many countries continue to import Russian resources. Although this is no longer as profitable for Russia due to lower commodity prices, it still allows Moscow to finance attacks on Ukraine.

“Energy resources provide Russian authorities with revenue to wage war in Ukraine, and at the same time, Russia uses its energy resources as a weapon in foreign policy. However, after the sanctions were imposed, the Russians had to find new markets for them, as the European Union introduced a number of restrictions on various kinds of energy resources from Russia, and reduced its dependence on Russian gas from approximately 40 to just a few percent. It is clear that the West has heavily cut off dependence on Russian resources, this dependence no longer functions,” says Professor Agnieszka Legucka.

The sale of energy resources, mainly oil and gas, was and is a significant source of income for the Russian Federation, accounting for about a third of the central budget’s revenues, largely financing the Kremlin’s war machine. According to the Polish Economic Institute, in 2021 – i.e., before the Russian invasion of Ukraine and the outbreak of war in this country – profits from the sale of oil only to EU countries accounted for approximately 10 percent of the central budget of the Russian Federation.

“Now this is changing a bit, resources are no longer as profitable for the Russian Federation, as they fell last year. At the same time, the Russians also have their part of the secret budget allocated for military purposes,” says the analyst from the Polish Institute of International Affairs.

The Russian aggression on Ukraine in February 2022 forced EU countries to impose sanctions and become independent of resources from this direction – within a year from the invasion, the daily flow of Russian gas imported to the EU through gas pipelines decreased sixfold. In 2022, the import of Russian gas to Europe (including LNG) fell by 52 percent. According to the PIE report (“Gas supply security in the EU. From crisis to independence”), replacing Russian resources was possible thanks to existing LNG infrastructure, diversification of supply directions, and reduction of consumption primarily by the industry. Importantly, Poland – historically the most dependent on Russian supplies – has most significantly reduced reliance on Russian supplies among gas market-dominant countries in the EU: it completely eliminated them in the first quarter of 2023.

“It was clearly seen that in 2022, the Russians were even profiting from the war, as their revenues were higher due to high oil prices. However, 2023 brought a drop in revenues related to oil and natural gas. Russia still plays these resources, but in other directions. Countries that most frequently appear in import statistics from this direction are China, India, and Turkey,” says the PISM analyst. “These three countries certainly have better negotiating positions when it comes to the prices of imported resources. It is not known exactly how much they buy them for, we do not have access to full data, but according to media and analytical estimates, they must have a so-called discount, as the Russians say, that is, the possibility of purchasing cheaper commodities.”

After European countries halted most of the oil and gas supplies from Russia after its full-scale invasion of Ukraine, China, India, and Turkey became the largest recipients of Russian energy resources. At the end of last December, Russian Deputy Prime Minister Alexander Novak reported that almost all of Russia’s oil exports (90 percent) were directed to these countries, which allowed Moscow to secure funds to continue the war in Ukraine. New customers for Russian resources, however, buy them at a considerable discount, and in Turkey’s case, the proximity of Russian ports translates into lower shipping fees. As a result – as estimated by Reuters – in 2022, Turkish companies saved about $2 billion on energy bills. Importing cheaper commodities also helped Turkey reduce its trade deficit. Meanwhile, data from the research firm Kpler shows that India imported 10 times more Russian oil in 2023 than before the war.

“Compared to the rest of the world, the European Union has imposed the highest number of sanctions on Russia, and will certainly tighten this sanction policy in the future, as some countries – like Bulgaria, Czech Republic, Slovakia, or Hungary – continue to import some resources from Russia. They have exclusion clauses that still allow them to adapt to the new situation, because they need to find other providers from around the world. Therefore, there is still a lot of work and many areas where restrictions could be imposed to make it more difficult, or in other words, to increase the costs of Russia waging war in Ukraine,” warns Professor Agnieszka Legucka.