Border controls will extend the border-crossing time by an average of 20 minutes, leading to an increase in transport costs. Two-thirds of German imports occur across land borders with neighboring countries – more expensive transport will result in a decrease in the import of goods to Germany, Poland being the second economy in terms of potential loss. Nonetheless, the competitiveness of German companies and the German economy will primarily suffer (potentially reducing the German GDP by even 11.5 billion EUR per year).

Moreover, there are also indirect effects – Germany is the main transit country for trade within the EU, which will result in significant delays and increased costs for companies involved in international trade in Europe.

Allianz Trade analysis indicates that the reinstatement of border controls in Germany will result in significant delays in transport, adding about 20 minutes to the typical crossing of border crossings in the Schengen zone. This will likely lead to a -9.1% drop in German goods import as well as a decline in services demand by -7.8%, totaling 1.1 billion EUR per year. The tourism and education sectors (+3.5%), followed by food (+2.6%), and trade (+2.4%) will be the most affected. Significant import reductions will also be experienced in machinery and electrical equipment sectors and in the chemical and pharmaceutical industry: respectively, by 147 million EUR and 142.1 million EUR. Overall, these restrictions could increase the risk of recession in an already unstable environment. Neighboring countries will feel this due to strong linkages in the supply chain: imports from the Netherlands will likely fall by -0.2 billion EUR, while imports from Poland will reduce by -0.1 billion EUR, and imports from France by -92.4 million EUR.

German border controls could lead to significant delays in transport due to extended waiting times and congestion. In response to the ongoing migration situation and illegal immigration, Germany has reinstated border controls at all its land borders for the next six months. Some of these measures have been in place since the significant influx of migrants in 2015 and after terrorist attacks, especially with neighboring countries like Austria, Czech Republic, Poland, and Switzerland. Now, this applies to the borders with Denmark, the Netherlands, Belgium, Luxembourg, and France as well. These intermittent border controls come with restrictions and additional costs of people flow, which might negatively impact tourism in Germany, as well as mobility of people commuting to work abroad.

Additionally, according to Allianz Trade opinion, the extended waiting time will impede the international trade due to congestions and load checks at temporary border posts. This will increase the transportation costs of imported goods, reducing competitiveness– already low German manufacturers– and the overall trade exchange. In normal conditions, a typical border crossing in the Schengen zone takes an average of 3.34 minutes. However, even temporary border checks can significantly slow down traffic due to delays resulting from inspections or congestions caused by reduced traffic flow and inefficient infrastructure. Travel and distance data suggest that crossing the external Schengen border on a transit route can extend the travel time by 20 minutes. Considering Germany’s role as the main transit country in Europe, these changes might also lead to significant delays and increased costs for companies involved in international trade in Europe.

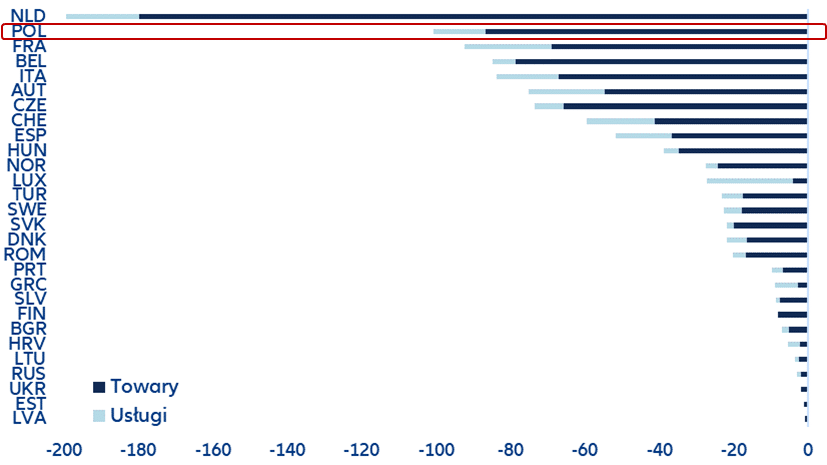

Allianz Trade’s perspective is that border controls may increase costs on major transport routes by +1.7% in relation to goods and +1.5% for services. Extended waiting times, especially at busy crossings such as the German-Dutch border through which about 1000 trucks pass daily, may significantly affect the punctuality of goods deliveries. Our estimates suggest that goods imported from Continental European trade partners may become costlier by +1.7%, while services may see a price increase of +1.5%. As a result, we predict that goods import to Germany may potentially fall by -9.1%, and services demand by -7.8%. Considering that about two-thirds of German imports occur across land borders with neighboring countries, this translates into a total annual decrease of -1.1 billion EUR, -0.9 billion EUR for goods, and -0.2 billion EUR for services. Neighboring countries will be particularly affected due to strong linkages in the supply chain (Figure 1). Imports from the Netherlands may fall by -0.2 billion EUR, with 90% falling on goods and 10% on services. Polish imports to Germany may see a decline of -0.1 billion EUR (86% in goods and 14% in services), while German imports from France may fall by -92.4 million EUR, ¾ of this reduction will be due to a decrease in goods import and ¼ in services.

Figure 1: Risk for German imports per year in connection with additional border controls, in millions of EUR

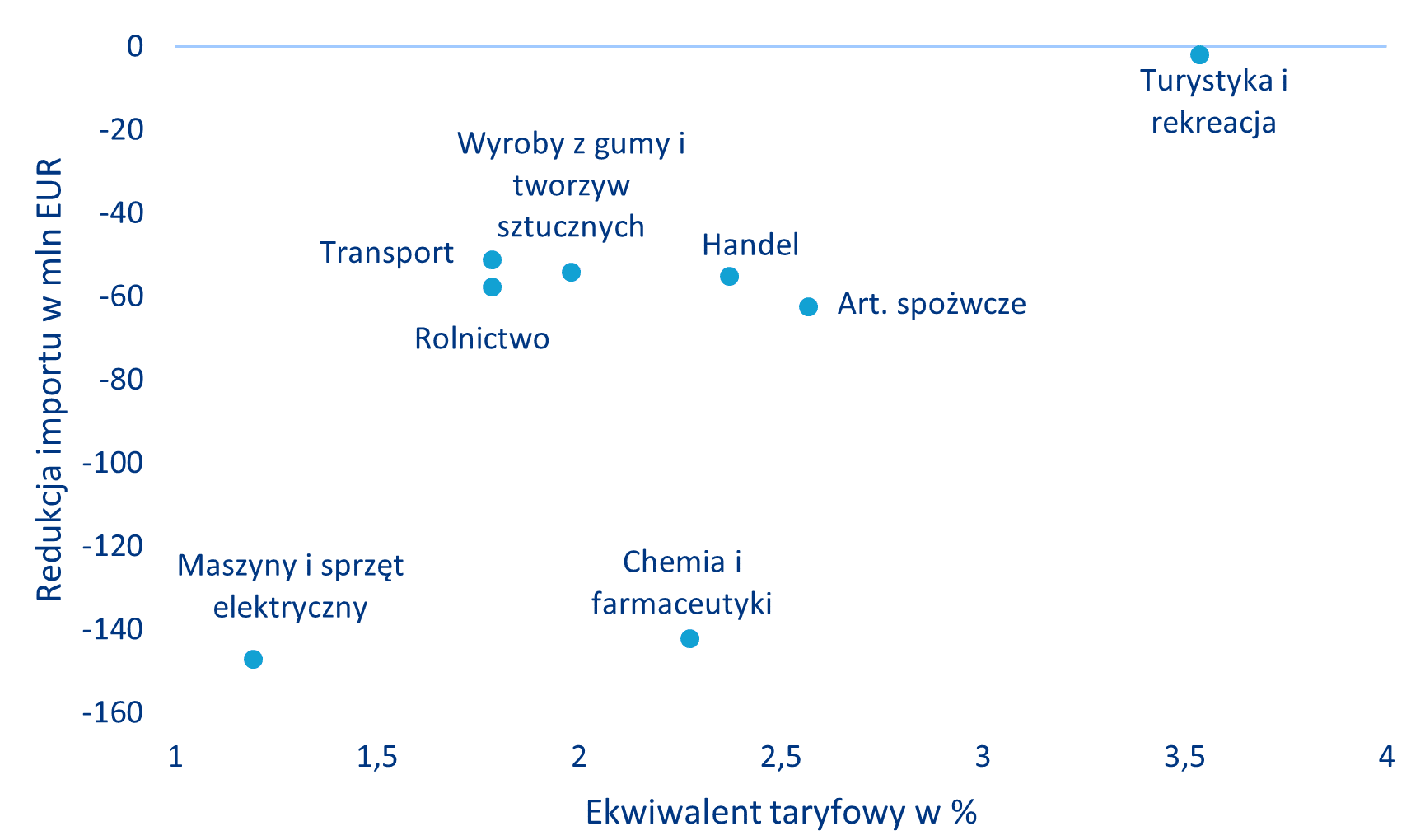

The forthcoming economic repercussions will put additional pressure on the German industry. Delays in goods flow can have significant consequences, especially for sectors that highly rely on cross-border trade. Disruptions in the supply chain can lead to shortages of stocks, increased operational costs, and lost opportunities for time-sensitive industries like perishable goods and just-in-time production. Among the most affected sectors, the tourism-education sector is facing the highest trade cost increase of +3.5%, followed by food items at +2.6%, and trade services at +2.4% (Figure 2). Meanwhile, it is anticipated that machinery and electrical equipment, as well as chemicals and pharmaceuticals, will experience a noticeable reduction of imports, respectively by -147 million EUR and -142.1 million EUR, highlighting their significance to the German economy. Such delays could endanger Germany’s status as a key transit node for European trade, making it less attractive for companies dependent on efficient logistics. German companies, which are already struggling with competitive pressure and global supply chain challenges, may be further burdened by these new controls. Moreover, increasing transport costs might translate into higher prices for consumers, weakeningthe already low domestic demand and potentially stifling economic growth. All in all, these factors might increase the risk of recession in an already unstable economic environment, potentially reducing German GDP by even 11.5 billion EUR per year.

Figure 2: Threatened German imports (in million EUR) and trade costs (in %) by sectors in connection with additional border controls

Sources for Figures: Eurostat, Felbermayr, Gröschl, and Heiland (2022), Allianz Research.

Footnote: Due to imperfect infrastructure development (e.g., narrowing of the road, interruption of motorways) and resulting traffic jams, the difference in travel time is not 0 minutes.

Source: https://managerplus.pl/kontrole-na-niemieckich-granicach-i-ich-wplyw-na-gospodarke-w-tym-sytuacje-polskich-firm-86271