-

- Tensions in the labor market (including insufficient supply) and the lingering effects of the inflation shock from 2022-23 have led to double-digit growth in real wages – primarily in Bulgaria (+15% in Q2 2024), followed by Poland (+12%), Hungary, and Romania (both +10%).

-

- Despite a significant drop in inflation, government policies in the region (e.g., significant increases in the minimum wage) further fuel this trend. Labor costs rose by +9.2% in Q2 2024 – the largest spike since 2010.

-

- Labor costs increased because productivity is not keeping up with wages: productivity lagged behind, falling by -48% across the region.

-

- Although Central and Eastern European (CEE) countries continue to attract (considerable) foreign direct investment (FDI), the region’s competitiveness in terms of labor costs is steadily declining: from -14% to -19% between 2022 and 2024, prompting Western European countries to reconsider their outsourcing strategies.

CEE countries were ideal outsourcing hubs for Europe, but higher wages are reducing their competitiveness. The region is gradually developing higher value-added services, including IT and advanced services such as computer programming, consulting, and information services, particularly in Bulgaria and Romania. Nevertheless, manufacturing, especially in the automotive sector, has so far been the cornerstone of their competitive edge, positioning CEE countries as ideal outsourcing centers for Western European firms. However, rising nominal and real wages are gradually eroding this competitive advantage.

Strong wage growth reflects tensions in local labor markets and the lingering effects of the inflation shock from 2022-2023. Real wages have surged this year, with Bulgaria leading with an extraordinary +15% y/y increase in Q2, followed by Poland at +12%, and Hungary and Romania at +10%. Although real wage growth rates slightly declined in Q3, they remain high compared to global trends, especially in comparison with the eurozone average of just +3% (Chart 1, left – EZ for Eurozone).

Chart 1: Real wage growth in selected countries, y/y % (left) and the Phillips curve (right)

Sources: LSEG Datastream, Allianz Research

Despite a significant drop in inflation – down to 3.8% y/y in Q3 2024 – real wage growth in the region remained impressive at +10.5% in the previous quarter. This is largely due to labor market tensions, with an average unemployment rate of just +4.5% in Q2 2024, which typically correlates with lower wage growth (Chart 1, right). The relatively stable relationship between unemployment and wage growth has changed since the pandemic, resulting in stronger wage growth at a given level of unemployment. Contributing factors include secure forms of employment, which increase workers’ bargaining power, and the pursuit of higher wages to offset prior income erosion during inflation periods.

Government policies also played a major role: minimum wage increases were significant, with Poland at +19%, Romania at +12%, and Bulgaria at +20% in 2024, while Hungary saw a +15% increase in December last year. Given the high percentage of workers earning at the minimum wage level, these increases, along with public sector wage growth, significantly contributed to overall wage increases in the region.

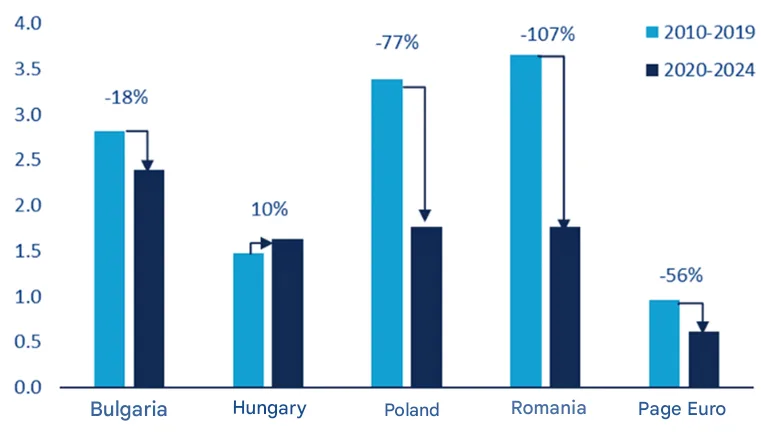

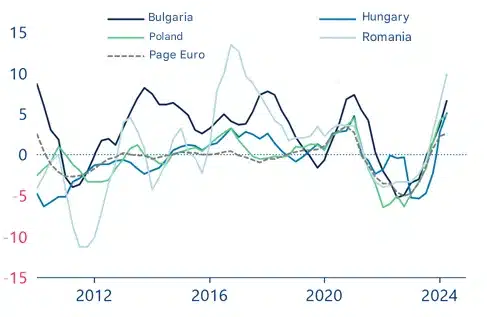

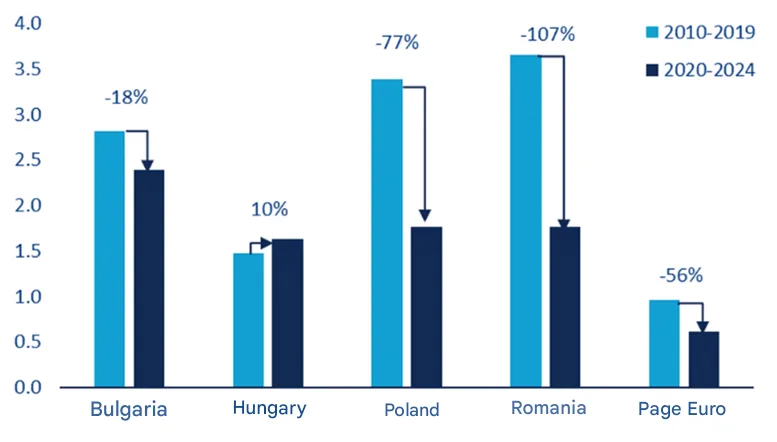

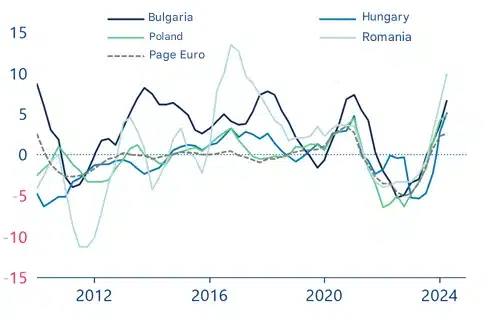

Labor costs increased because productivity is not keeping up with wages. While strong wage growth is typically driven by significant productivity improvements – allowing companies to raise employee salaries without harming profit margins – this correlation is not currently seen in the CEE region. In fact, labor productivity is declining. Comparing pre- and post-pandemic periods, we find that productivity growth in CEE fell by -48%. Real productivity per hour worked in Romania plummeted from 3.7% in 2010-2019 to just 1.8% in 2020-2024, more than twice the decline seen across the eurozone.

Poland experienced a staggering -77% drop in average productivity growth, while Hungary managed a modest +10% increase (Chart 2, left). This widening gap between wage growth and productivity growth has been a key driver of rising unit labor costs, which saw an average y/y increase of +9.2% in Q2 2024 – the highest since 2010.

Chart 2: Real productivity per hour worked, y/y % and % change (left) and unit labor costs, y/y % (right)

Sources: LSEG Datastream, Allianz Research

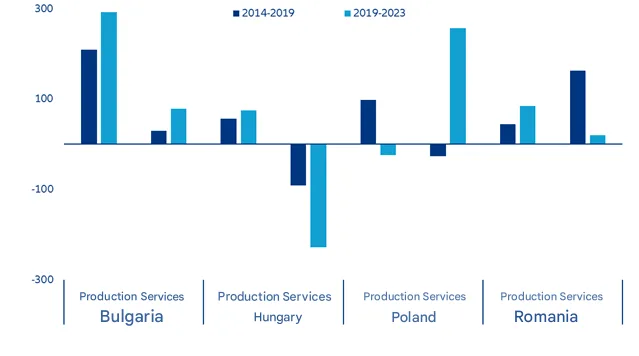

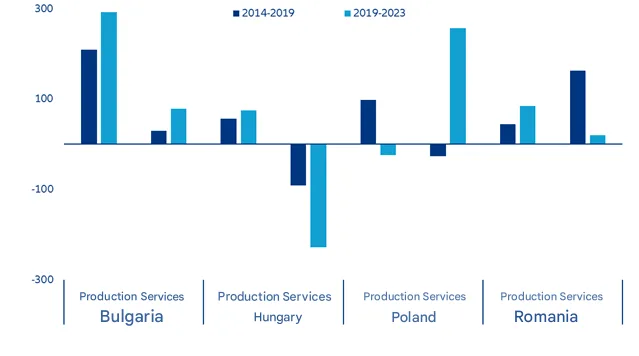

Despite competitiveness challenges, the region continues to attract investments. The recent flattening of the correlation between productivity and unit labor costs may indicate a decline in competitiveness. Rising labor costs may prompt Western European countries, which previously outsourced labor to the region, to reassess their strategies. Nevertheless, the inflow of FDI suggests that the region remains attractive for outsourcing (Chart 3). In particular, Bulgaria has become a key investment hub in both manufacturing and services, with FDI in manufacturing nearly tripling between 2019 and 2024, surpassing pre-pandemic growth levels.

Conversely, Poland has recently become less attractive in manufacturing but recorded an impressive +250% increase in service-sector FDI.

Chart 3: Inflows of FDI by industry and country, % change

Sources: LSEG Datastream, Allianz Research

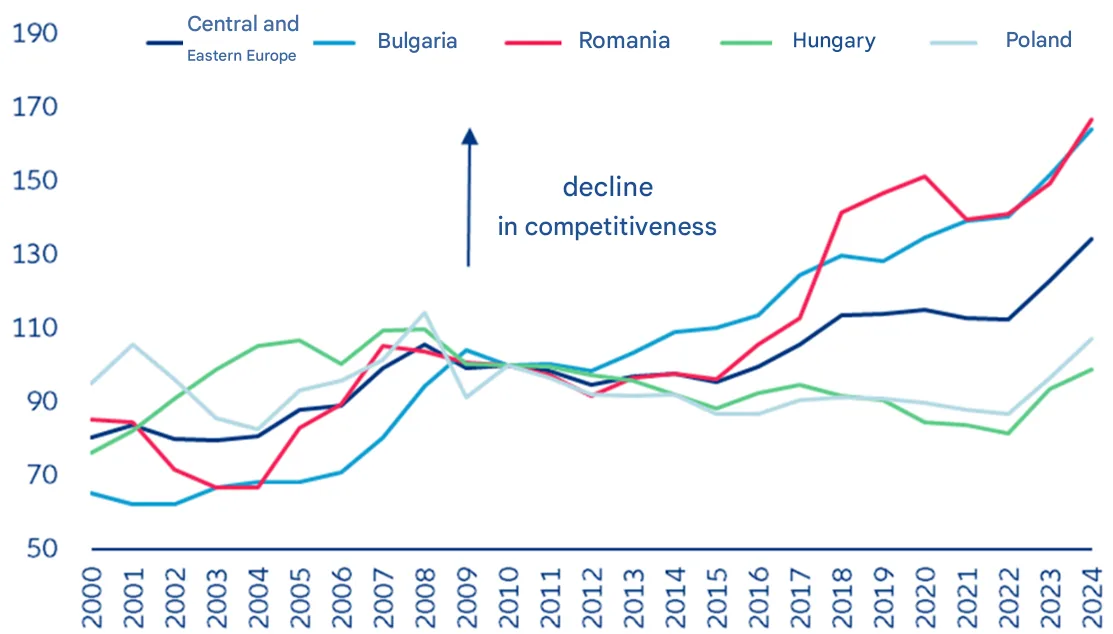

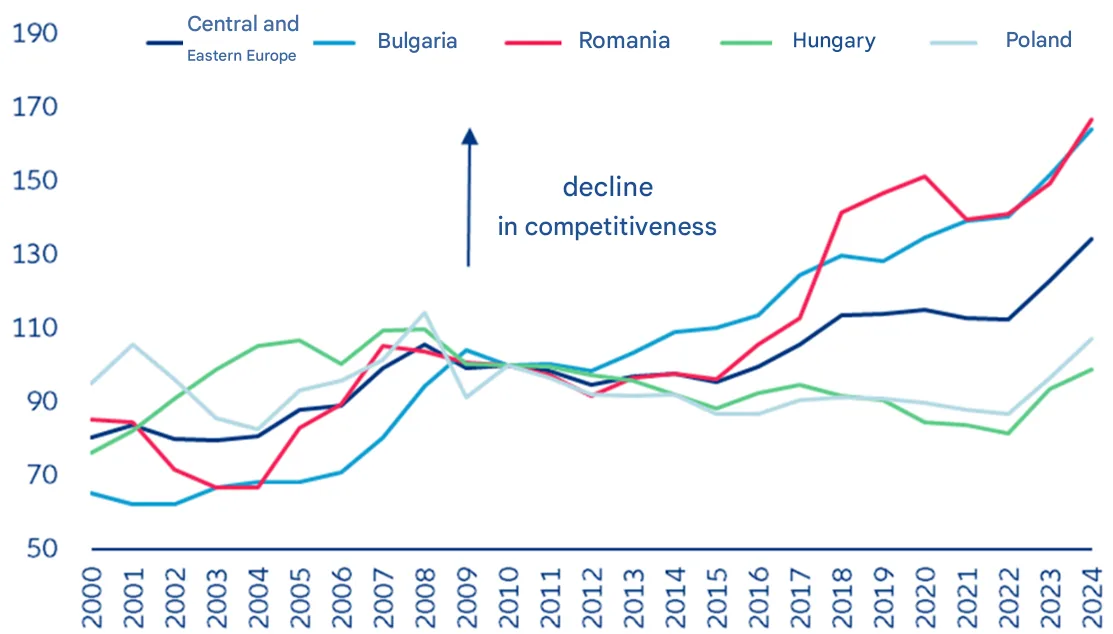

The competitiveness of CEE countries in terms of labor costs has significantly decreased in relative terms, with Bulgaria and Romania particularly affected.

Sources: LSEG Datastream, Allianz Research

The competitiveness of CEE countries in terms of labor costs has significantly decreased in relative terms, with Bulgaria and Romania particularly affected. Historically, the average cost competitiveness of CEE countries remained relatively stable until a sharp decline began in 2022.

Between 2022 and 2024, each country saw a decline in competitiveness ranging from -14% to -19%.

Chart 4: Competitiveness index based on relative unit labor costs, 2010 = 100

Sources: EIU, Allianz Research

Sources: EIU, Allianz Research

Source: https://ceo.com.pl/wzrost-plac-wyprzedza-produktywnosc-kraje-cee-traca-na-atrakcyjnosci-outsourcingowej-32829

Sources: LSEG Datastream, Allianz Research

The competitiveness of CEE countries in terms of labor costs has significantly decreased in relative terms, with Bulgaria and Romania particularly affected. Historically, the average cost competitiveness of CEE countries remained relatively stable until a sharp decline began in 2022. Between 2022 and 2024, each country saw a decline in competitiveness ranging from -14% to -19%.

Chart 4: Competitiveness index based on relative unit labor costs, 2010 = 100

Sources: LSEG Datastream, Allianz Research

The competitiveness of CEE countries in terms of labor costs has significantly decreased in relative terms, with Bulgaria and Romania particularly affected. Historically, the average cost competitiveness of CEE countries remained relatively stable until a sharp decline began in 2022. Between 2022 and 2024, each country saw a decline in competitiveness ranging from -14% to -19%.

Chart 4: Competitiveness index based on relative unit labor costs, 2010 = 100

Sources: EIU, Allianz Research

Source: https://ceo.com.pl/wzrost-plac-wyprzedza-produktywnosc-kraje-cee-traca-na-atrakcyjnosci-outsourcingowej-32829

Sources: EIU, Allianz Research

Source: https://ceo.com.pl/wzrost-plac-wyprzedza-produktywnosc-kraje-cee-traca-na-atrakcyjnosci-outsourcingowej-32829