Normalization complete – according to the Allianz Trade analysis, after five years, the global risk landscape of individual countries finally shows signs of improvement compared to the pre-pandemic period. The risk assessment of industries is less optimistic and more stable – indeed, in the last quarter there was an improvement in 9 and deterioration in 5 sectors, but sector ratings in all regions are mostly average (46%) or susceptible to risk (41%).

- Normalization complete: After the last quarter, the Allianz Trade Economic Analysis Department raised the ratings of 14 countries, reflecting the ongoing improvement in economic prospects.

- The road ahead of us, however, remains uneven – protectionist policies are still prevalent compared to the pre-crisis situation, along with geopolitical tensions.

-As for sectors – the improvement of industry risk prospects is limited, with nine increases and five declines. Downgrades occur in all regions, mainly in terms of medium and sensitive risk, especially in the automotive sector due to negative events in Germany and Switzerland, as well as in retail trade, including China, due to weak prospects for Chinese consumers.

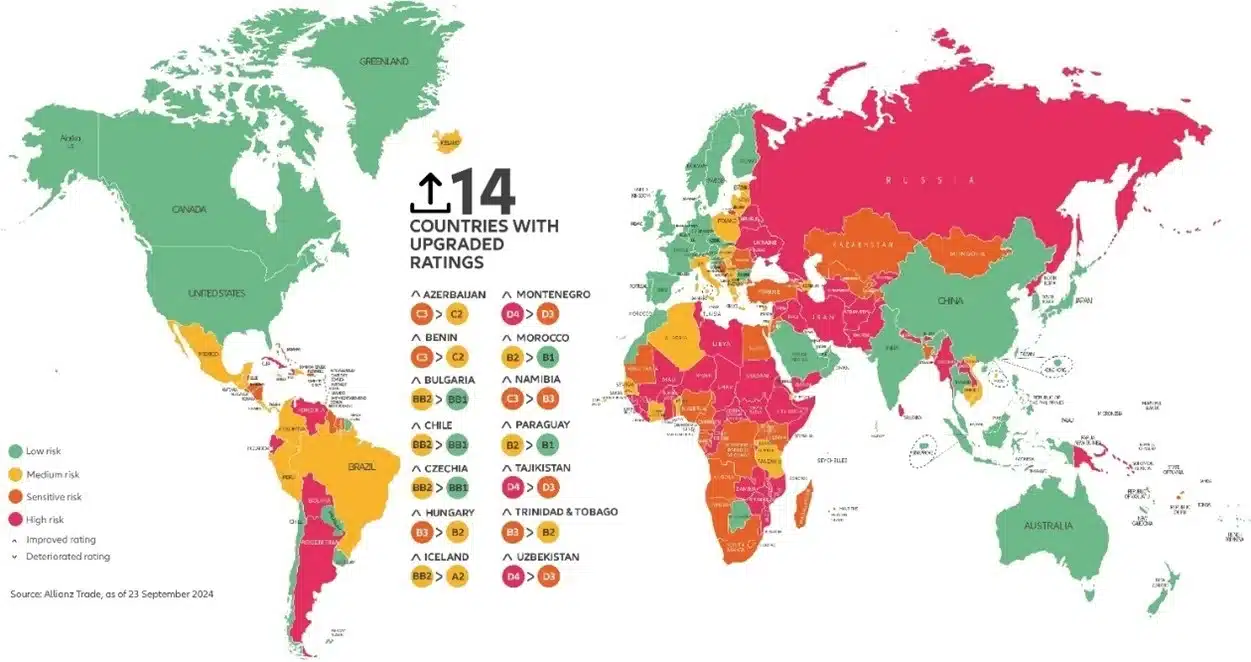

After nearly five years, the global country risk landscape finally shows signs of improvement compared to the pre-pandemic period. This quarter in Allianz Trade, we raised the rating of 14 countries, these were: Azerbaijan, Benin, Bulgaria, Chile, Czech Republic, Hungary, Iceland, Montenegro, Morocco, Namibia, Paraguay, Tajikistan, Trinidad and Tobago and Uzbekistan. These raises reflect an ongoing improvement in economic prospects observed for several quarters (see Graph 1). While the termination of the restrictive monetary policy cycle seems to give many economies a breather, there are still concerns about political and structural business environment risks. These factors continue to influence exchange rates and monetary policy trajectories in various economies.

Graph 1: Country risk map, end of September 2024

The economic road ahead of us is still uneven. Political risk associated with restricted access to hard currency liquidity continues to pose a challenge, potentially complicating currency transfers and convertibility. This makes economies that have a deficit of political consensus and institutional strength (central bodies) vulnerable. In addition, although lower interest rates are expected to mitigate financing conditions, the actual transfer effect (on the situation of companies) remains uncertain, especially for countries that still need to curb fiscal spending and/or those that maintain a sizable interest rate differential (e.g., compared to developed economies). Furthermore, both endogenous variables such as institutional stability, regulatory barriers, and protectionist policies, and exogenous factors such as international tensions, can significantly impact risk prospects. These factors can hamper progress in improving economic conditions despite a more favorable global financial momentum.

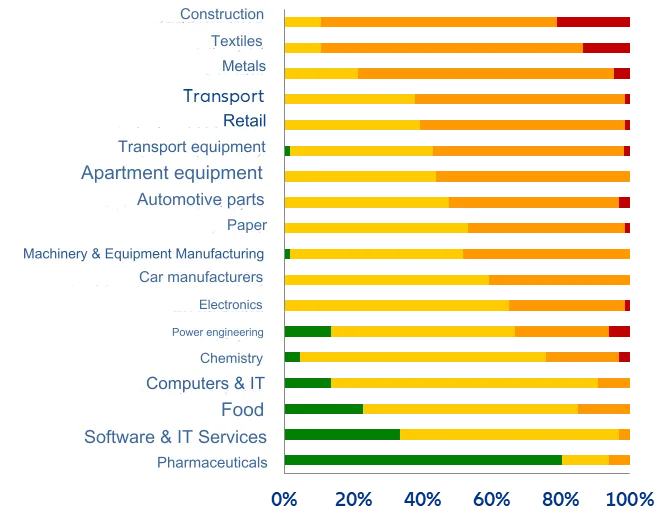

There’s a limited improvement in terms of risk from a sectorial perspective, according to Allianz Trade’s Economic Analysis Department – with nine increases and five declines (last quarter). This fifth consecutive quarter of minimal changes from a historical perspective, even after discounting the exceptional period during and immediately after the Covid-19 pandemic, reflects the lack of dynamic global economy, with constant growth but still below (expected) potential facing: decreasing recession risk in the Eurozone but growing in the U.S and China – dealing with an economic slowdown but ahead of impending fiscal consolidation. The second factor influencing the sluggishness in improving sectoral prospects is the early stage of the expected easing of financial and monetary conditions, and third, a number of geopolitical uncertainties.

Graph 2: Sectoral risk ratings at the end of September 2024

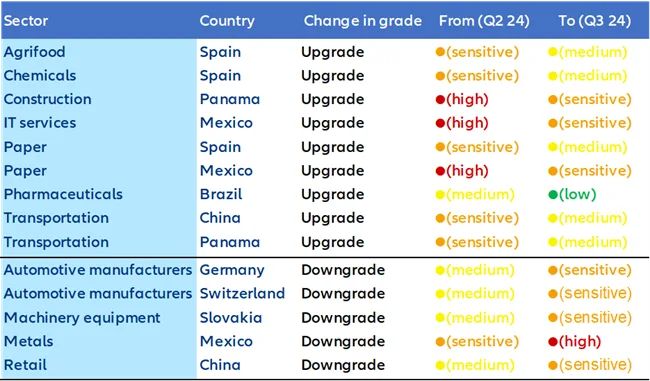

Like in the second quarter, improved risk assessments for the previous quarter mainly concern the transportation sector in Latin America (Panama) and Asia (China), as well as the paper sector in Mexico and Spain. Spain stands out with two other key sectors, namely the agri-food and chemical sectors, in which the risk rating changed from sensitive to average. It is also worth noting that IT services in Mexico and construction in Panama are no longer high risk and pharma in Brazil has returned to the low-risk area.

On the other hand, in all regions there were downgrades (mainly from medium to sensitive risk) primarily in the automotive sector – mainly due to changes in Germany and Switzerland, as well as in retail trade in China due to poor prospects for Chinese consumers.

In general, these adjustments resulted in another slightly positive balance of rating changes, extending the trend that has been ongoing for two years, and to a generally stable global ratings picture. As of the third quarter of 2024, the slight majority (55%) of sectors are on the positive side (low or medium risk) in this case. However, sector ratings in all regions are mostly either average (46%) or risk-sensitive (41%). The overall risk dispersion remains noticeable between the relatively safest region (Asia) and the riskiest (Latin America). Overall, there are still fewer low-risk sectors (10%) than before the pandemic (15% in the 4th quarter of 2019). Six sectors still stand out for the slowest return to pre-pandemic and pre-Ukrainian war risk levels: retail trade, chemicals and textiles, followed by transport equipment manufacturers, car makers, and construction.

Graph 3: Changes in sector risk ratings after the 3rd quarter of 2024.

Source: https://managerplus.pl/allianz-trade-podnosi-ratingi-14-krajow-40181